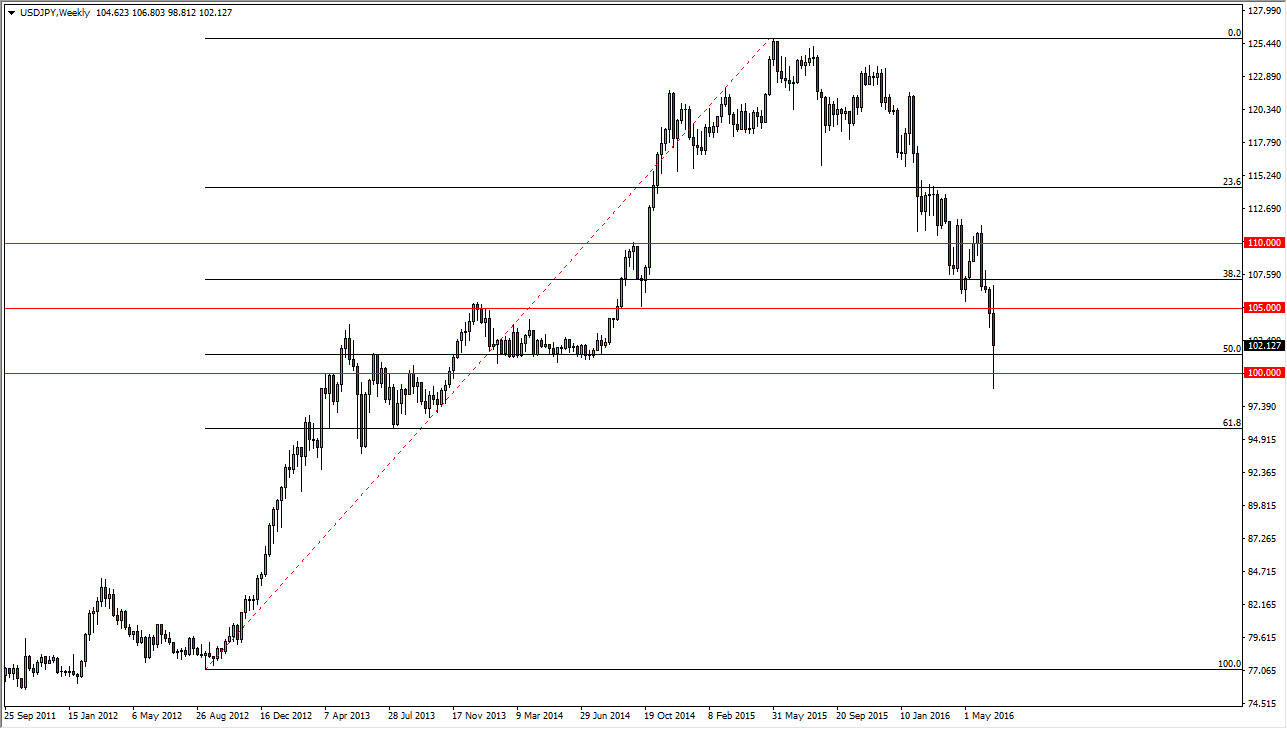

USD/JPY

The USD/JPY pair had a wild ride during the course of the week obviously, as the British left the European Union, or at least voted to do so. We are testing the 100 level right now, and at this point in time I believe that short-term rallies will continue to offer selling opportunities. There is a massive amount of support just below though, so I think we will bounce around this general vicinity with a somewhat negative bias.

