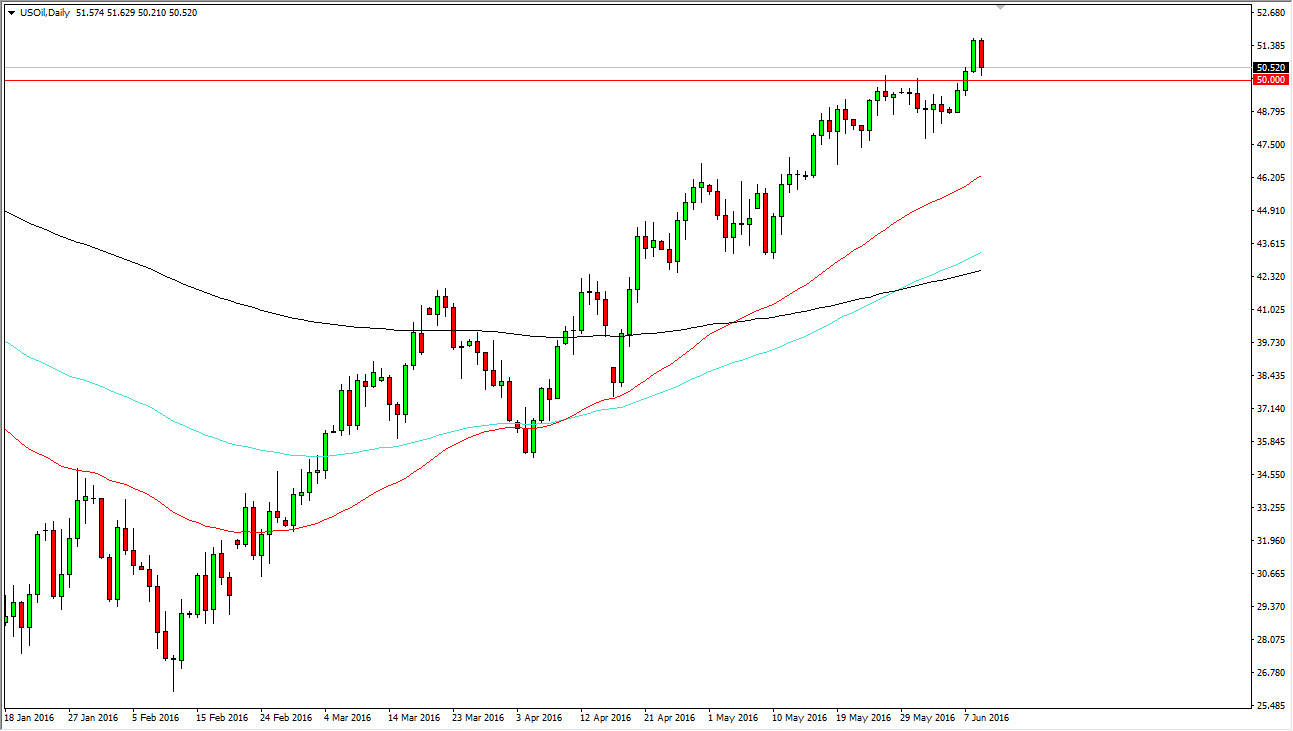

WTI Crude Oil

The WTI Crude Oil markets fell during the course of the session on Thursday, testing the $50 level for support. This was an area that previously had offered quite a bit of resistance, so having said that it makes sense that it offers support. When you look at the exponential moving averages, you can see that the 50 and the 100 day exponential moving averages are above the 100 day exponential moving average, so without it appears that the longer-term trend is on now. I think any type of supportive candle in this region is reason enough to start buying, and believe that the support runs all the way down to the $48 level for that matter.

Brent

Brent markets broke higher during the course of the day on Thursday, clearing the $2.50 level significantly. In fact, we even touched the $2.60 level, and as a result it looks like the market is ready to continue a longer-term to the upside. However, I believe that we will have to pullback in order to build up momentum, and that means that we will probably drop towards the $2.50 level.

There is a cluster of noise just below the $2.50 level, so I believe that the market will respect that as support, as the market participants will certainly know that we are in an uptrend at this point in time. With that, I think a lot of people have missed this move and therefore will be willing to jump in somewhere closer to the $2.50 level. Keep in mind that the US dollar continues to fall, and drillers have step away from the field so we could get a bit of a run in this particular market right now, even though the seasonality isn’t there for natural gas. Having said that, this is a market that should continue to strengthen.