USD/JPY

The USD/JPY pair fell initially during the day on Tuesday but found enough support at the 106 level to bounce yet again. This is an area that seems to be very strong as far as support is concerned, and as a result I think that it can be difficult to continue going lower. However, today we have the FOMC Statement, which is without a doubt an event that could cause that to happen. A break above the top the hammer is a classic bullish signal, as a point time I think that this pair will probably try to reach towards the 108 level. A break down below the bottom of the hammer for the day on Tuesday would be a move that should test the 105 support barrier, and below their things could get dicey as the Bank of Japan could suddenly get involved again. Nonetheless, expect a lot of volatility.

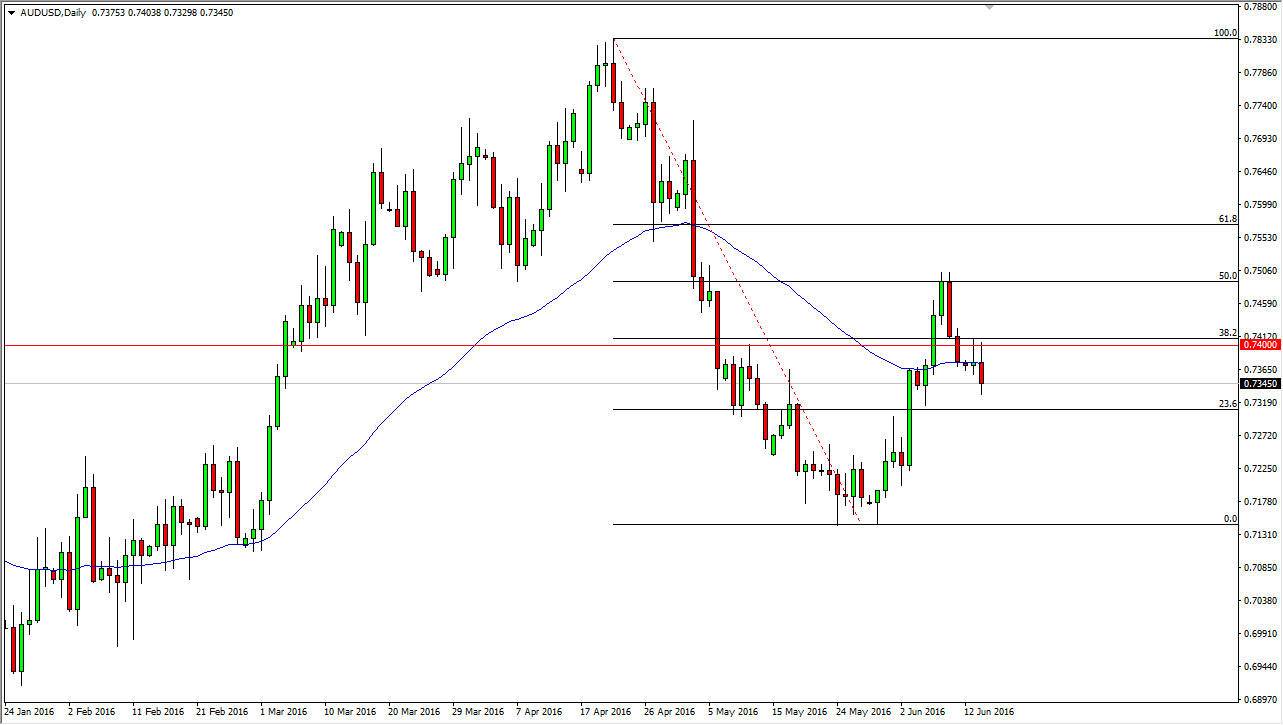

AUD/USD

There is something amiss about the Australian dollar right now, as we have seen such strength in the gold markets. Not that they have to follow each other, but the typically do. There doesn’t seem to be much in the way of desire to only Aussie, and as the Reserve Bank of Australia recently cut interest rates, I think that this could continue to be the case. At this point, I believe that a move below the 0.73 level since this market looking for the 0.7150 level yet again. That was an area that the markets bounced off of recently, and therefore should be the target as the 50% Fibonacci retracement level offered enough resistance to turn things back around. I don’t know that is going to be an easy move lower, but it certainly looks like something is working its way against the Aussie dollar, even as the Federal Reserve may step away from some of the interest-rate hikes that had recently been expected.