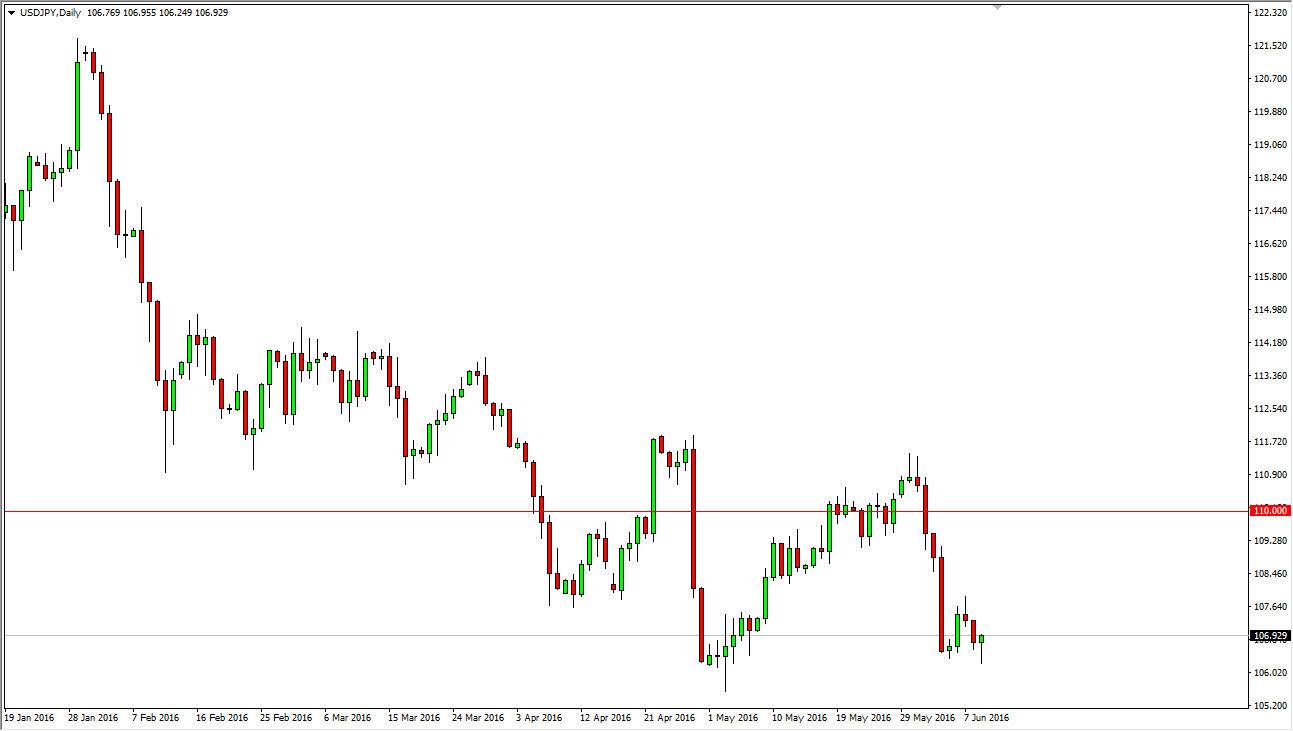

USD/JPY

The USD/JPY pair initially fell during the course of the day on Thursday, but bounced enough to turn around and form a hammer. While this is a positive sign, the fact that we ended up forming a shooting star on Tuesday has me thinking that perhaps this market is just going to consolidate in this general vicinity. Because of this, I don’t think I’m going to be that excited to trade this particular pair. A bounce could be coming but I also believe that the overall downtrend continues to be very strong, so I prefer to sell rallies that show signs of exhaustion, as I believe that sooner or later the poor jobs number will really put the screws to this particular pair.

