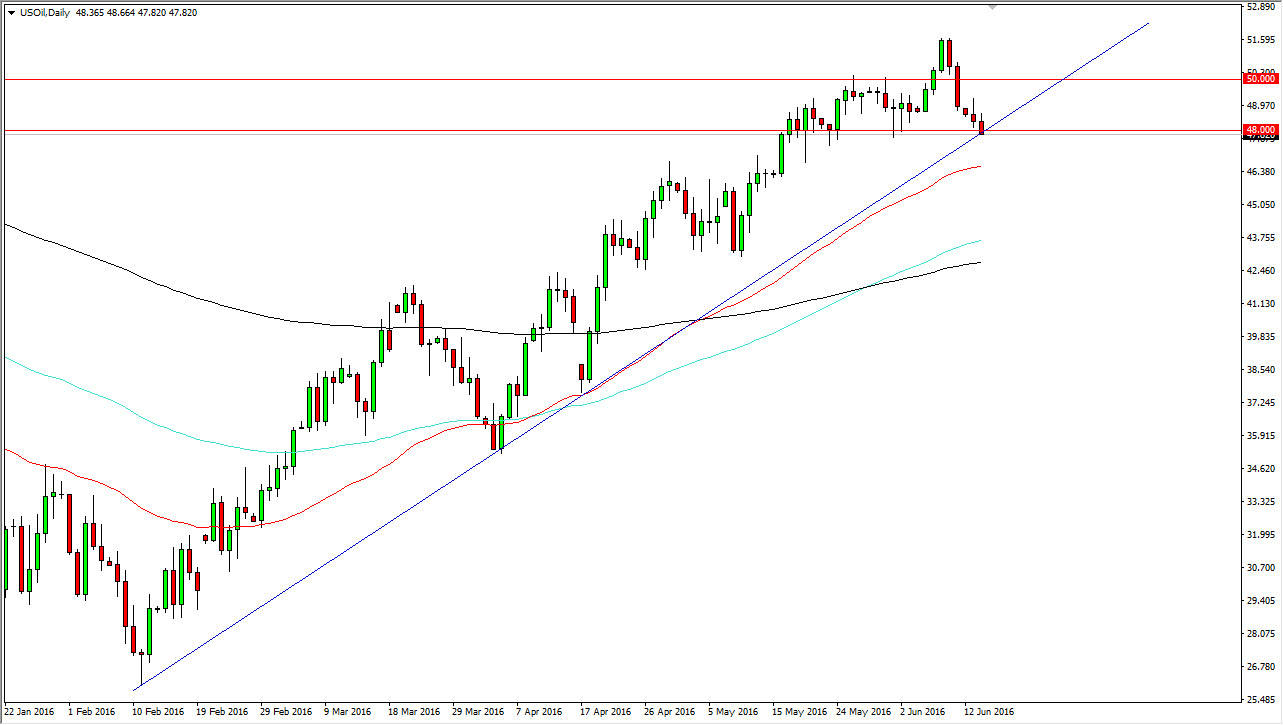

WTI Crude Oil

The WTI Crude Oil market could have a very interesting session today, as we will have several different announcements that can have an effect on this market. Most importantly will be the crude oil inventories number, which of course takes a look at the amount of demand that we see in the markets. Obviously, if the markets have quite a bit of demand in them, it should drive prices higher. If we get a huge drawdown due to demand, expect buyers to step in. However, we also get the FOMC Statement, and that of course will have a major effect on the value of the commodity. This is because it will greatly influence where the US dollar goes. With this, I believe that it is going to be a very important day during the course of the session today. It should be noted that we fell during the day on Tuesday, and we are testing support at the $48 level, as well as an uptrend line. With this, I believe that whichever direction we break, the market is about to make a big decision.

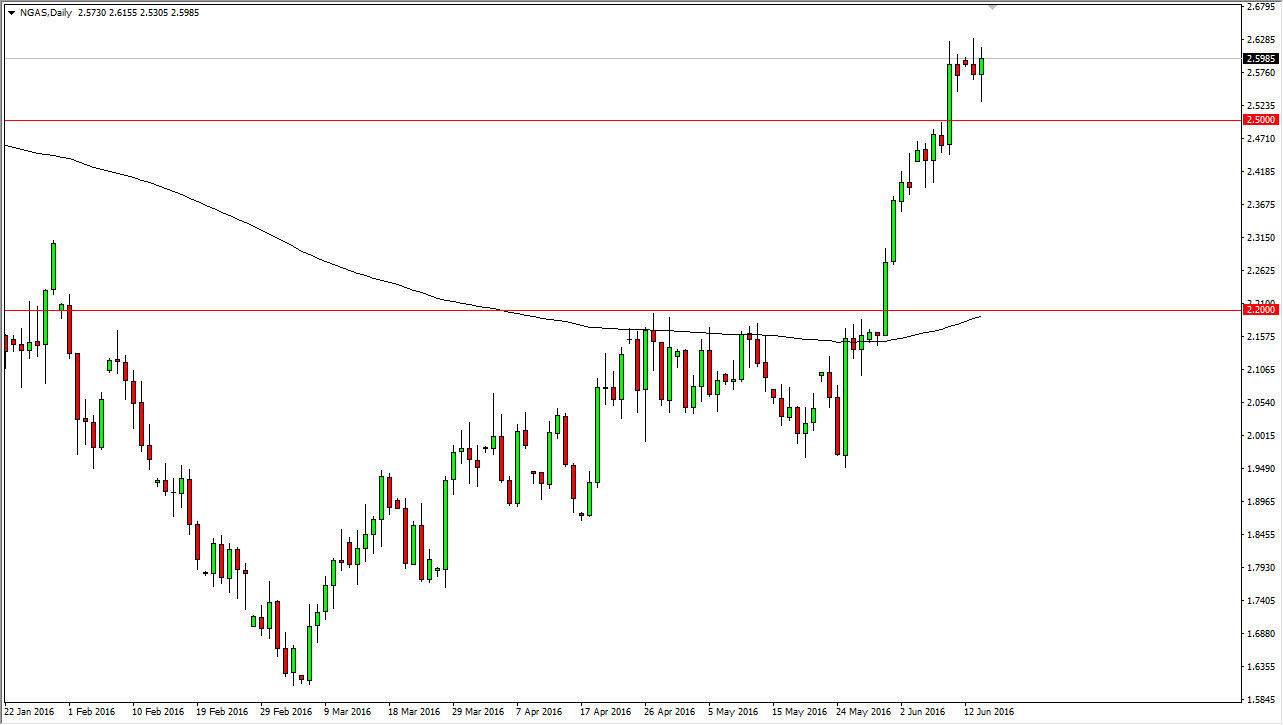

Natural Gas

Natural gas markets initially fell during the day on Tuesday but found enough support above the $2.50 level to continue to show signs of life. With that being the case I believe that the market will continue to try to fight to the upside, and pullbacks should continue to be thought of as value going forward. In fact, it’s not until we break down below the $2.40 level that I am comfortable selling. In the meantime, I believe that the market continues to find buyers every time we dipped, and that we will more than likely try to continue the uptrend. However, we have recently been far too bullish and overextended, and as a result it looks like we will probably have to try to build up momentum.