By: DailyForex.com

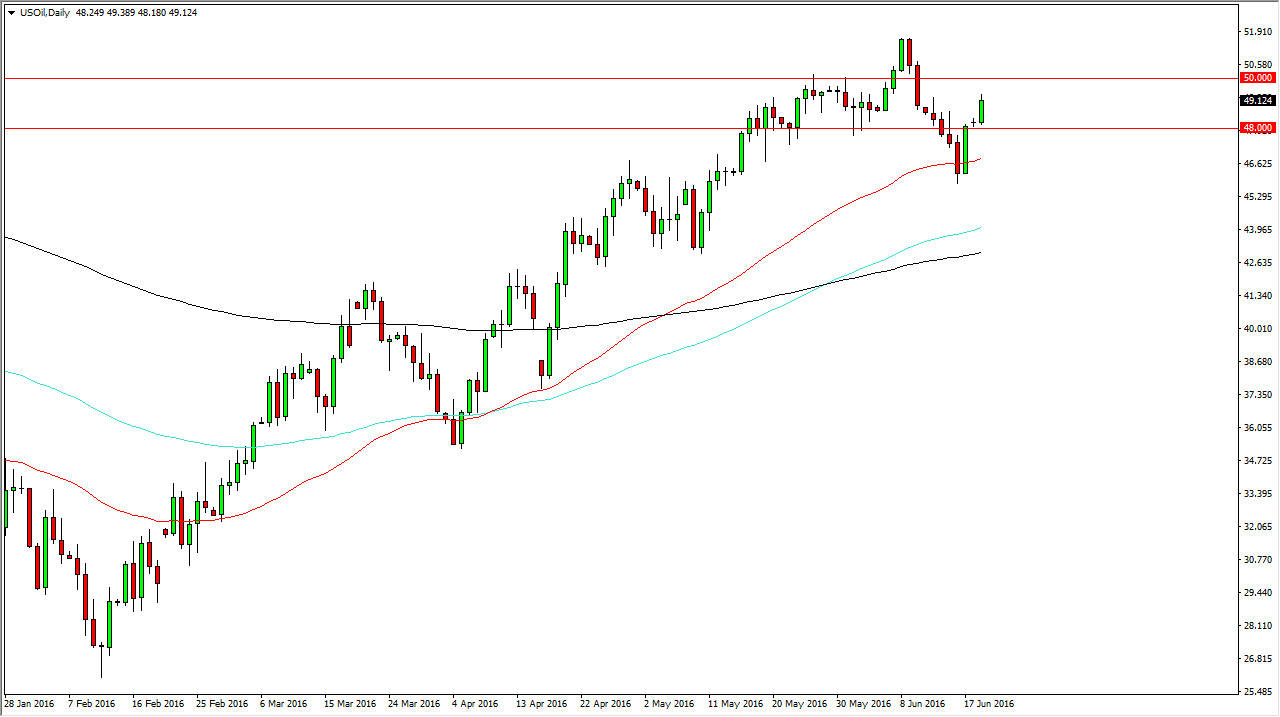

WTI Crude Oil

The WTI Crude Oil markets rallied during the course of the session on Monday, as we continue to grind higher overall. After all, the $48 level has been resistive in the past, as well as supportive. The market looks as if it is going to reach towards the $50 level. If we can break above the $50 level, the market could continue to go much higher over the longer term. On top of that, we have the 50 day exponential moving average offering a bit of support dynamically, so it appears that all markets are pointing to the upside. In fact, it’s not until we break down below the 200 day moving average, pictured in black, but I’d be interested in selling. I believe this market eventually builds a “buy-and-hold” type of situation.

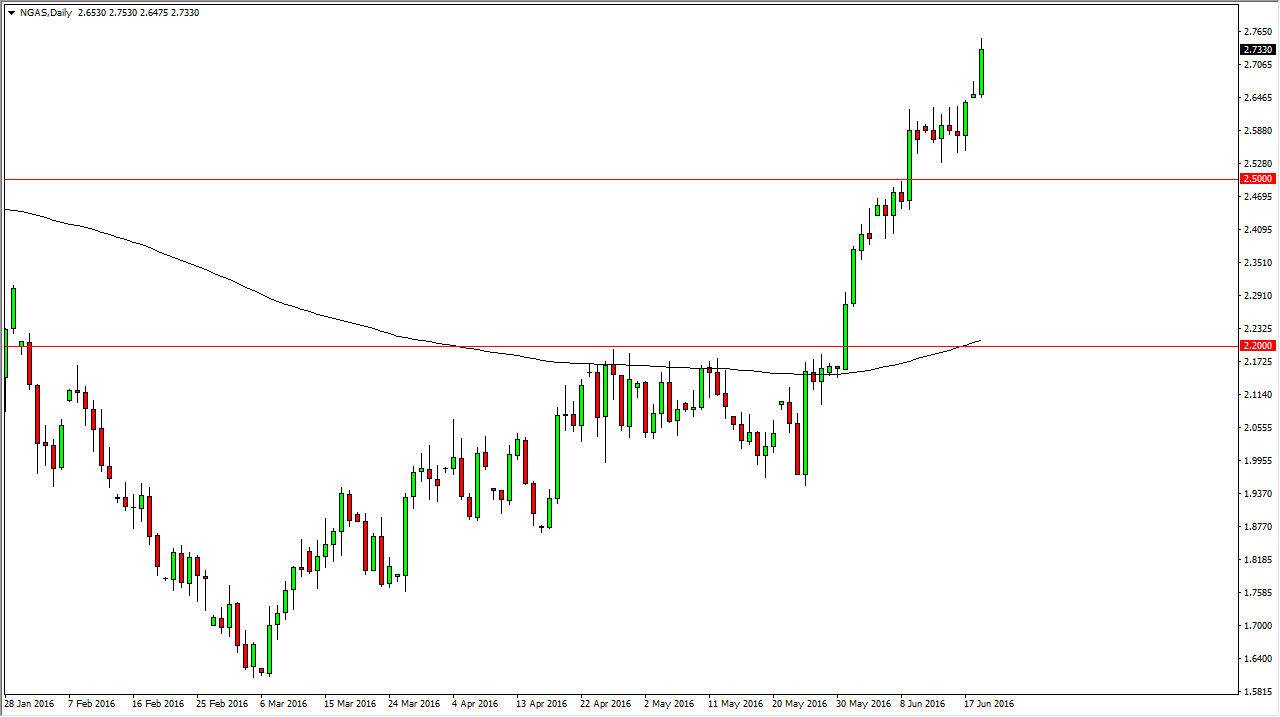

Natural Gas

The natural gas markets broke out to the upside after gapping higher on Monday. By doing so, looks as if the market is reaching towards the $2.75 level, an area that of course has some psychological significance. This is a market that should continue to find buyers every time we pullback, as the $2.50 level below should essentially be the “floor” in this market. With this being the case, a supportive candle should be reason enough to go long every time we pullback as it should represent a bit of “value” in a market that continues to attract hot money as natural gas had been sold off so drastically.

While I do not like the idea of longer-term “bullish” trades in this market, I recognize of the buyers have certainly taking over. The question of course is going to be whether or not supply and demand dictates higher numbers, but longer-term I don’t think that’s the case. In the meantime, you certainly cannot fight the bullish pressure so I look at pullbacks as buying opportunities as well as a break out above the top of the candle for the session on Monday.