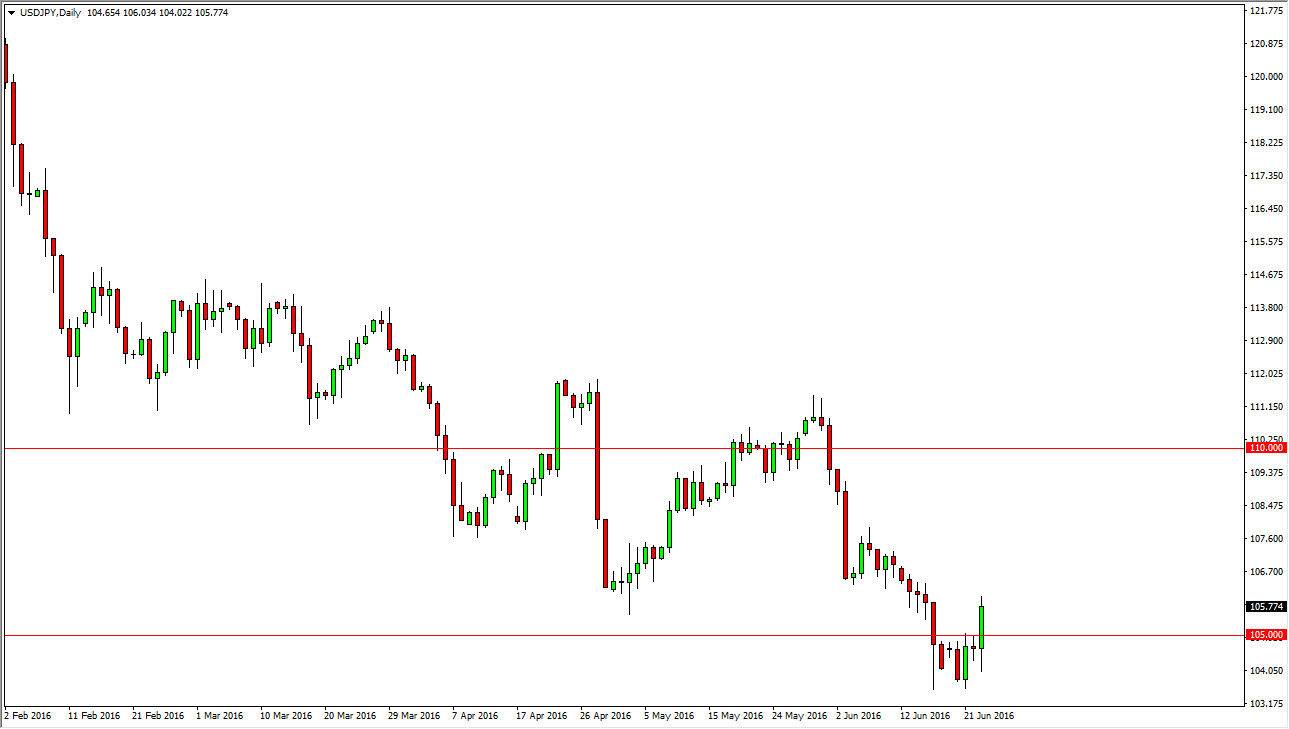

USD/JPY

The USD/JPY pair initially fell during the course of the day on Thursday, but turned right back around to break out above the 105 level. By doing so, it looks as if the “risk on” play could be coming, and a break above the 106 level, the market should continue to go much higher. On the other hand, we could get an exhaustive candle that gives us an opportunity to sell. While this doesn’t seem to be the case that’s most likely, it would more than likely be due to a “risk off” move due to the EU vote coming out of the United Kingdom. The 103 level below would be targeted on a sign of exhaustion in my estimation.

