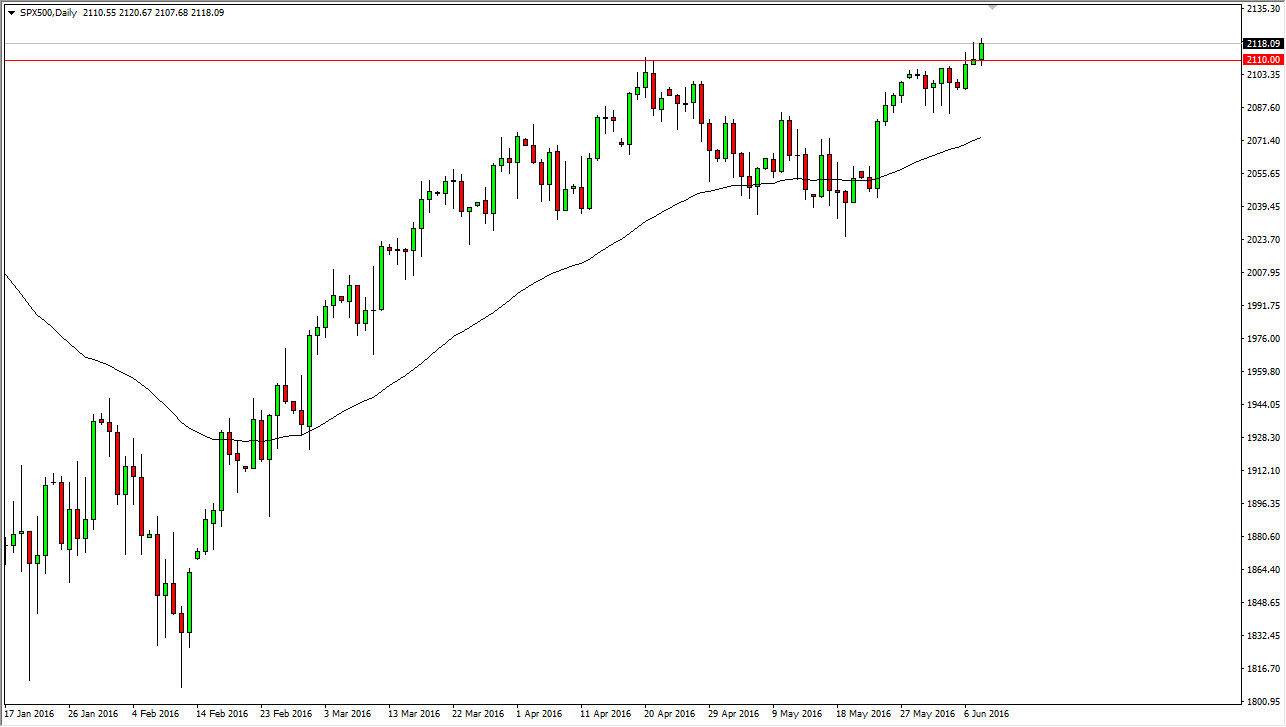

S&P 500

The S&P 500 broke higher during the day on Wednesday, as we have clearly moved above the 2110 level. We tested the 2120 level, but pulled back a little bit. However, we did close towards the top of the range I feel that the market is ready to go higher given enough time. Once we do get above the top of the range for the Wednesday session, I feel that this market is one that you can buy every time it pulls back. The 2110 level below should be the “floor” in this market, and as a result I think that every time we approached the general vicinity we should see buyers step back into this marketplace and push the S&P 500 higher.

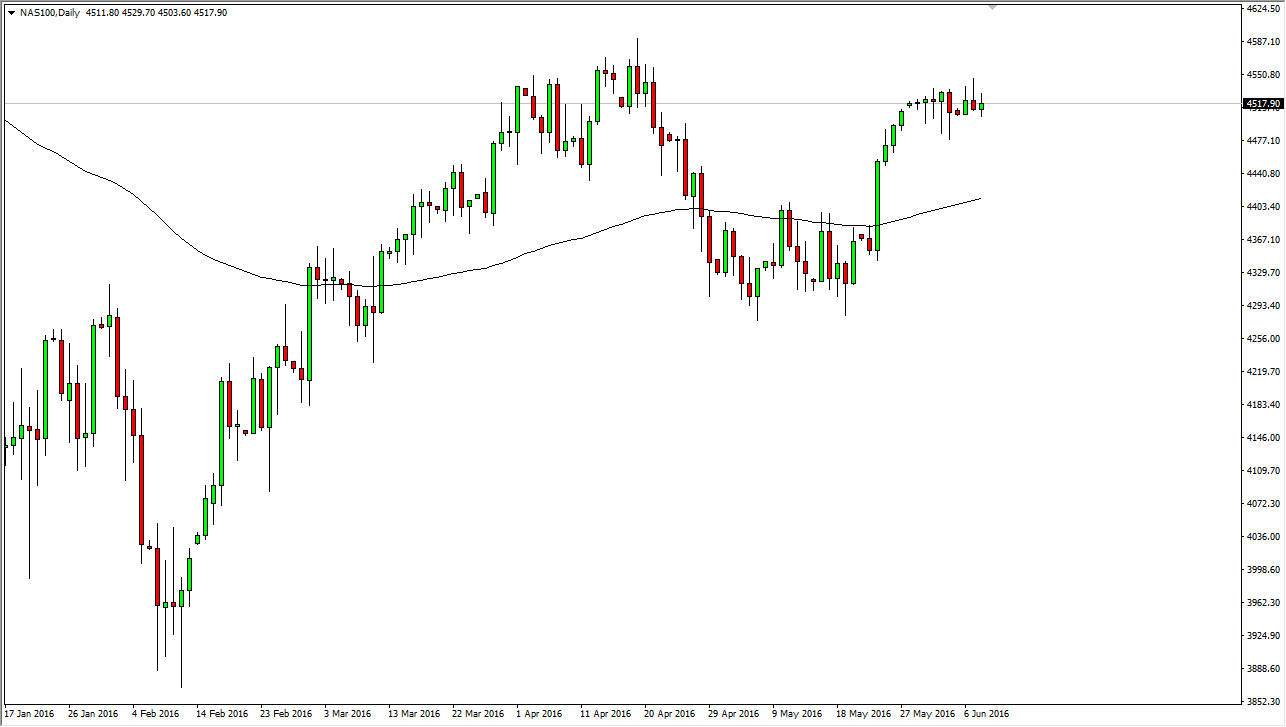

NASDAQ 100

The NASDAQ 100 had a slightly positive candle for the day, as we bounced around back and forth and simply could not get enough momentum to go in one direction or the other. With this, looks as if the market is ready to sit still for a while as we try to build up enough momentum to go higher in my estimation, after all we have a lower valued US dollar and of course the Federal Reserve looks very unlikely to raise interest rates as rapidly as one originally would have thought.

Currently, I’m using the 100 day exponential moving average on this chart as the “floor” in this market, as it proved to be so resistive a couple of weeks back. With this being the case, I think that a lot of longer-term traders are going to continue to be attracted to this market overall. However, I have to admit that this is the least favorite of the US indices that I follow, so while I am cautiously optimistic, I don’t necessarily want to trade this particular market at this moment.