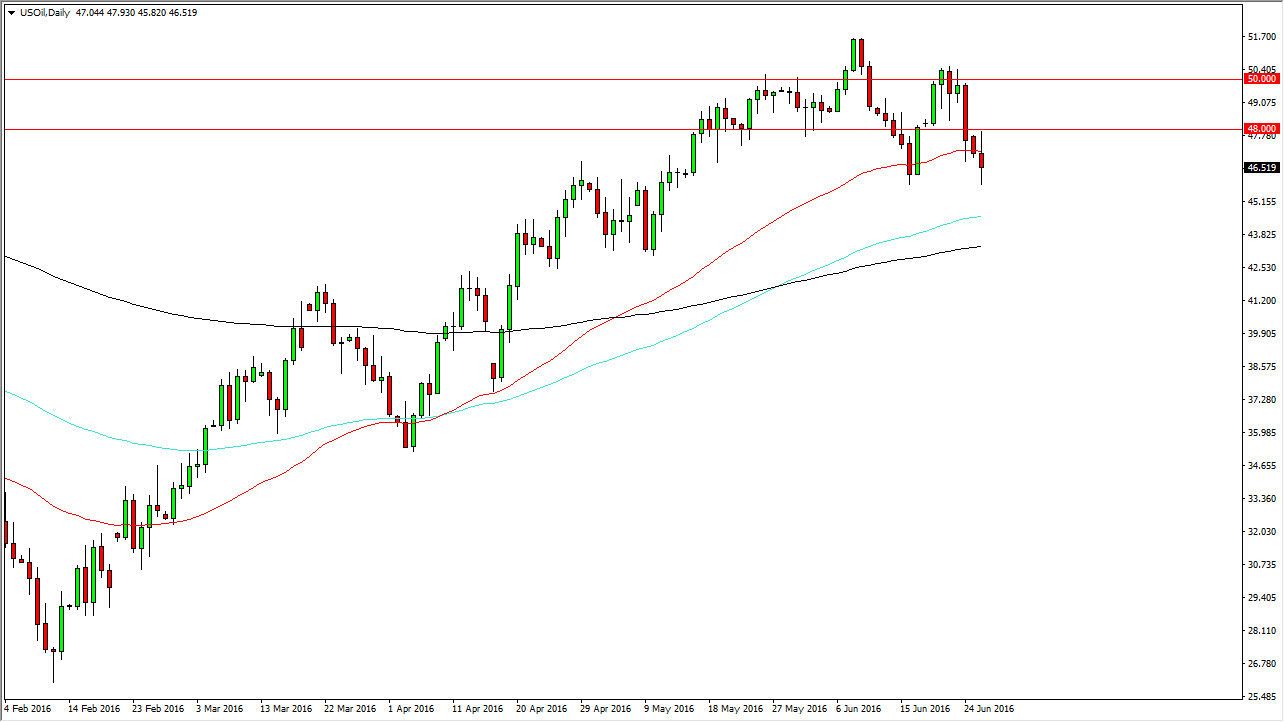

WTI Crude Oil

The WTI Crude Oil market did try to rally during the course of the day on Monday, but found the $48 level be far too resistive. In fact, we turned right back around at that level and formed a bit of the shooting star. That shooting star of course is negative, and as a result it’s likely that we will see some type of continuation to the downside. We have the 50 day exponential moving average now acting as potential resistance, along with the aforementioned $48 level. At this point in time, I believe that if we can break down below the bottom of the range for the day on Monday, this market will more than likely reach towards the green 100 day exponential moving average below, and then possibly even the 200 day exponential moving average on the chart pictured in black.

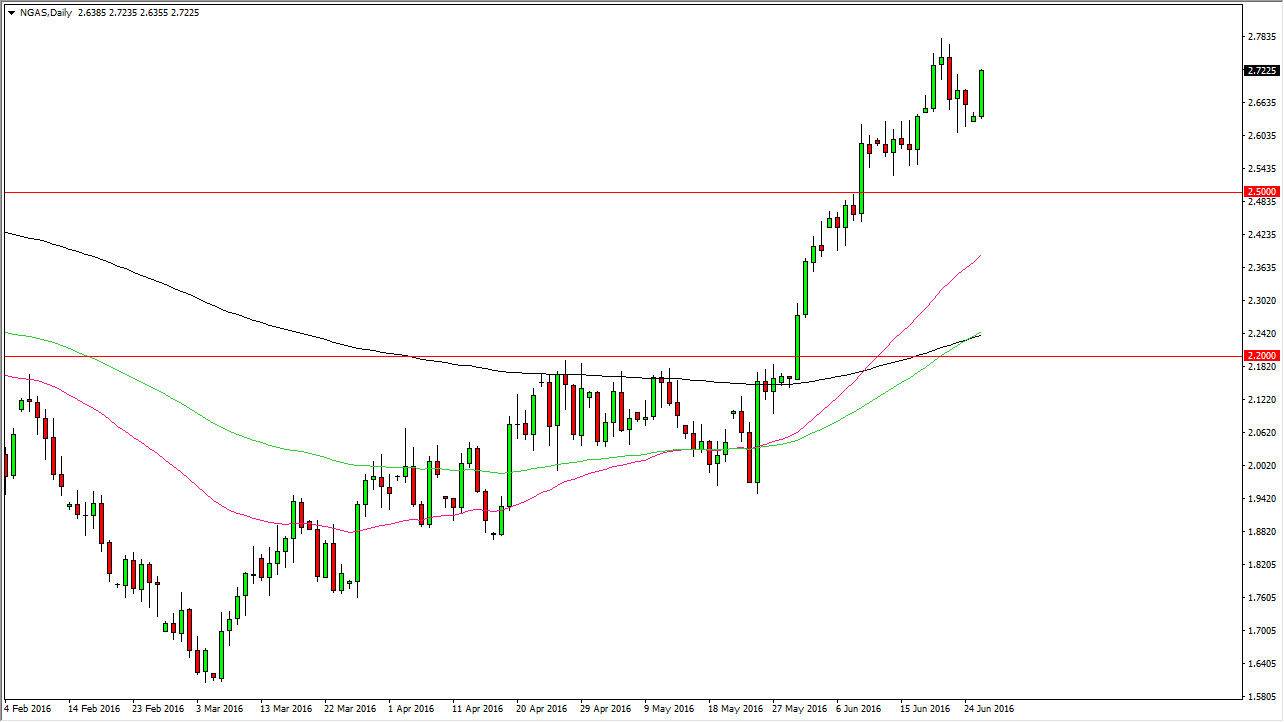

Natural Gas

The natural gas markets rose during the course of the day after initially gapping lower on Monday, using the very top of the range showing real strength. Because of this, it looks as if the natural gas markets will continue to go higher at this point in time and therefore short-term pullbacks will continue be buying opportunities as far as I can see. I have no interest whatsoever in selling this market, as I see a massive amount of support below at the $2.60 level, and of course the $2.50 level below there. With that, it’s only a matter time before the buyers return every time we pull back as far as I can see, so having said that I believe that we will eventually break out to the upside.

If we did break down below the $2.50 level, at that point in time I would have to reevaluate everything but it does appear that the natural gas markets have quite a bit of strength in them as the candle is at the very top of the range for Monday.