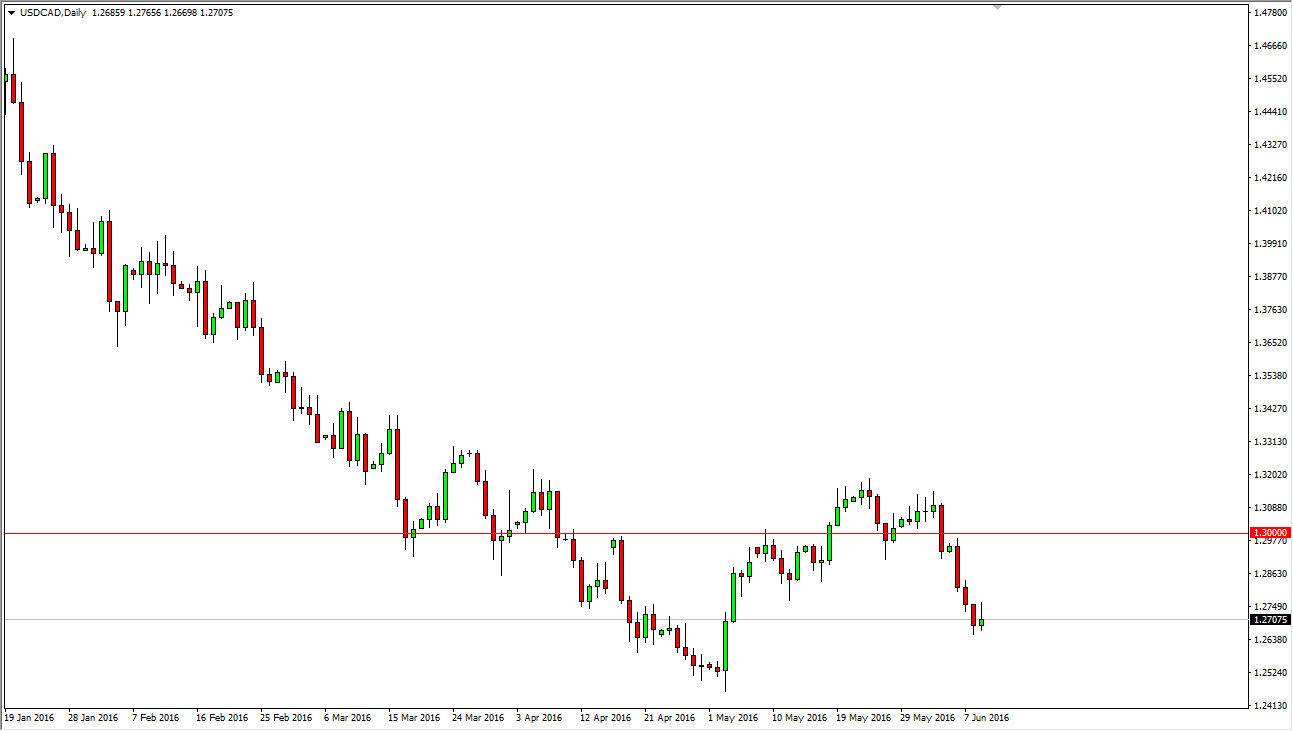

The USD/CAD pair initially rallied during the course of the session on Thursday, but you can see that we turn right back around to form a bit of a shooting star. That of course is a negative candle, some in some that I’m looking to sell this market again. You have to keep in mind that the oil markets fell a bit during the course of the session on Thursday, and that of course works against the Canadian dollar in general. That being the case, the market is simply going the way it typically does, following the oil markets in an inverse pattern.

Support for the oil market

At this point in time, the oil markets have a significant amount of support at the $50 level, an area that was tested in the West Texas Intermediate grade of oil during the day on Thursday, and ended up offering quite a bit of support. That being the case, oil markets look like they are ready to continue going higher of the longer-term which means of this pair should continue to go lower.

Beyond the oil market, you have to pay attention to the Federal Reserve and the expectation for interest-rate hikes. That has taken a serious beating lately as the jobs number on Friday was so poor. Adding to the fact that the oil markets are going higher, we have a softer US dollar in general so that creates a little bit of a perfect storm for this particular pair to go much lower. I believe at this point in time we will probably head down to the 1.25 level, and then perhaps even lower than that. It will not be until we break down in the oil market that this pair turns back around, and that could be a while as it seems the market has made up its mind as far as the intermediate term.