USD/JPY Signal Update

Yesterday’s signals were not triggered as the small bearish reversal occurred above 104.75 at the higher round number of 105.00 instead.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be taken from 8am New York time until 5pm Tokyo time.

Short Trades

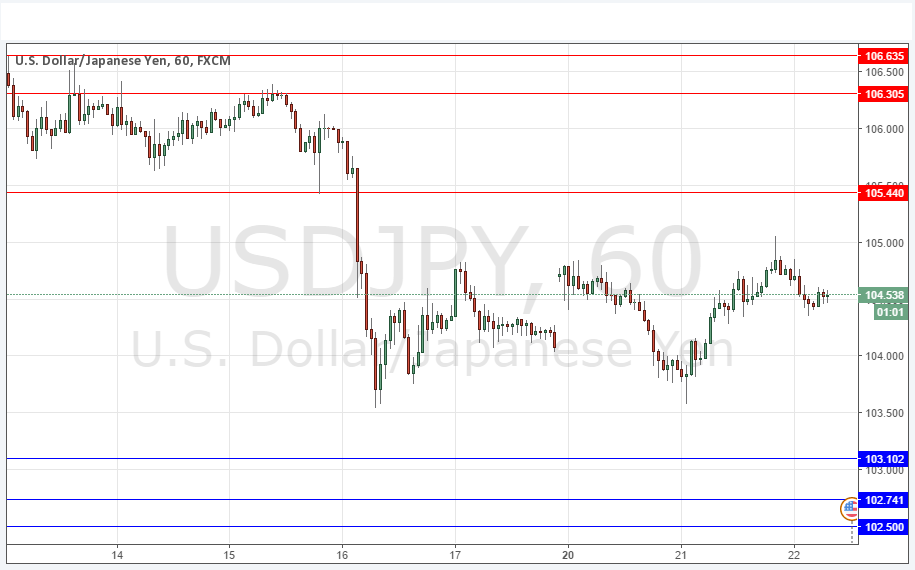

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 105.44 or 106.30.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 103.10 or 102.74.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

The price broke up above the resistance at 104.75 but was not really able to clear the round number at 105.00. Although we have now seen a move down from that level, it is neither strong nor convincing. Of course a lot will depend upon the result of the British Referendum on E.U. membership that will be conducted tomorrow. If the result is Remain, as the markets are expecting, this pair is very likely to move higher, and would logically test resistance at 105.44 or possibly even 106.30 before it might reverse downwards back into the direction of the long-term trend.

Note there was fairly strong buying as the price made a double bottom earlier this week.

There is nothing due today concerning the JPY. Regarding the USD, the Chair of the Federal Reserve will be testifying before Congress at 3pm London time, followed later by the release of Crude Oil Inventories at 3:30pm.