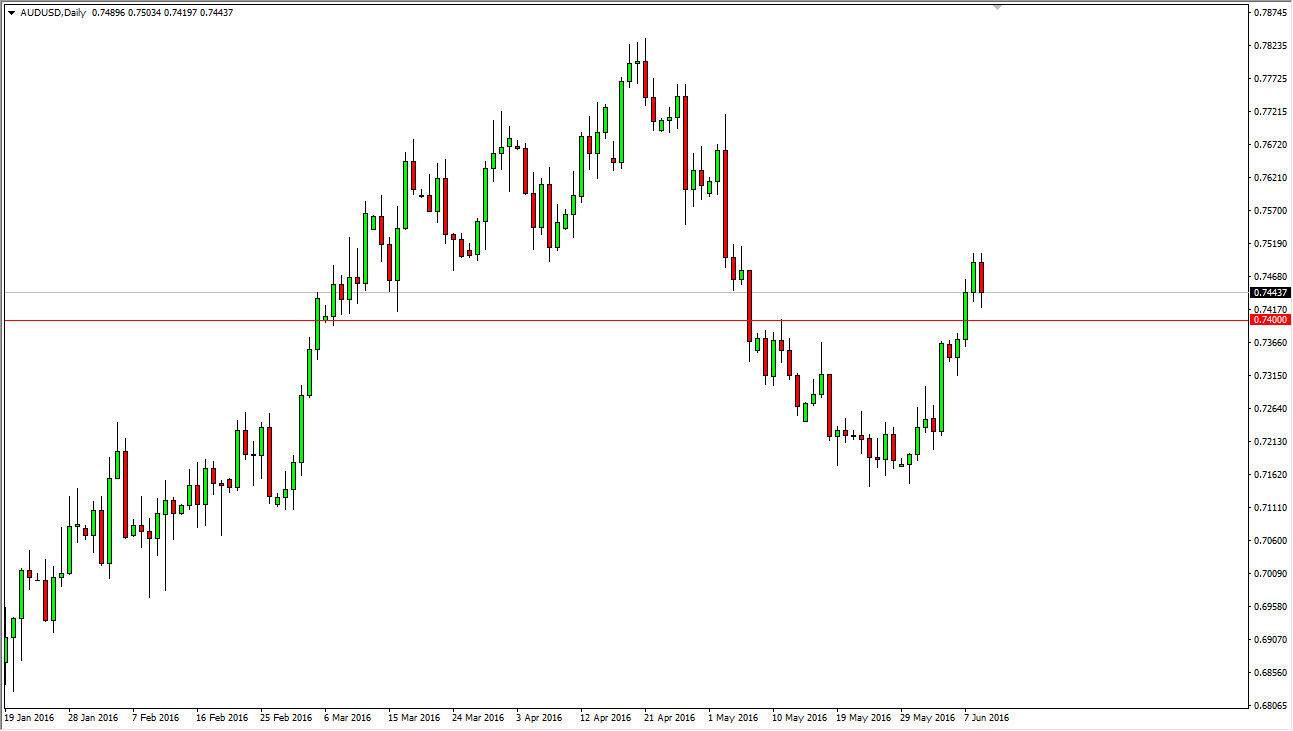

AUD/USD

We fell during the Thursday session the AUD/USD pair, but the 0.74 level offered enough support to keep the market afloat. This was an area where we had seen quite a bit of resistance previously, so the fact that we have seen support here is not a surprise to me. I would be willing to buy this market on a supportive candle or a break out to the upside. Nonetheless, I do believe that eventually we will reach towards the 0.7850 level but it will be very difficult to get there as the market has a lot of noise between here and there. That being the case, the market will probably offer several opportunities on pullbacks, and more than likely will be the type of market that you can buy again and again.

Because of this, I believe that the market is one that you cannot sell, but will have to be very patient to wait for buying opportunities. Gold markets of course have quite a bit of an influence on the Australian dollar as it typically does, and at this point in time it appears that the buyers are definitely stepping into the market.