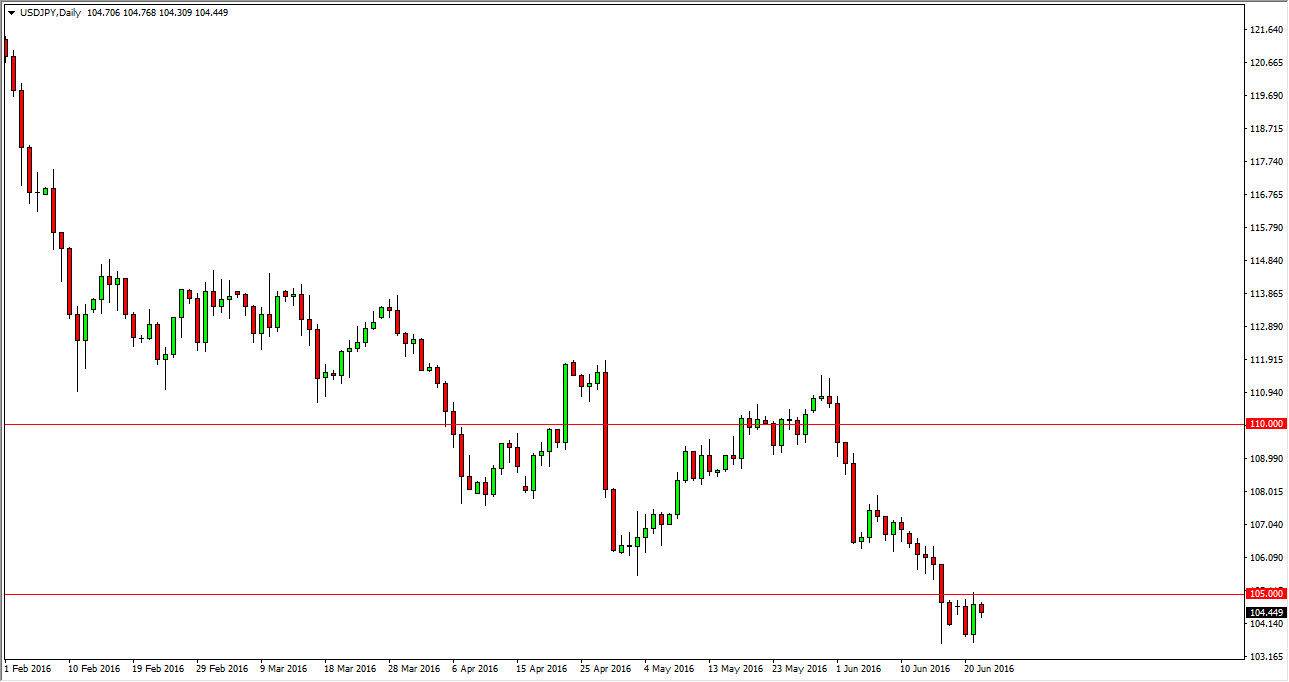

USD/JPY

The USD/JPY pair fell initially during the day on Wednesday, as the 105 level of course continues offer quite a bit of resistance. I believe that this level will continue to be important, and as long as there’s a lot of uncertainty in the marketplace, this market will more or less have a negative bias to it. However, I’m not expecting any type of meltdown because quite frankly the Bank of Japan will get involved things get ugly enough. They have to be very unhappy about what’s going on right now, and as a result I think that even if we do descent from here, it will be a slow grind back to the 100 level over the longer term. If we broke above the 106 level, at that point in time I am willing to start buying again.

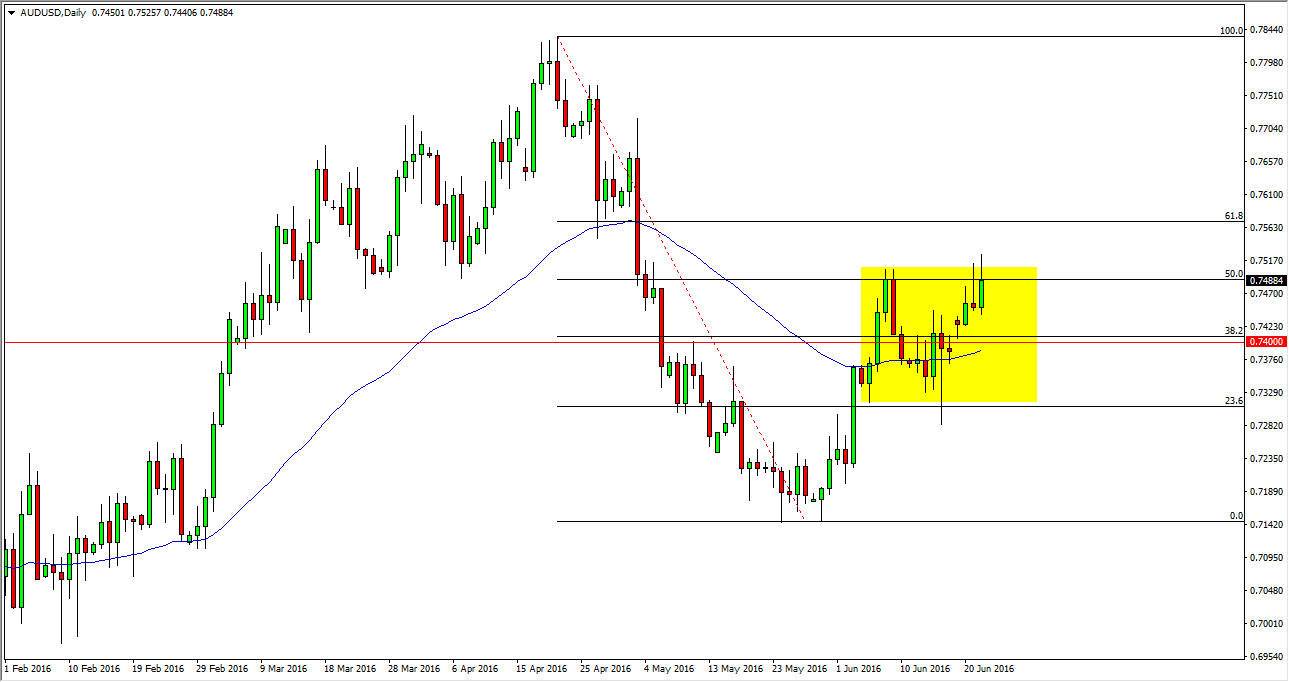

AUD/USD

The AUD/USD pair broke higher during the course of the session on Wednesday, and of course cleared the top of the shooting star from Tuesday. I believe that this is a very bullish sign, but it will probably be quite difficult to continue to go higher. This is a market that will grind its way to the 0.77 level, but more than likely will continue to find buyers every time we pullback. I’m especially interested in this pair because it avoids both the Euro and the Pound, but it is also highly sensitive to the gold markets. Gold markets of course going higher drives up demand for the Australian dollar typically, but at this point in time it’s likely that the volatility in these markets will continue to drive things back and forth. I believe that sooner or later we do go higher though, so if you are patient enough you should be able to make quite a bit of profit over the longer term.

If we do fall though, the 0.74 level and the 100 Exponential Moving average on the daily charts should continue to offer dynamic support.