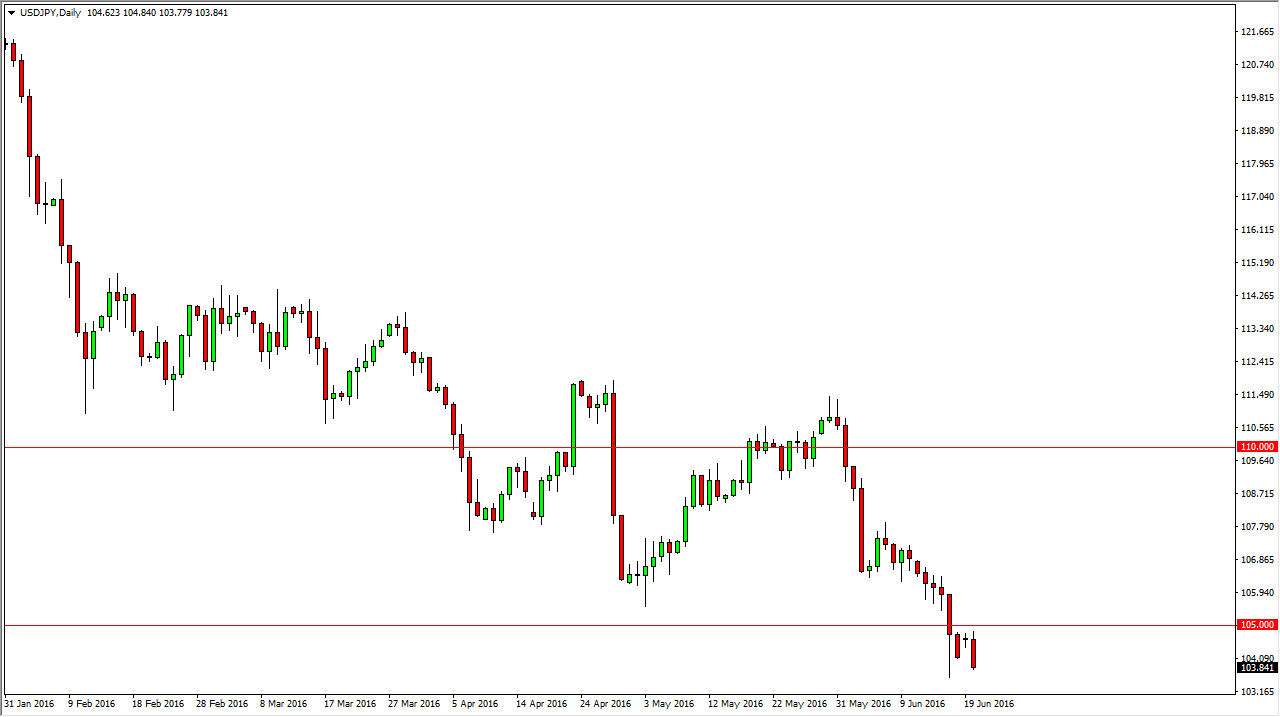

USD/JPY

The USD/JPY pair fell during the day on Monday, as the 105 level continues to be rather resistive. Ultimately, this market could go much lower as it is very sensitive to risk appetite, which of course is very soft at this point in time. I believe that short-term rallies will continue to be sold off as long as we can stay below the 105 level, and as a result I have no interest whatsoever in buying this market until we break above that level which should be rather significant. Ultimately, I believe this pair probably heads down to the 102 level and then possibly the 100 level. Be aware that the Bank of Japan will lose it sense of humor about this pair falling given enough time, so they of course could get involved if we continue to sell off.

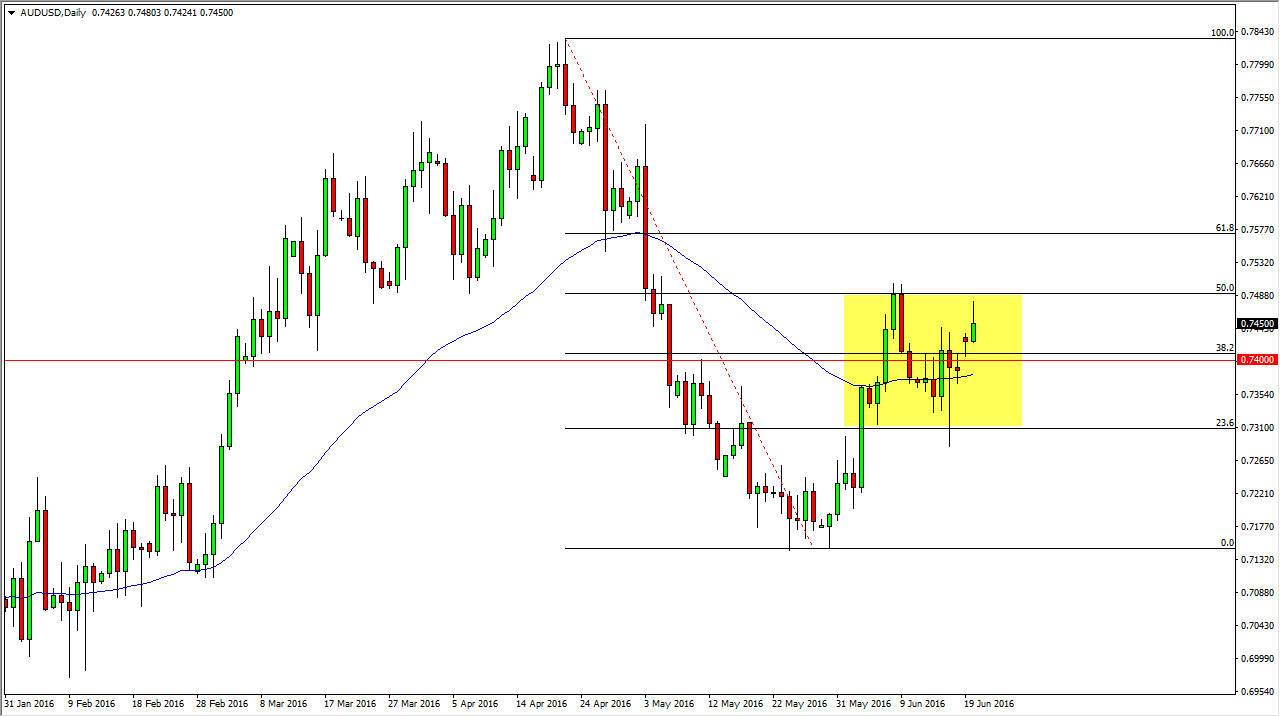

AUD/USD

The Australian dollar of course rose as we gapped higher at the open on Monday, but we had quite a bit of resistance at the 0.75 level. With this, we ended up forming a bit of a shooting star like candle, and I believe that means that we will probably continue to meander around the 0.74 level. The 50 day exponential moving average is fairly flat, so having said that it’s likely that this market will continue to chop as there is no real momentum. As you can see by the yellow box on the chart, it’s more than likely going to be a situation where short-term traders will continue to go back and forth.

Once we break above the 0.75 level, the market could very well go to the 0.77 level. The 0.73 level below should be supportive, and as a result I believe that we continue to go back and forth and it will be difficult to trade the Aussie as it of course is very sensitive to risk.