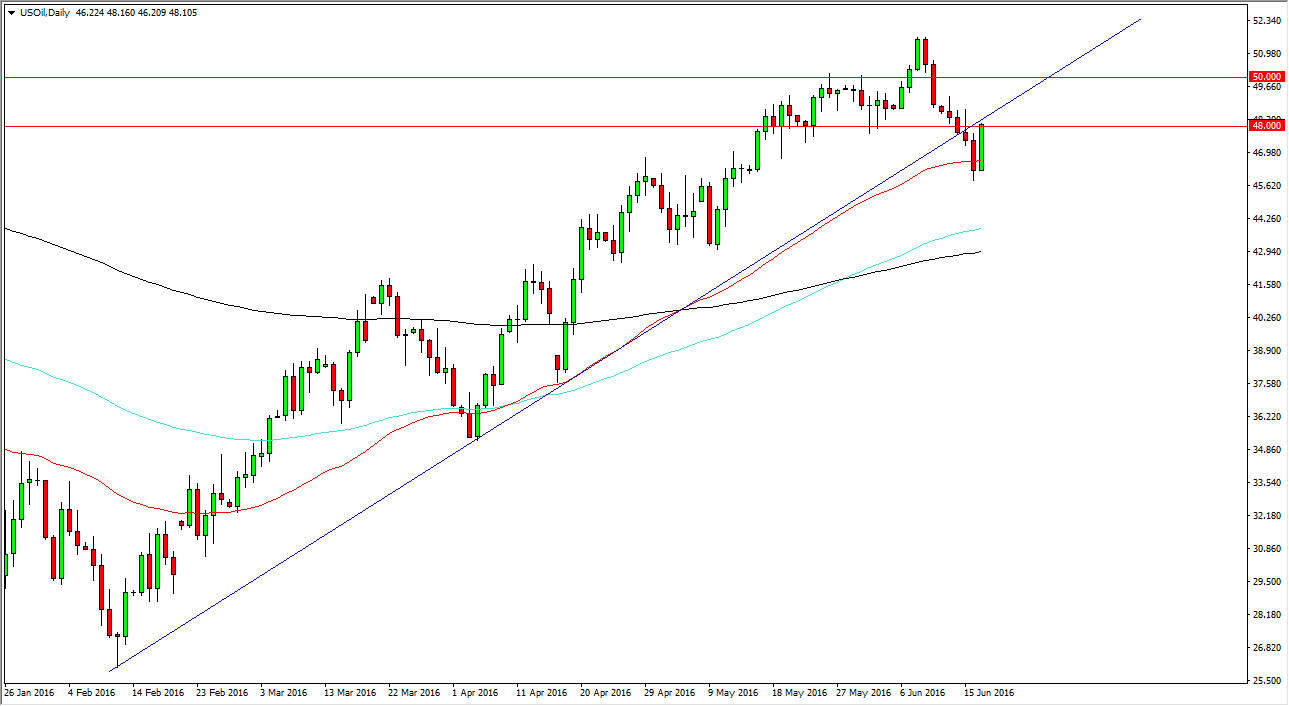

WTI Crude Oil

The WTI Crude Oil market rose during the course of the session on Friday, testing the $40 handle. More importantly, we tested the shooting star from a couple of days ago, and of course the bottom of the uptrend line that we had recently broken. With this being the case, we have to see whether or not we break above the shooting star, and if we do this market could continue to go much higher and perhaps reach towards $50 next. Ultimately, if we form a resistant candle near it could be a selling opportunity but I have to admit that the candle during the session does look very bullish, so caution will have to be used.

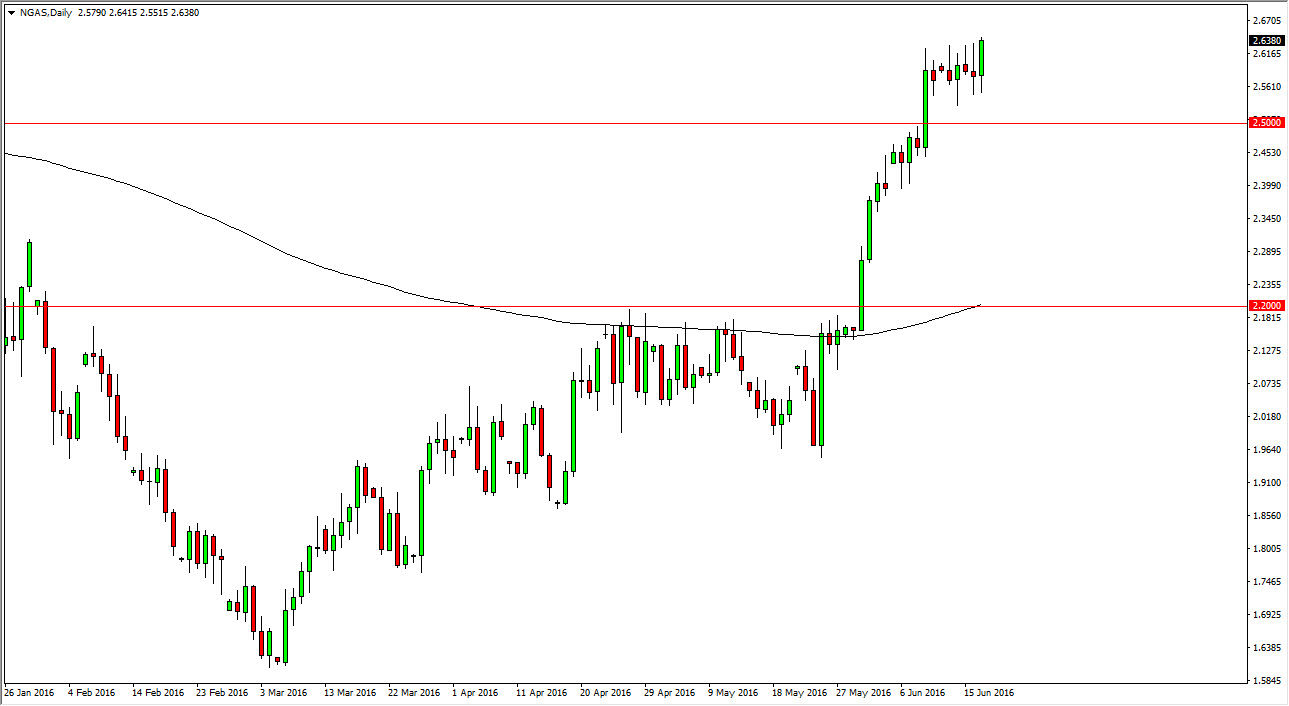

Natural Gas

Natural gas markets initially fell during the course of the day on Friday but turned right back around form a very bullish candle. The market has been extraordinarily strong recently, so it’s likely that we will continue to see buyers step into this marketplace as natural gas has been absolutely bullish lately. Pullbacks at this point in time should find buyers below at the $2.50 level. The support below that area extends all the way down to the $2.40 level as far as I can see, and as a result pullback should be thought of as value.

A break above the top of the candle for the Friday session could be a buying opportunity as well, as the market should then reach towards the $2.75 level. Ultimately, this is a market that should continue to go higher regardless, and it’s not unless we break below the $2.40 level that I would consider selling, and at that point in time it would only be a selling opportunity for the short-term. At this point time, it looks as if the market is going to continue to go much higher.