EUR/USD

The EUR/USD pair initially rallied during the course of the week but turned back around to form a slightly negative candle. By doing so, it looks as if we are stuck in the previous consolidation area, and I believe we’re going to drop slightly over the first session or 2 during the week, and then we will find buyers to turn things back around.

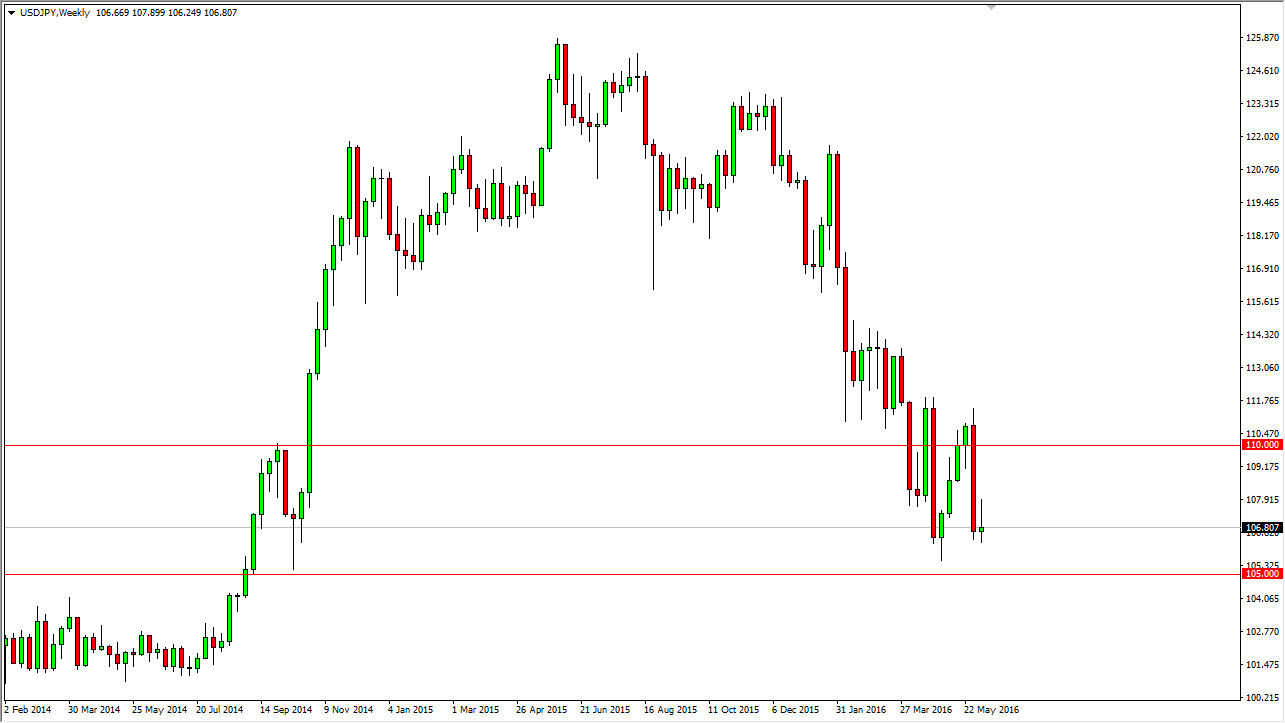

USD/JPY

The USD/JPY pair initially rallied during the course of the week but turned back around to form a shooting star. That is a very negative sign and the bottom of the downtrend, and as a result I believe that this market will eventually break down and try to reach towards the 105 level. Ultimately, any rally at this point in time will more than likely struggle, and as a result an exhaustive candle would be reason enough to start selling as well. I have no interest in buying this pair at the moment.

