By: DailyForex. com

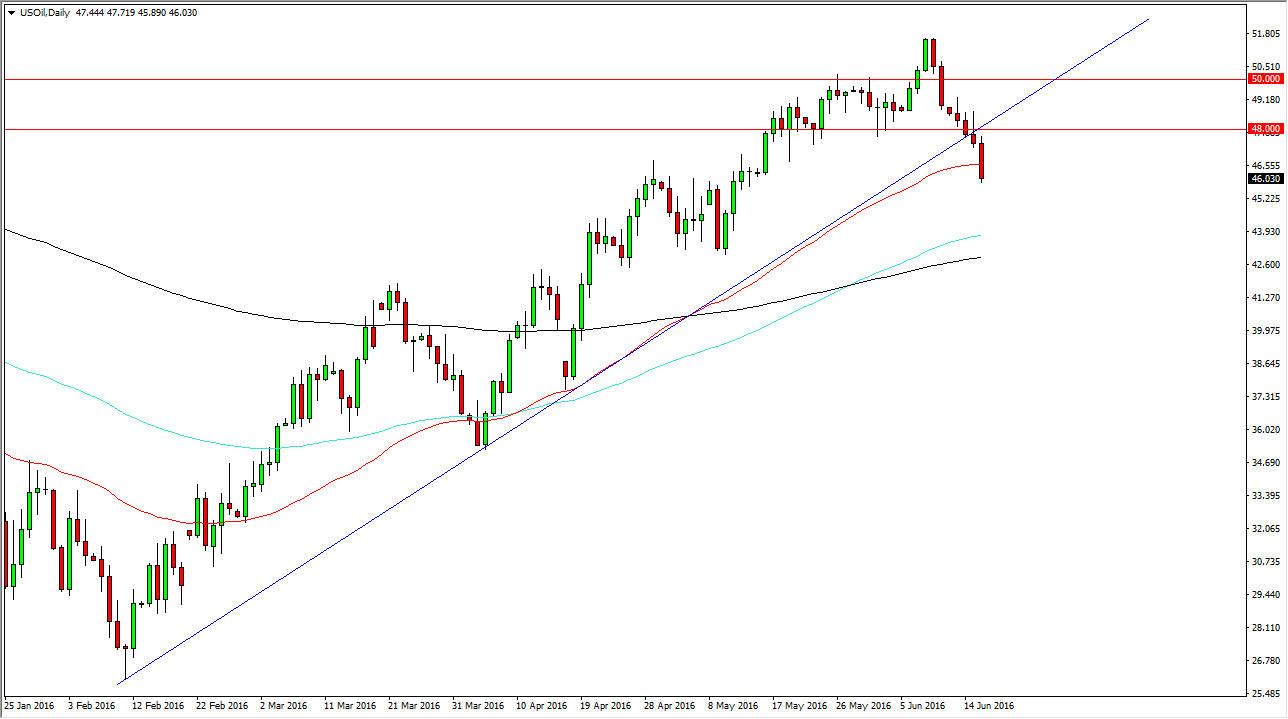

WTI Crude Oil

The WTI Crude Oil market fell significantly during the course of the day on Thursday, breaking below the 50 day exponential moving average, a significant moving average as far as longer-term traders are concerned. With that, it looks as if we could get more selling pressure, and as a result a break below the range for the day on Thursday would be reason enough to sell and perhaps reach towards the 100 day exponential moving average, shown as a green moving average on this chart. Ultimately, it is not until we break back above the $48 level that I would consider buying, and as a result an exhaustive candle after short-term rally would also be a selling opportunity at this point in time.

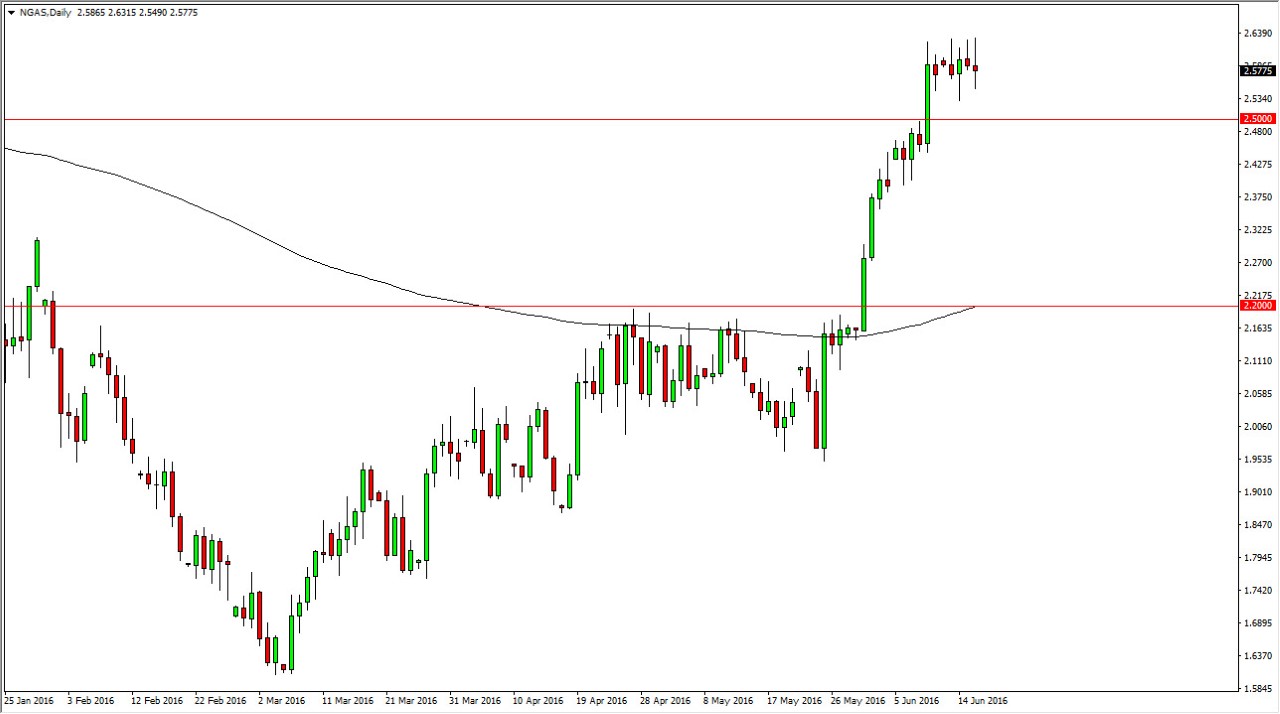

Natural Gas

The Natural Gas market went back and forth during the course of the day on Thursday, and as you can see it looks as if the markets will continue to be very volatile. After all, the $2.50 level below is massively supportive, and that extends all the way down to the $2.40 level. A supportive candle between here and there would be a buying opportunity as far as I can see. On the other hand, if we break above the top of the candle for the session on Thursday, we would be willing to buy there as well.

If we did manage to break down below the $2.40 level, the market will more than likely reach down to the $2.20 level as a target. That area should be massively supportive, but as that’s the case it should also be a target and be very magnetic for price on a break down. As far as going higher, if we do break out to the upside anticipate that the $2.75 level will be the target as the market is a large, round, psychologically significant number.