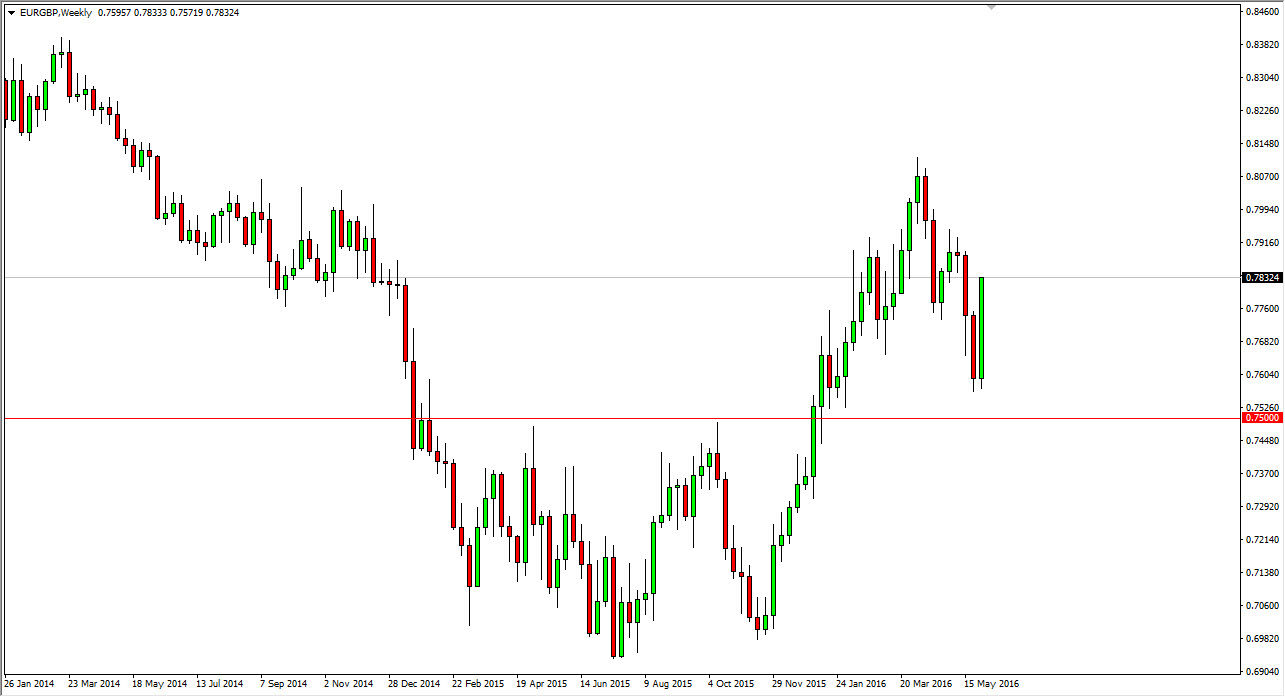

EUR/GBP

The EUR/GBP pair rose during the course of the week, showing intense strength as the British now look a little bit more likely to exit the European Union than previously thought. On top of that, the jobs number came out of America only adding 38,000 jobs for May, and that of course had people buying the Euro and selling the Dollar. This had a little bit of a knock on effect in this market as well. I believe that short-term pullbacks will be buying opportunities as well.

