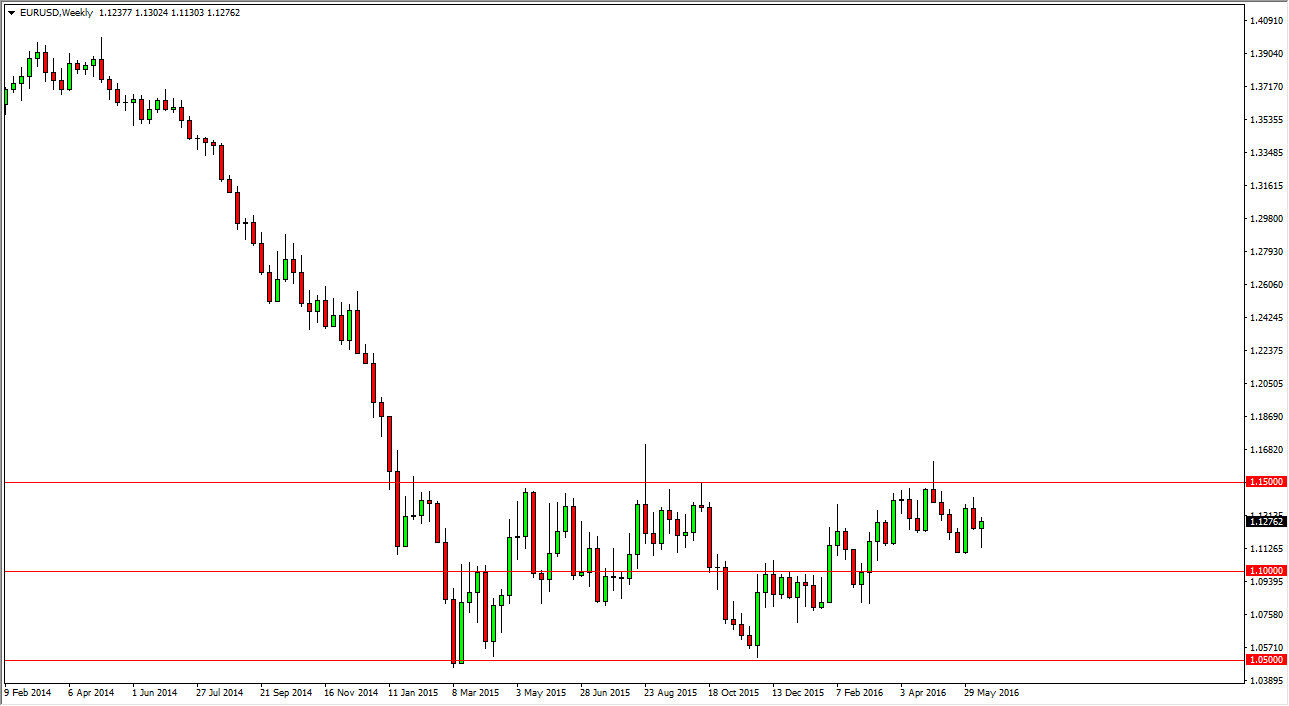

EUR/USD

The EUR/USD pair initially fell during the course the week but turned right back around to form a hammer. The hammer of course is a bullish sign so I think that the Euro will gain a bit during the course of this week, but I’m not looking for fireworks at this point. I believe that we are eventually going to reach towards the 1.14 level above. Pullbacks will continue to be buying opportunities on short-term charts.

GBP/USD

The GBP/USD pair initially fell during the course of the week but found enough support at near the 1.40 level to turn things back around and form a hammer. Ultimately though, I am very hesitant to get involved in this pair because of the vote that’s coming up, and that of course will continue to cause quite a bit of volatility. At this point in time I recommend staying far away from this pair.

