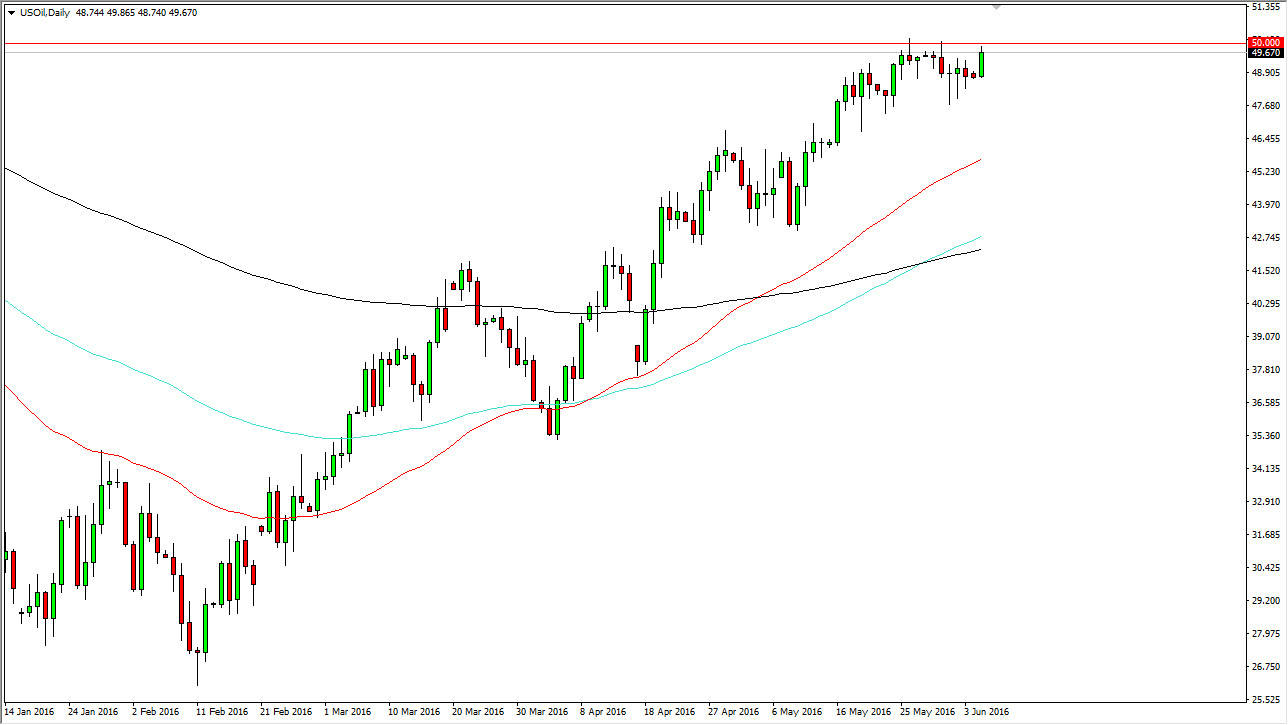

WTI Crude Oil

The WTI Crude Oil market rose during the course of the day on Monday, testing the $50 level yet again. That area has offered quite a bit of resistance but with the way that the US dollar has been falling, it’s more than likely going to force this market higher given enough time. Short-term pullbacks should offer buying opportunities as well, and as a result this is a “buy only” market. I believe eventually we will break above the $50 level for significant amount of time, and that could lead into a “buy-and-hold” type of situation. I have no interest whatsoever in selling this market as the 50 and the 100 day exponential moving averages are both clearly above the 200 day exponential moving average.

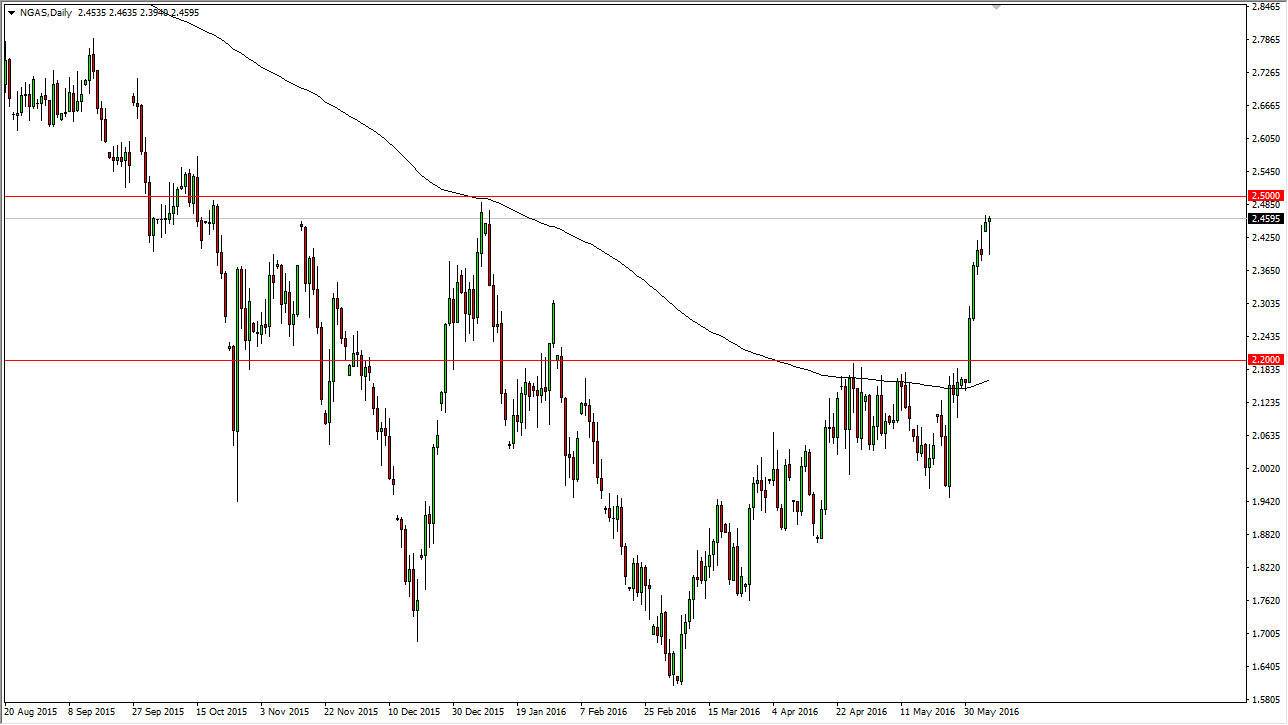

Natural Gas

Natural gas markets gapped higher at the open on Monday, but then turned right back around to fall and fill that gap and then eventually bounce. By doing so, we ended up forming a hammer and it now looks as if the natural gas market is going to reach towards the $2.50 level next. This was an area that I anticipated being the longer-term target, and now it appears that we are most certainly going to make it. If we can break above that level, the market could continue to go much higher.

If we break down below the bottom of both the hammer from the session on Monday and of course the shooting star from the session on Friday, that would be an extraordinarily bullish sign. At this point in time though, it does not look like it’s likely to happen anytime soon. A break above the $2.50 level would of course be a very strong sign, and perhaps even lead into a longer-term “buy-and-hold” type of situation. The falling US dollar is of course helping natural gas at the moment.