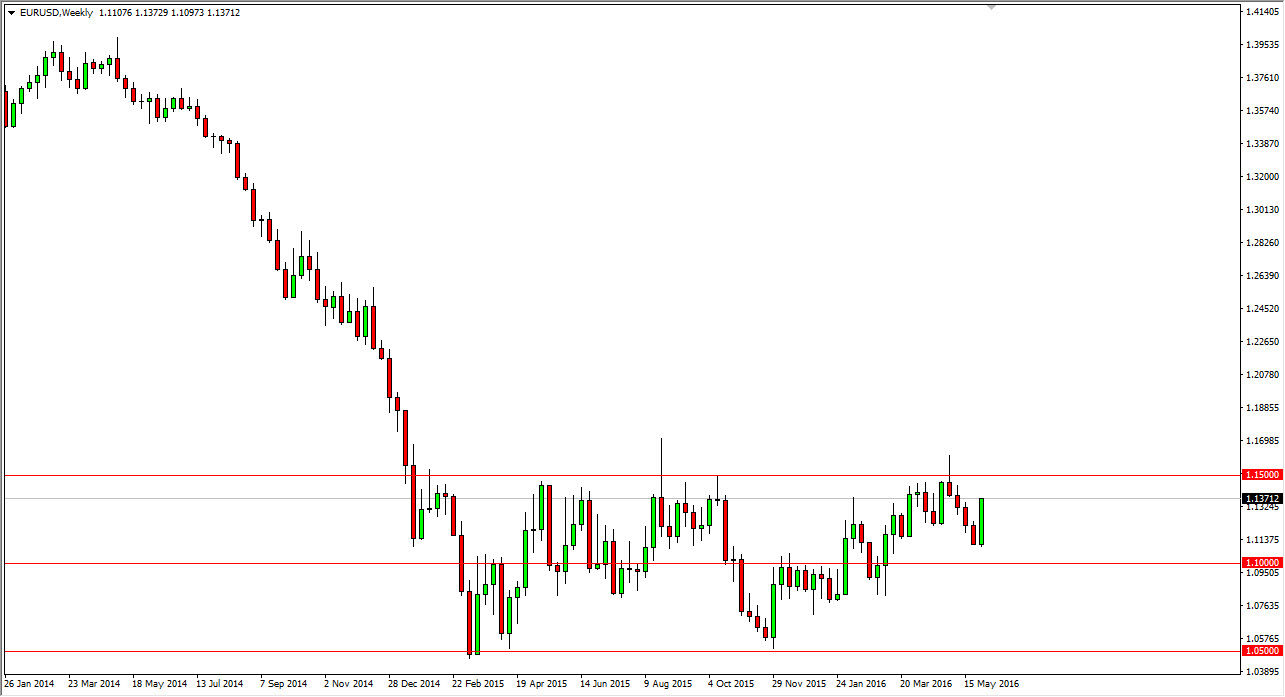

EUR/USD

The EUR/USD pair broke higher during the course of the week as well, as we of course had the horrific jobs number coming out of the month of May. Ultimately, it looks as if we will reach towards the 1.15 level, and then possibly even break above there. I think anytime this market pulls back you have to be thinking about going long on signs of support.