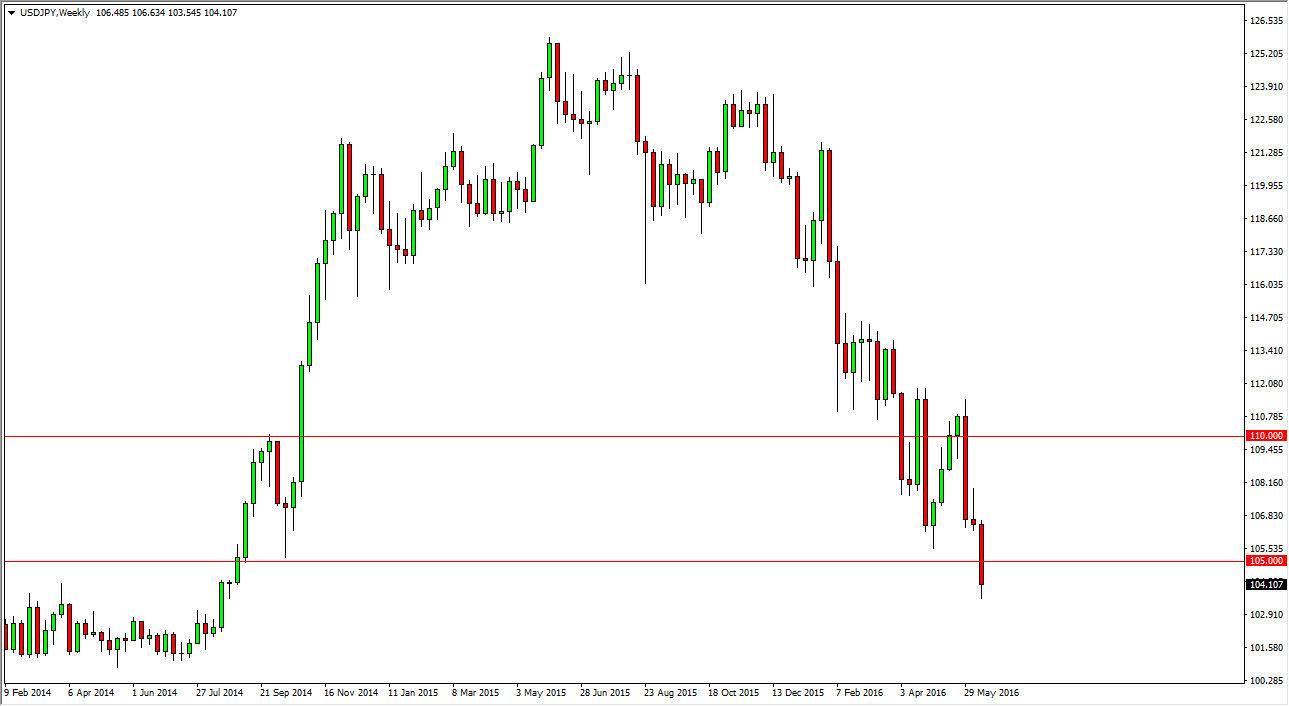

USD/JPY

The USD/JPY pair fell significantly during the course of the week, as we broke down below the bottom of the shooting star from the previous week. The fact that we closed below the 105 level is of course a very negative sign, and as a result I believe that this pair will continue to fall given enough time, and that short-term rallies will offer selling opportunities. I have no interest in buying this pair at the moment.

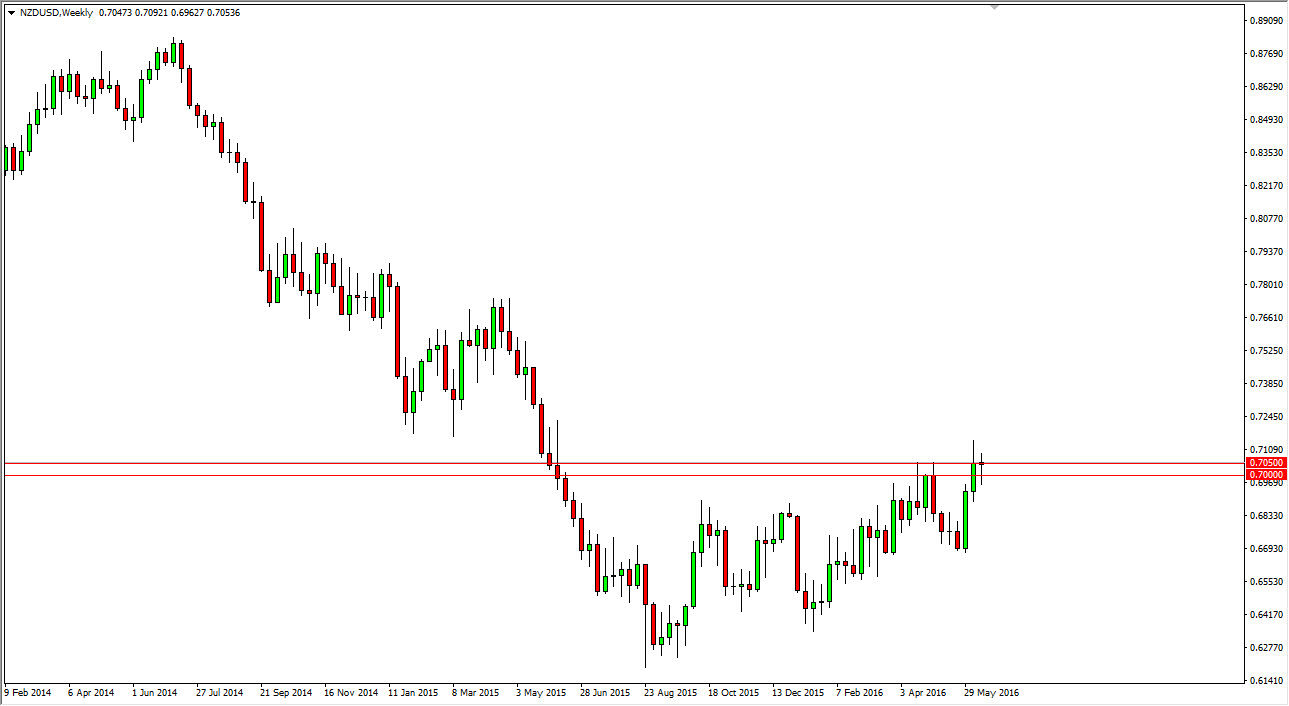

NZD/USD

The NZD/USD pair initially fell during the course of the week but turned right back around to form a hammer. The 0.70 level offered quite a bit of support, and as a result it looks as if we are going to try to grind higher. A break above the top the hammer would be a very bullish sign, and as a result it’s likely that we will go higher and as a result I am a buyer of this pair.