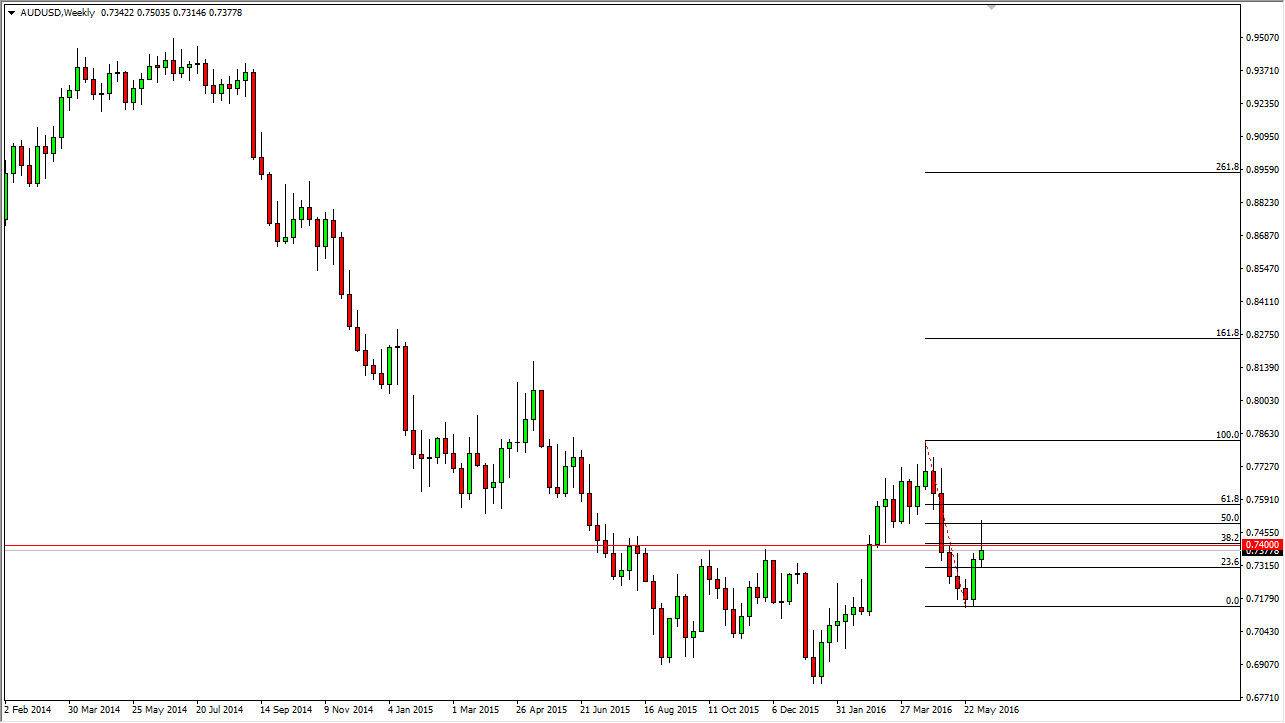

AUD/USD

The AUD/USD pair initially tried to rally during the course of the week but as you can see turned right back around to form a shooting star. We found quite a bit of resistance at the 50% Fibonacci retracement level, and as a result it looks as if we are going to try to sell off from here. A break down below the bottom of the weekly range is reason enough for me to start selling and aiming for the 0.7150 level next. If we can get below there, I think we can go much lower.

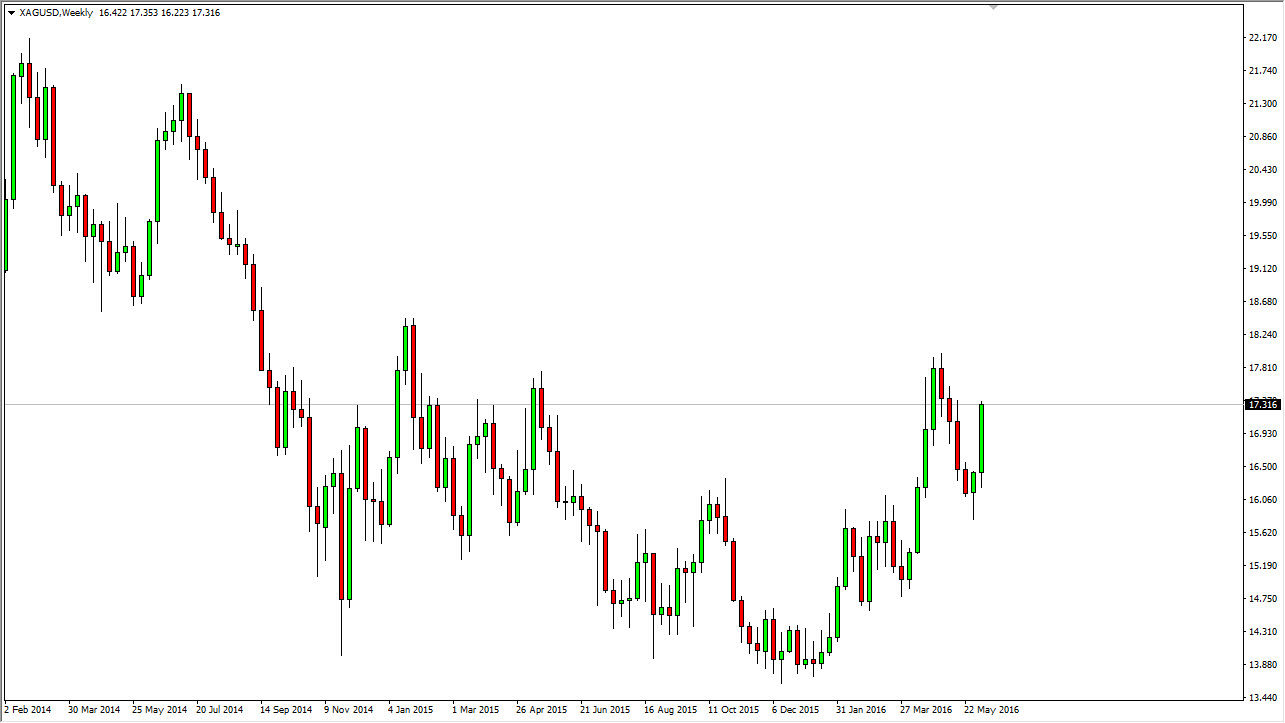

Silver

Silver markets had quite a bit of bullish pressure over the course of the week, and as a result it looks as if the buyers have taken control. The fact that we did up forming a hammer from the previous week and broke above the top of it shows that the buyers really have stepped in. I think that pullbacks will offer value in a market that certainly looks like it’s ready to break out to the upside. Short-term pullbacks continue to be nice entry points.