USD/JPY Signal Update

Yesterday’s signals were not triggered.

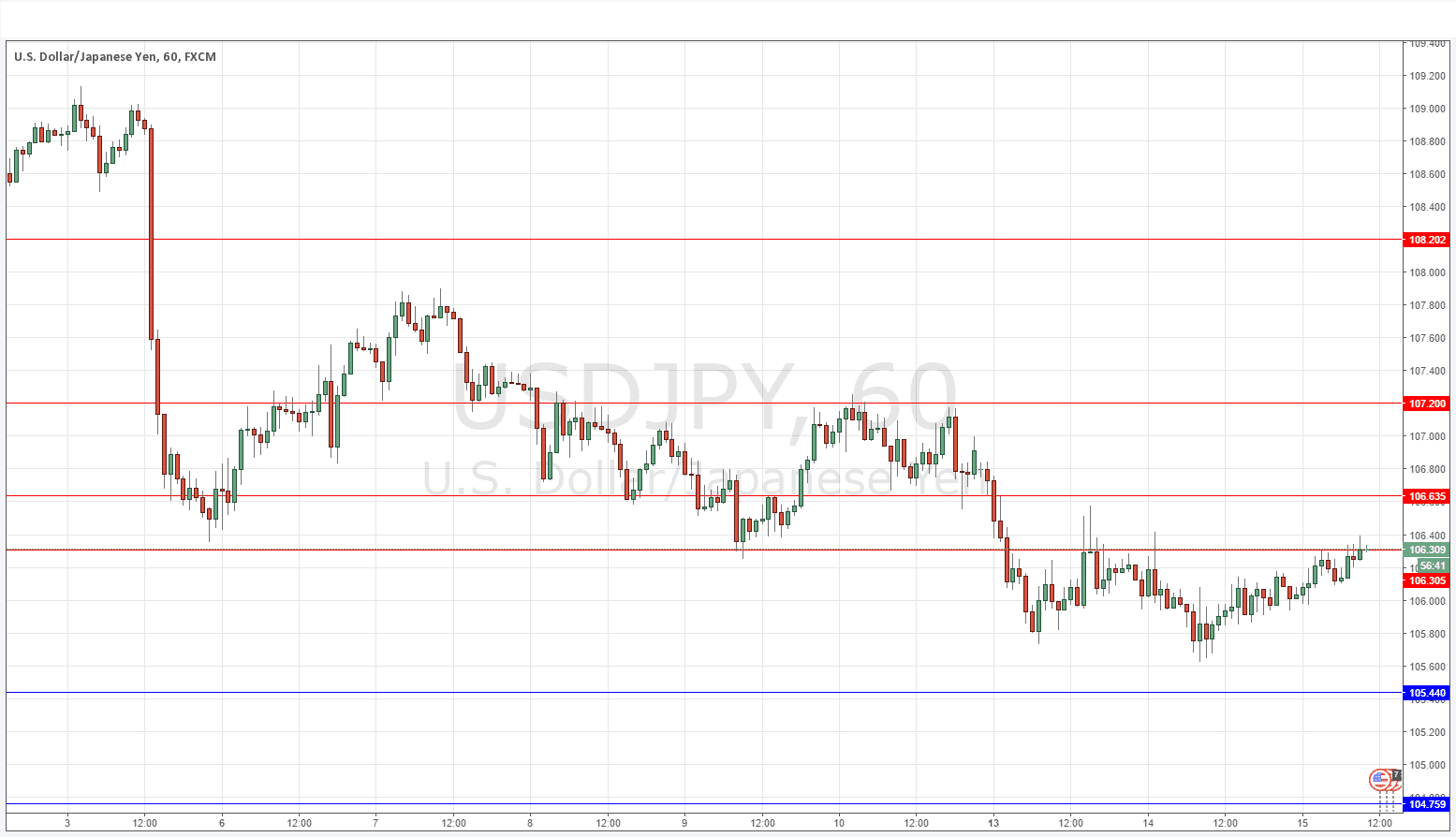

Today’s USD/JPY Signals

Risk 0.75%

Trades must be taken from 8am New York time until 5pm Tokyo time only.

Short Trades

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 106.64 or 107.20.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trades

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 105.44 or 104.76.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

This pair is very much awaiting the FOMC releases due later. The key structure has been a long-term downwards trend that has been the strongest trend in the Forex market for a while, with a key resistance / selling area at around 106.25.

The price has actually been grinding upwards and is threatening this level, but it is unlikely to really get beyond it before the FOMC releases, which should produce considerable volatility in this pair. There will be the Bank of Japan’s Monthly Report some hours later, so anything could happen over the forthcoming 24 hours.

Regarding the USD, there will be a release of PPI data at 1:30pm London time, followed later at 3:30pm by Crude Oil Inventories. At 7pm there will be the release of the Federal Funds Rate, FOMC Statement and FOMC Economic Projections, followed by the usual press conference. Concerning the JPY, the Bank of Japan’s Monetary Policy Statement will be released some time after 4am.