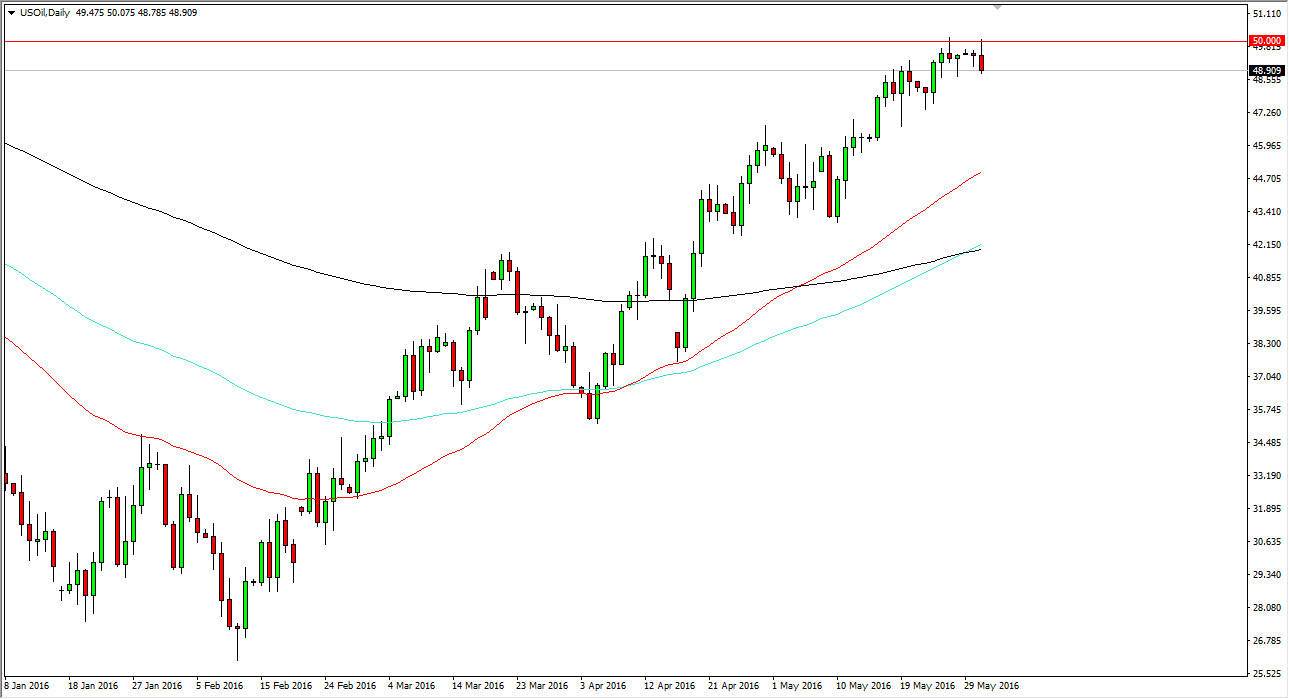

WTI Crude Oil

The WTI Crude Oil market initially tried to rally on Tuesday but found the $50 level be far too resistive, and as a result we turn right back around to form a pretty negative looking shooting star. There is quite a bit of support below, so I think we’re simply going to try to build up enough momentum to break out to the upside. I have no interest in shorting this market, it has been far too strong lately and therefore I am waiting to see whether or not I get a weekly candle that tells me it might be time to sell. At this point in time, this simply looks like it’s going to be a bit of a pullback and not necessarily a selloff.

Natural Gas

I have to admit that I’m a little surprised by this move, as the natural gas markets broke above the $2.20 level significantly. We are not only above that resistance barrier, but we are well above the 200 day exponential moving average that I have plotted on the chart as well. Because of this, we could continue to go higher, perhaps even as high as the $2.50 level. With this, I believe that short-term pullbacks will end up being short-term buying opportunities as the market will more than likely continue to show quite a bit of volatility.

In fact, this point in time I don’t believe that we can sell this market until we are below the 200 day exponential moving average. Once we dipped down below there, I think it would show that we have a significant amount of momentum that has turn right back around. Ultimately, this is a market that looks bullish, but nonetheless it will be very difficult to hang onto the trade for any real length of time as there are so many moving pieces at the moment.