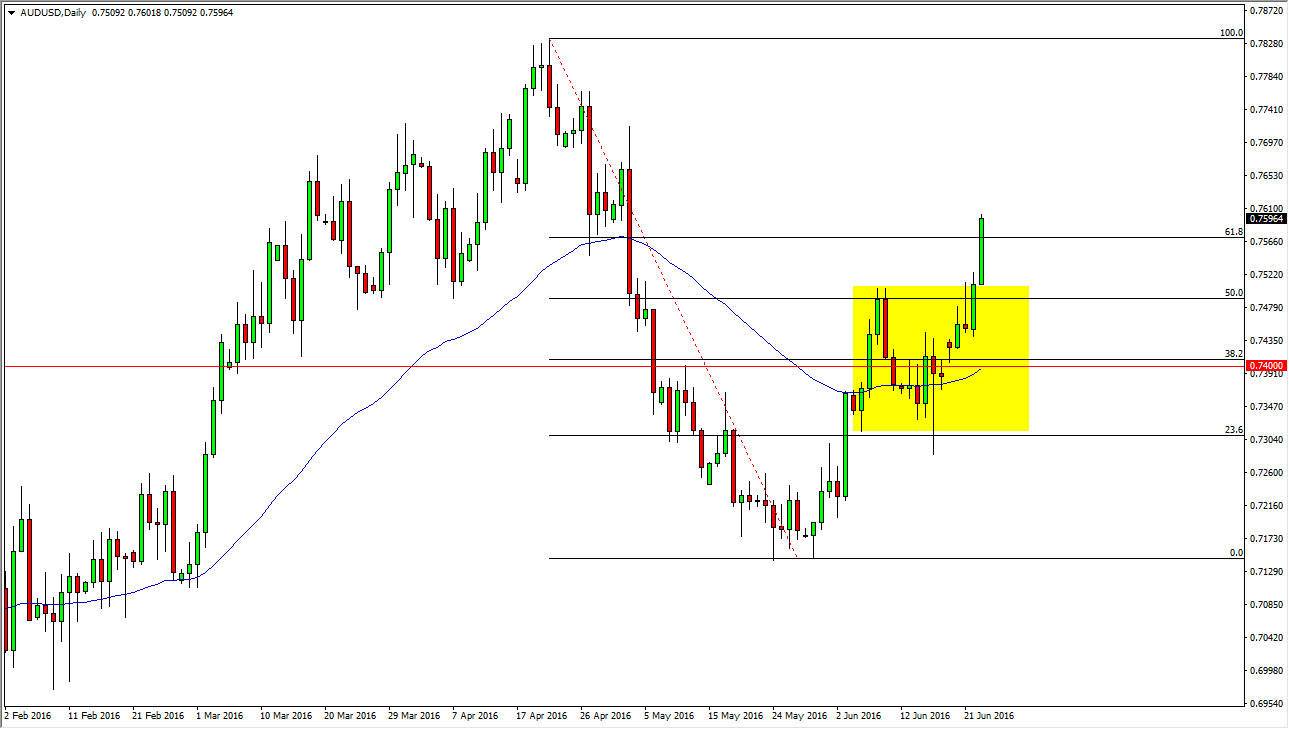

AUD/USD

The AUD/USD pair broke higher during the course of the session on Thursday, finally clearing the consolidative rectangle that we have been in recently. Now that we have continue to go higher, I feel that the market is going to continue to go much higher, as we have not only broke above the resistance, and should act as support going forward. We have cleared the 61.8% Fibonacci retracement level now, and as a result I believe that the Australian dollar will continue to go much higher. After all, this is a “risk on” move, and people are speculating that the United Kingdom is staying within the European Union.

Pullbacks at this point in time should find support at the previous resistance barrier, and as a result I would look to supportive candles as an opportunity to go long and a market that obviously has quite a bit of bullish pressure. Ultimately, we could go as high as the 0.78 level given enough time, but it will be very choppy. Pay attention to the gold markets, because if they rise than that could put more bullish pressure on the Australian dollar as well.