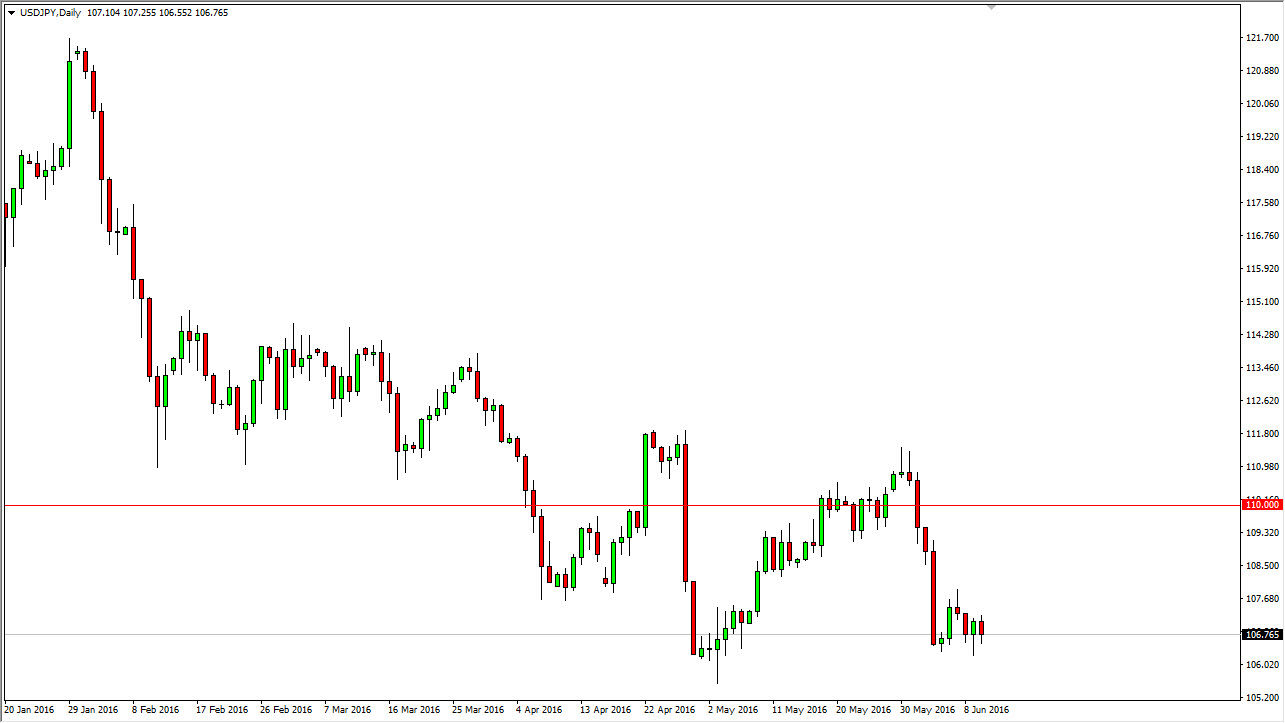

USD/JPY

The USD/JPY pair did very little during the session on Friday as we continue to hang about the 106.75 region. We are at extreme lows at the moment, so would not be surprising at all to see a little bit of an attempt to rally from this point. However, any rally will run into quite a bit of resistance above, and as a result I’m simply looking for short-term rallies to start selling on signs of exhaustion. On the other hand, we could find yourselves breaking down and if we clear the bottom of the hammer from the Thursday session, I believe that is reason enough to start selling the USD/JPY pair again as we are most certainly in a downtrend over the longer term.

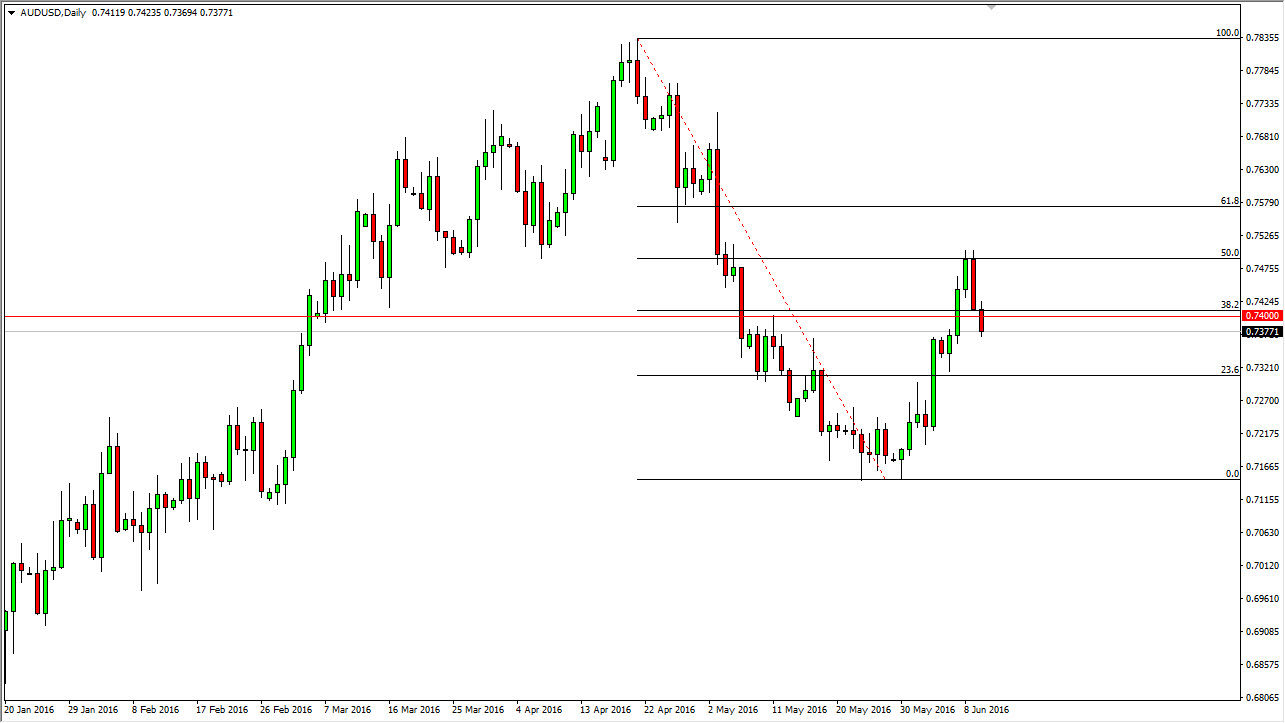

AUD/USD

While the candle for Friday in and of itself isn’t necessarily overly impressive, you have to keep in mind that the weekly candle for the AUD/USD pair was a shooting star. On top of that, the 0.74 level was an area of interest as far as I can see, and the fact that we formed a shooting star right at that level suggests that we very well could turned back around. On top of that, we peaked at the 50% Fibonacci retracement level from the downtrend, so it certainly looks as if we could make an argument to start selling.

Ultimately, keep in mind that the gold markets can have an influence on the Australian dollar as well, and they look somewhat supportive. So with that being the case will have to see what happens next. The hammer from the Monday session could provide support, but if we break down below there, I feel that this pair drops fairly significantly from here.

Alternately, if we form a supportive candle in this area, we could get a short-term bounce. If we break above the top of the range for last week, that would be an extraordinarily bullish sign.