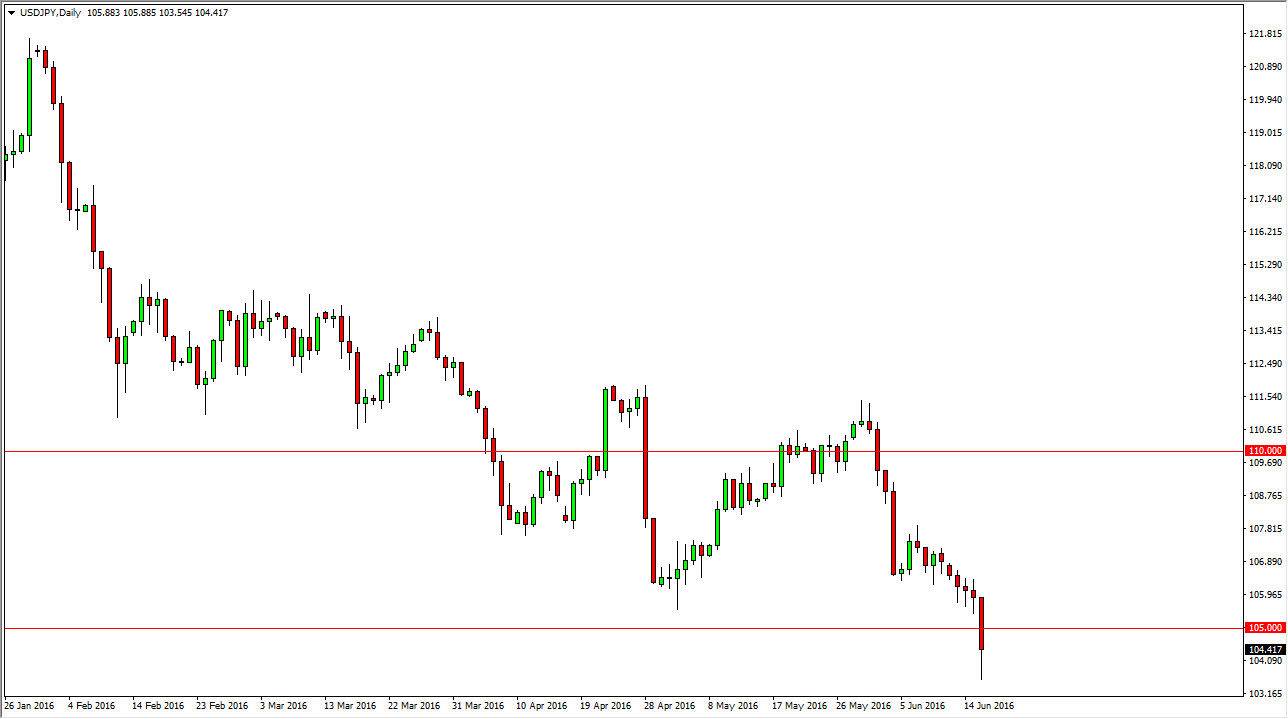

USD/JPY

The USD/JPY pair fell during the day on Thursday, breaking below the 105 level. This is an area that of course has a certain amount of psychological significance, mainly because it had been supportive in the past, as well as the fact that it is a large, round, psychologically significant number anyway. So with that I think that we will more than likely break down from here and continue to drift lower. Short-term rallies that show signs of exhaustion could be nice selling opportunities, but the closer we get to the parity level the more likely I think it is that the Bank of Japan may get involved. With that being the case, I will continue to sell this market on short-term charts, for short-term moves only. I’m not looking to hang onto any trade at this point.

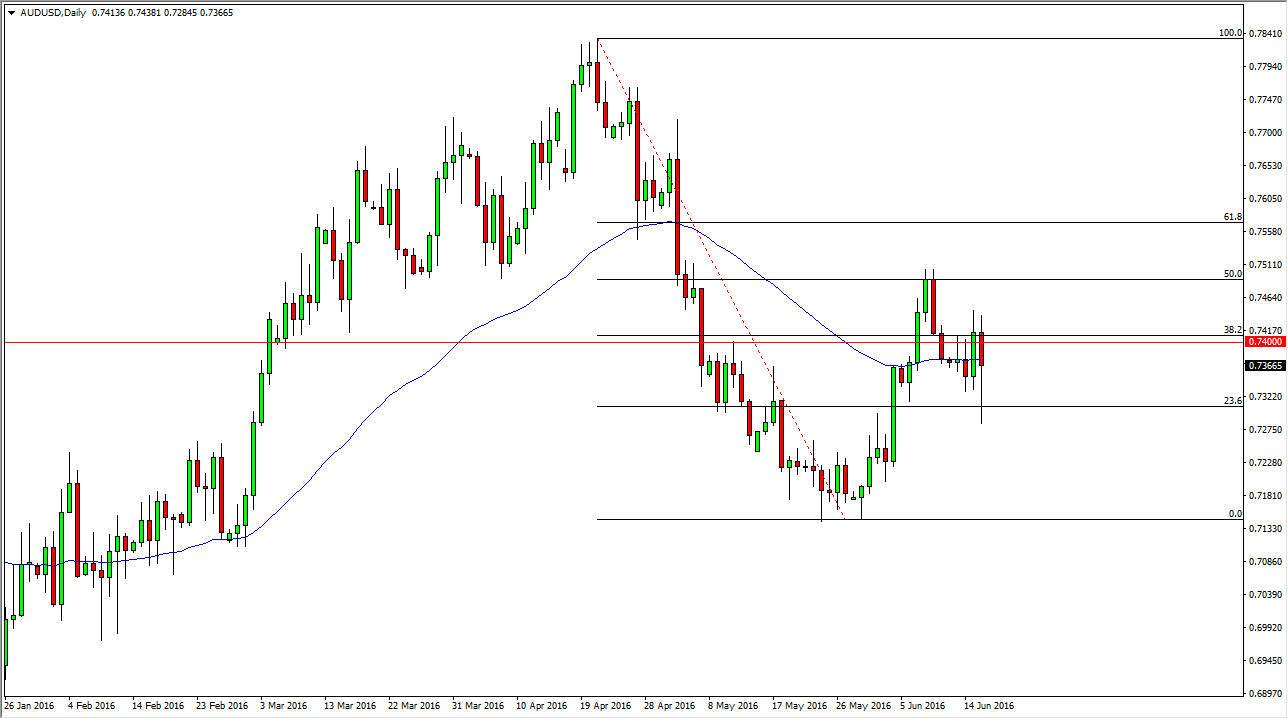

AUD/USD

The AUD/USD pair initially fell during the day but turned right back around and formed a massive hammer. However, I think that there is enough noise in this pair that we are probably better off simply waiting for some type of clear signal before he put any real money in this market. After all, there’s a lot of noise just above, and of course if we break above the top of the hammer shaped candle - the classic buy signal - the market will have to deal with the most recent high of the 0.75 level. In other words, the risk to reward ratio just isn’t there for me.

It doesn't seem that I will be trading this pair anytime soon, but I recognize that it seems to be a bit directionless at the moment, and directionless markets are great ways to lose money. With that being the case, I will stay on the sidelines but I will certainly keep you abreast at any changes that I see in this pair over the next several sessions.