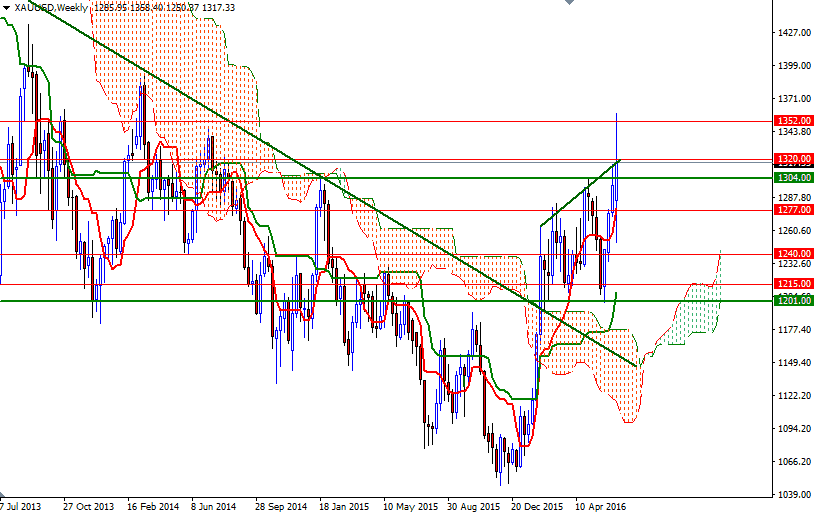

Gold prices settled at $1317.33 an ounce on Friday, a rise of 2.4% over the course of the week's trading, as investors sought refuge from volatility in the wider markets. Britain’s surprise vote to leave the European Union shocked financial markets that had priced in a vote to remain in the bloc. From Tokyo to New York, stocks tumbled sharply and currency markets saw huge swings. The British pound plunged to its lowest level since 1985, while the Japanese yen advanced the highest level since late 2013.

No one really knows what happens now. It is unlikely that the U.K.'s departure from Europe will set off a full financial crisis but the success of the Leave campaign heightens the likelihood of similar separatist movements which cloud threaten the integrity of the European Union. The dollar's rally and turbulence in the global markets will probably prevent the U.S. Federal Reserve from raising rates in the coming months. These factors should be supportive for gold, though keep in mind that the bullish side of the boat is overcrowded. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 292729 contracts, from 279862 a week earlier.

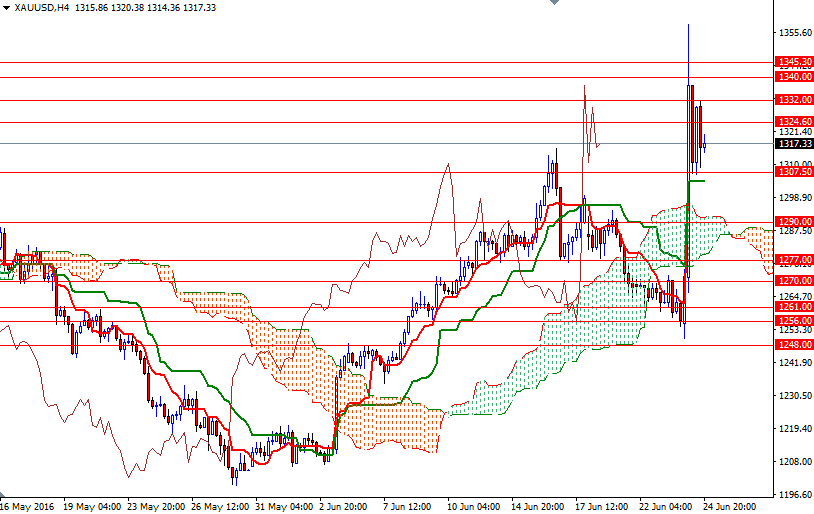

To the upside, the bulls have to push through 1320 so that they can make a fresh assault on the 1325-1324.60. A break up above 1325 paves the way for a retest of 1332/1. Closing beyond 1332 on a daily basis would make me think that the market is about to proceed to the 1340-1337.50 area. Once beyond 1340, the 1345.30 and 1352 levels will be the next possible targets. If the market finds it difficult to penetrate the 1320 level, I wouldn't be surprised to see prices retreating back to the 1308-1307.50 area. The bears will need to push prices back below 1307.50, so that they can have a chance to challenge the support in the 1304/2 area where the 4-hourly Kijun-Sen (twenty six-period moving average, green line) resides. Falling back below 1302 would suggest that the market will have a tendency to test the supports at around 1290 and 1285.