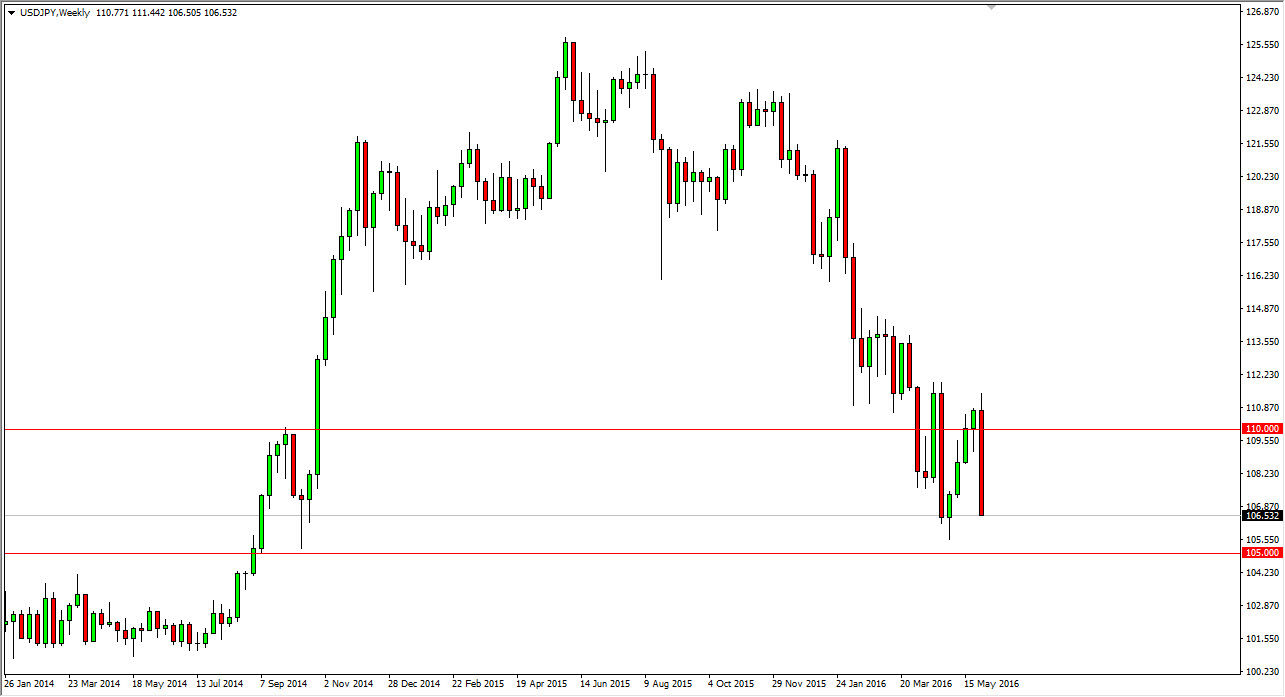

USD/JPY

The USD/JPY pair initially tried to rally during the course of the week but then fell apart as we got a soft jobs number. Because of this, the market continues to look soft as we closed towards the bottom of the range, and we should then fall down to the 105 level. Rallies at this point in time will be selling opportunities in my estimation, so therefore have no interest whatsoever in buying.

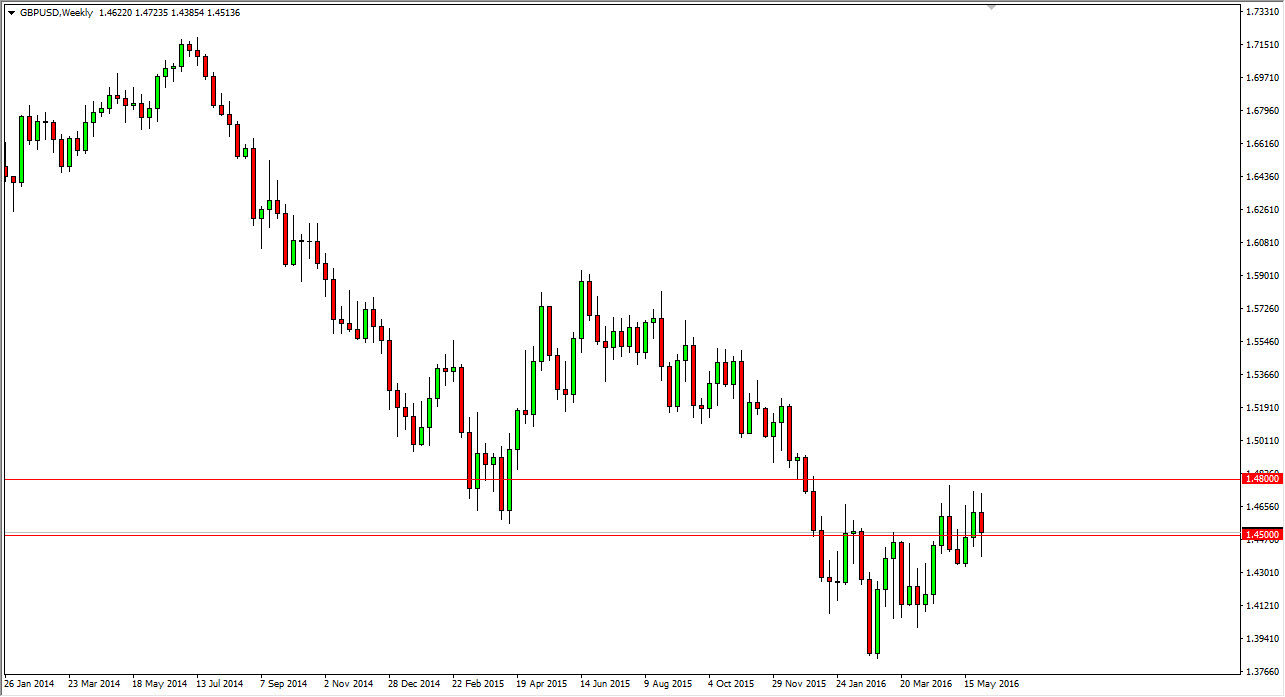

GBP/USD

The GBP/USD pair fell during most of the week, but once we got the horrible jobs number, the US dollar fell significantly in value, and as a result we ended up forming a nice-looking hammer here in this pair. I think that we will probably continue to bounce around between the 1.45 level and the 1.48 level, with a bit of upward pressure as the US dollar is certainly on its back foot at this moment in time.