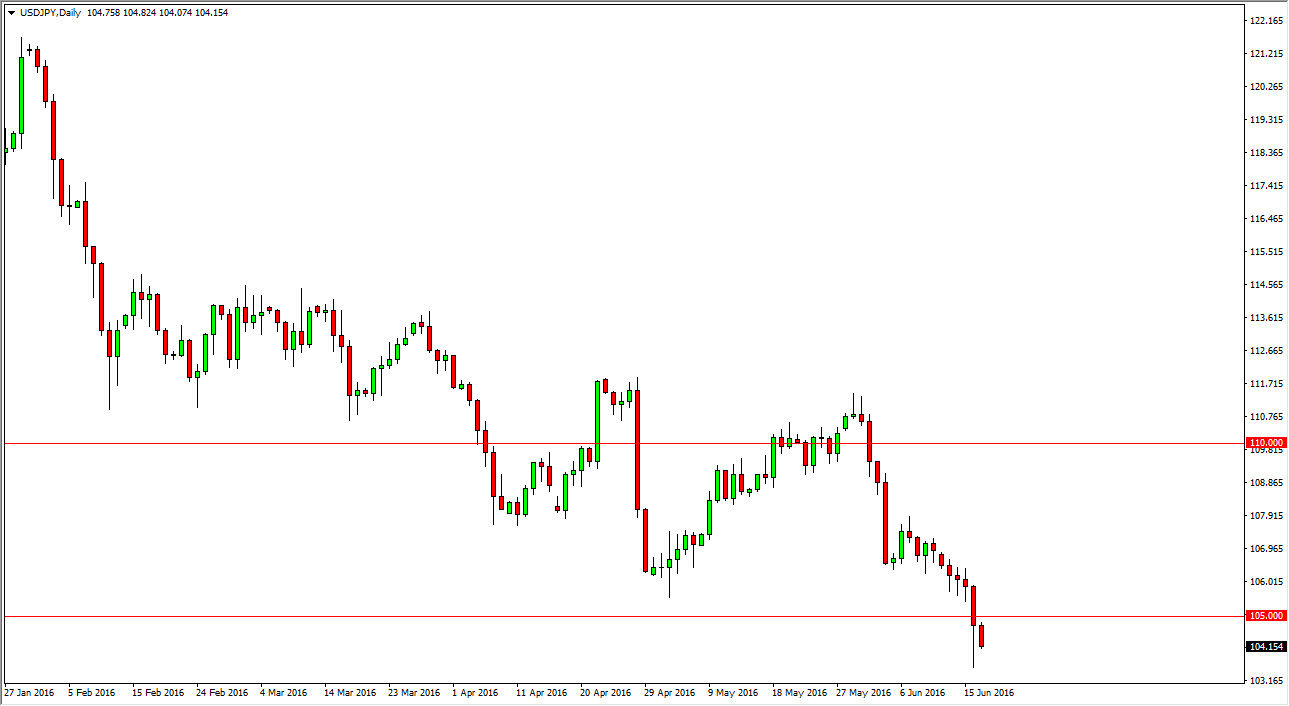

USD/JPY

The USD/JPY pair ground lower doing the course of the day, and having said that it looks as if we are going to test the bottom of the hammer from the Thursday session given enough time. The Japanese yen will continue to attract attention as it is a “safety currency”, as the market has a lot to worry about right now. The jobs number was horrific, and as a result people are starting to think that perhaps the Federal Reserve will struggle to raise interest rates with any normality, and as a result the US dollar continues to have quite a bit of bearish pressure on it against some other currencies, especially the Japanese yen as it also gets bought when people were concerned about economic conditions around the world.

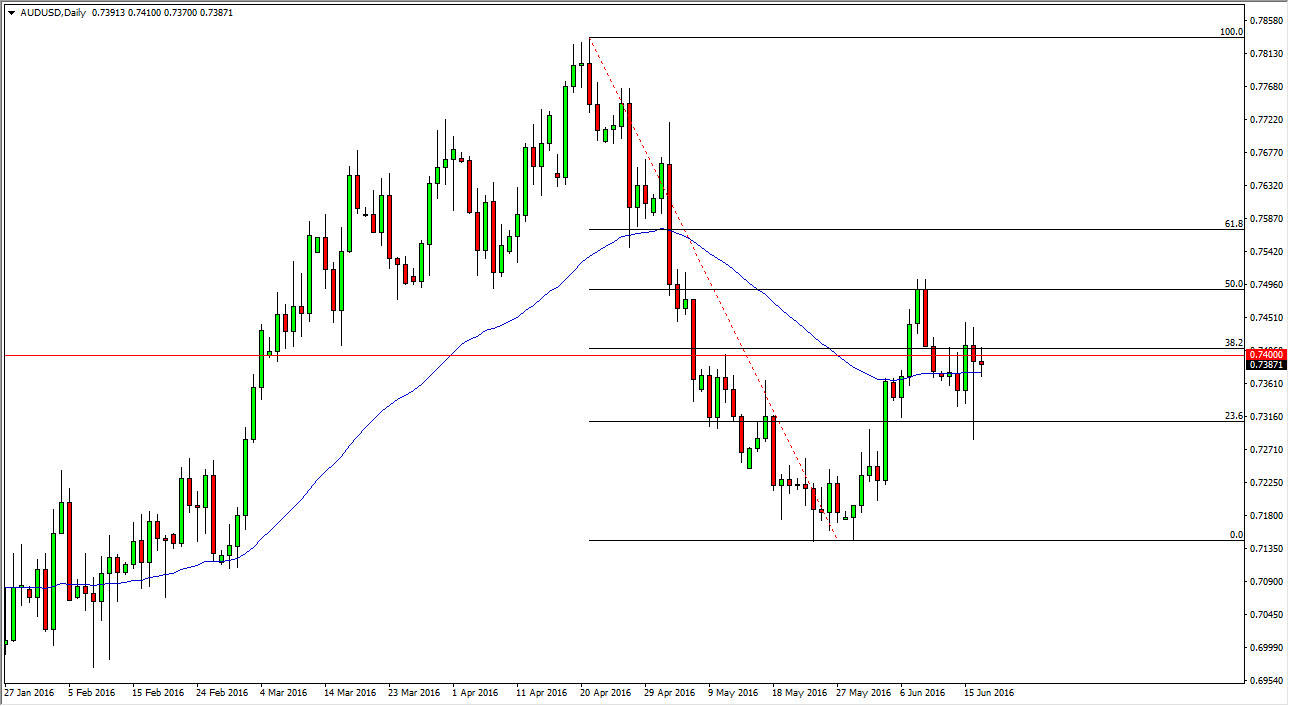

AUD/USD

This is a market that simply had no traction whatsoever during the day on Friday, as we continue to bounce around at the 0.74 level. The 50 day exponential moving average is flat, and we are hugging the round number. Because of this, it’s likely that this market will continue to grind sideways more than anything else. The hammer that formed on Thursday is very supportive, so if we can break the top of that hammer, it’s likely that the market will continue to go higher and perhaps reach towards the 0.75 level.

Pullbacks at this point in time should be supportive, so I suppose if you were willing to look for short-term trades, you may be able to trade. At this point in time though, it’s likely that the market is going to be difficult to deal with, as while we have a stronger gold market recently, we also have to worry about the fact that the Reserve Bank of Australia recently cut rates so this market seems a bit confused at the moment and therefore not one that I like to trade in currently.