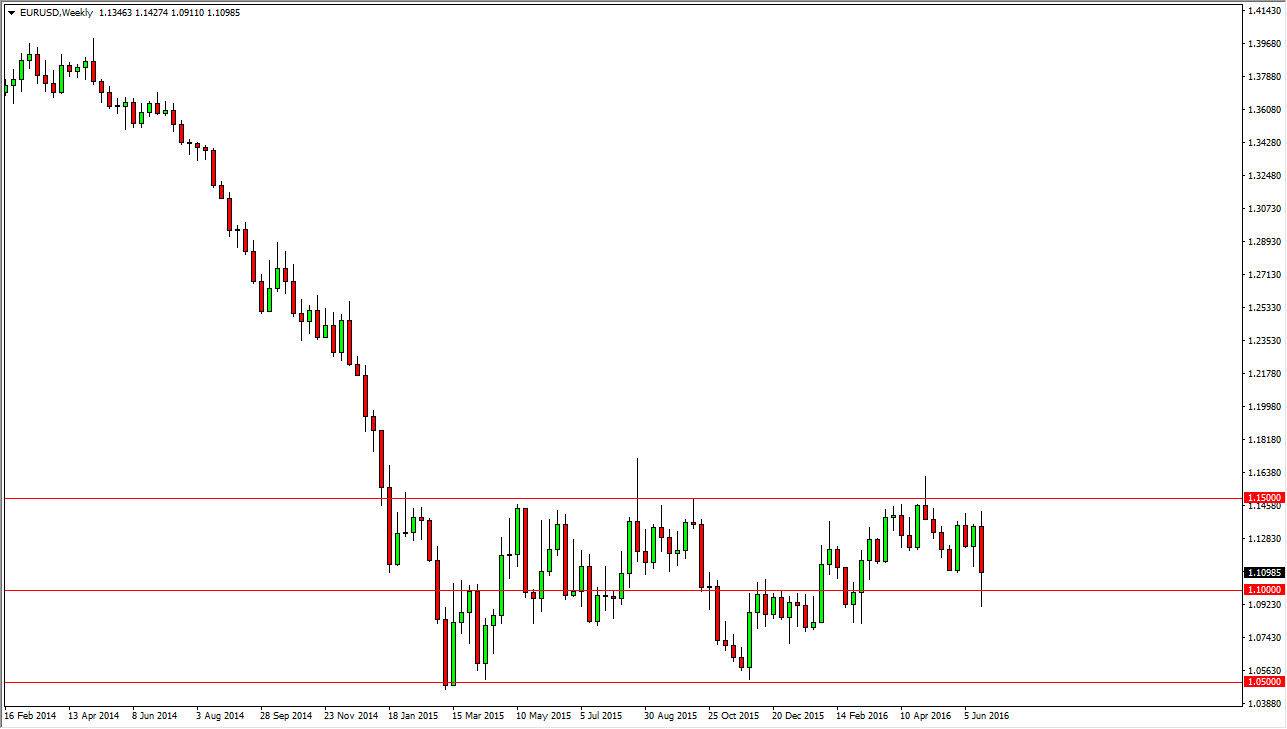

EUR/USD

The EUR/USD pair fell during the course the week as the British of course are leaving the European Union. Now there are fears of other countries leaving the European Union such as Sweden, Denmark, Austria, the Netherlands, and many others. Because of this there will continue to be quite a bit of uncertainty when it comes to the Euro. The 1.10 level is essentially the “middle ground” of the larger consolidation area between the 1.05 level on the bottom, and the 1.15 level on the top. Because of this, I do think that we will continue to sell every time this market rallies on the short-term chart.

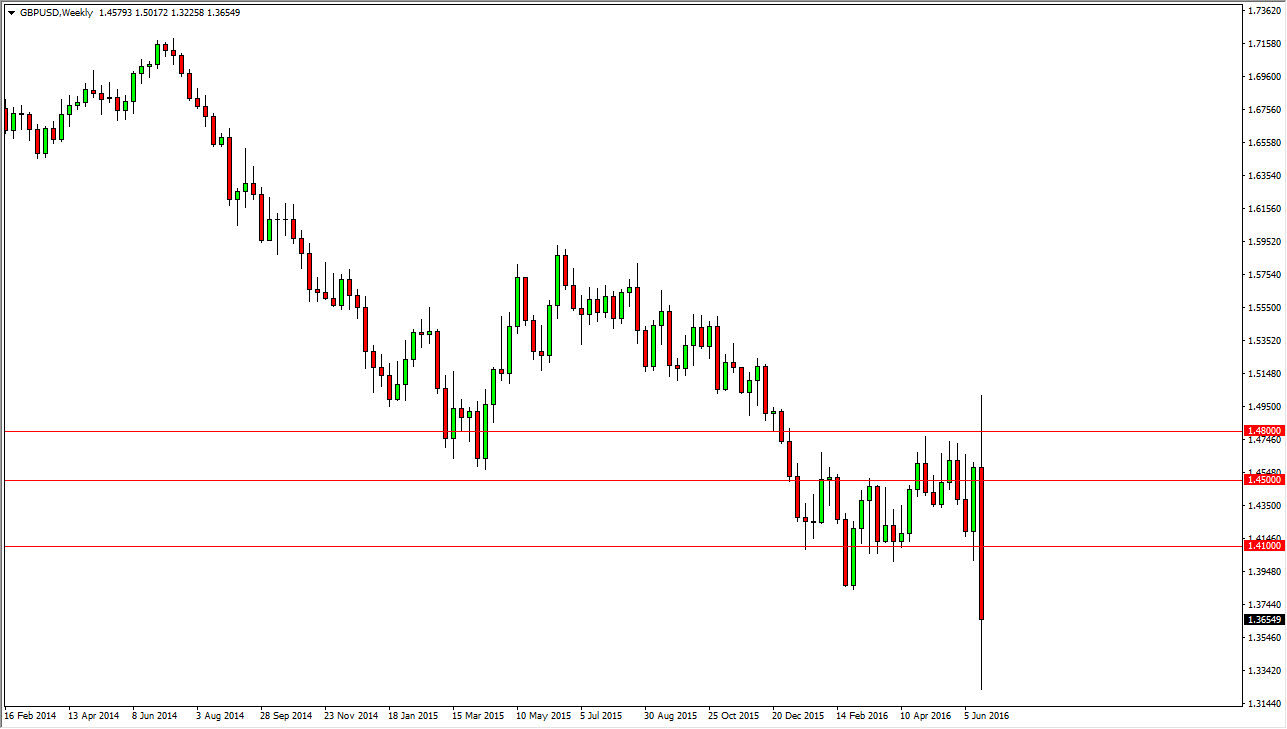

GBP/USD

The GBP/USD pair initially tried to rally during the course of the week, but then turn right back around to slice through the 1.40 level. As the British have voted to leave the European Union, the British pound of course fell significantly due to the fact that there is real concern now. However, at this point in time I believe that the best way to trade this market is to simply wait for short-term rallies that show signs of exhaustion in this market.

NZD/USD

The New Zealand dollar had a very wild ride during the course of the week, but we turn right back around to form a massive shooting star that sits above the 0.70 level. With this, it looks as if the market is going to continue to see quite a bit of volatility. However, if we can break down below the hammer from the previous week, at that point in time I think that the New Zealand dollar will start falling. Ultimately though, this market looks like it is more than likely going to bounce around just above the 0.70 level and therefore seems more apt to grind back and forth.