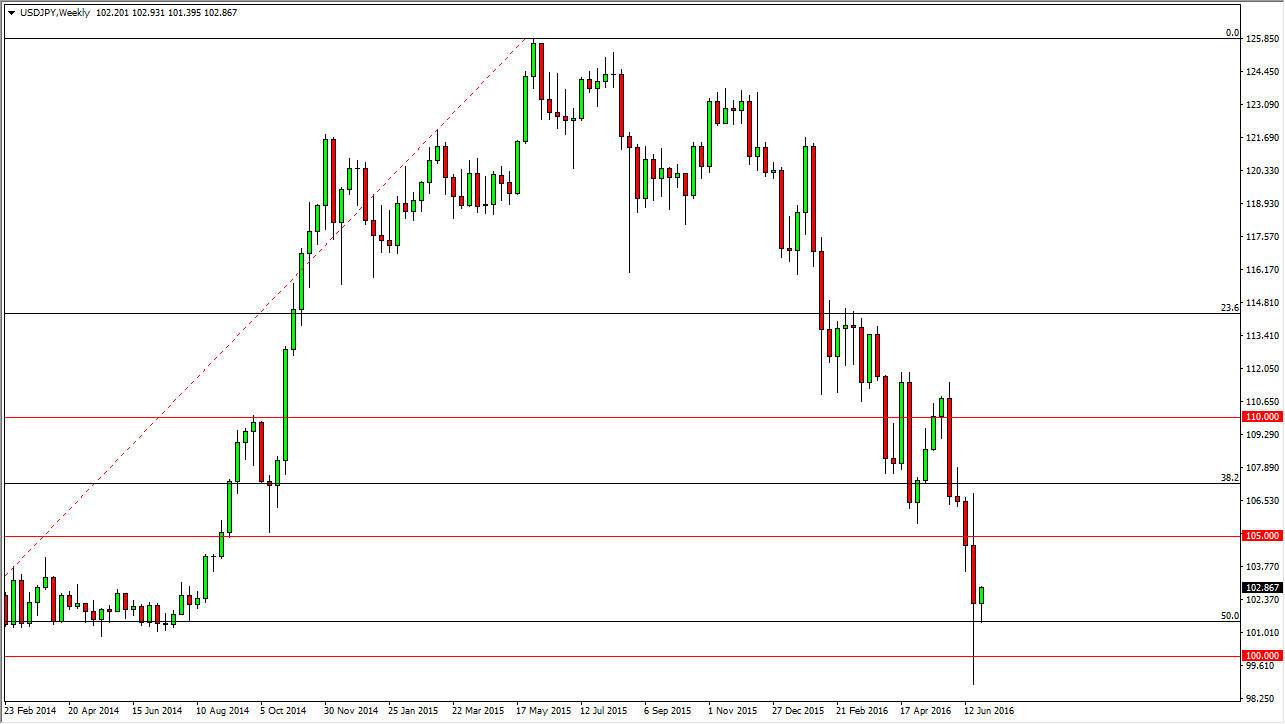

The USD/JPY pair has been very negative of the last several weeks, and it appears that the market has finally found an area where it could try to stabilize. The 100 level below is a bit of a “line in the sand” as far as I can see, especially considering that the Bank of Japan has been very vocal about being displeased with the way this pair has been acting lately. Sooner or later, the market will more than likely have to deal with the Bank of Japan either intervening, or continuing to step up its efforts to devalue the Japanese yen. The market may very well bounce a bit initially, as I think that perhaps this market has been a bit oversold. Previously during the year of 2014, we had seen quite a bit of interest in this area, I think that will continue to be the case.

Intervention

The Bank of Japan will almost undoubtedly intervene if we break down below the 100 level for any real length of time. In fact, I would be interested in buying just below that level as long as I can keep the leveraged down, as it would only be a matter time before they either get involved, or they start talking the value of the Yen down. Also, you have to believe that sooner or later central banks around the world are going to have to do something to fight the “risk off” situation that we have been in. At the same time though, I think that the 105 level will be far too resistive to get above with any real length of time behind it, unless of course the central bank is the cause of that actual action. Because of this, it would not surprise me at all if we simply bang around during the month as we continue to go sideways sitting on top of a massive “floor” in this market.