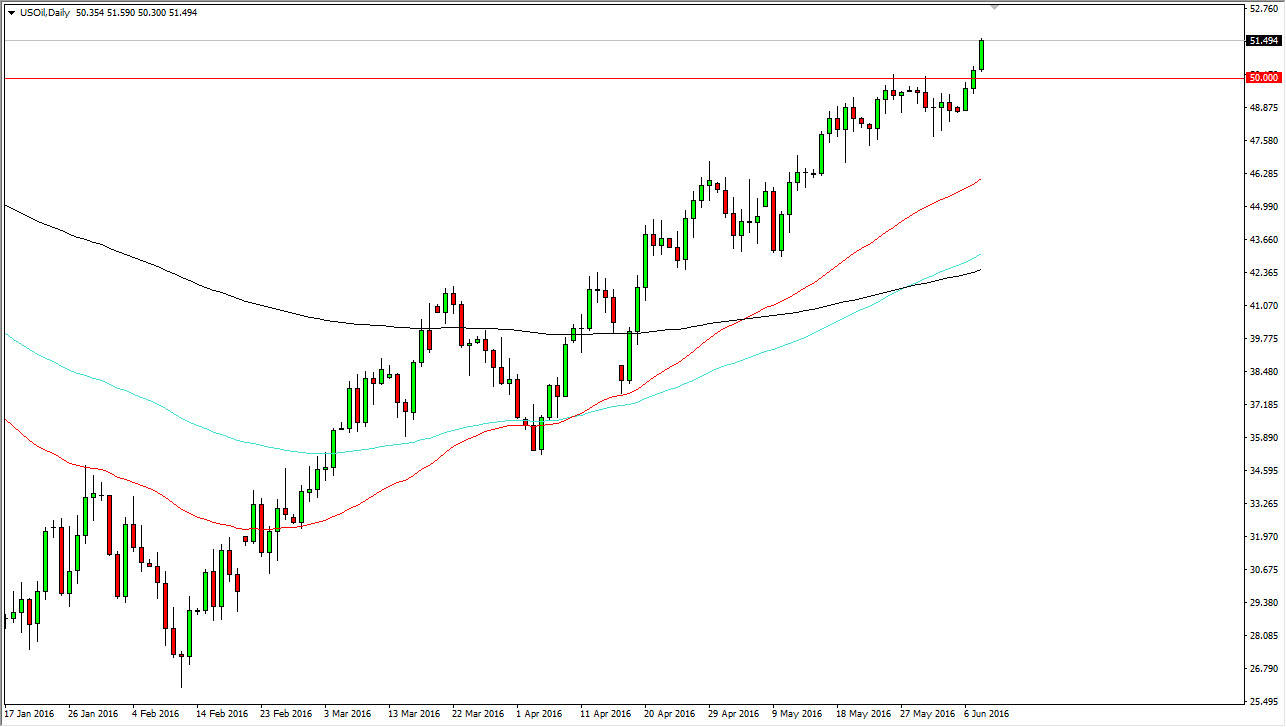

WTI Crude Oil

The West Texas Intermediate grade of crude oil broke out during the day on Wednesday, as we have certainly left the $50 region behind. Because of that, this market should continue to go higher as I have that as one of the major resistance barrier to overcome from both a psychological and an actual resistance point of view. The moving averages are all pointing up, and we do have the 50 and 100 day moving averages above the 200 day moving average now. Adding to that is the fact that the market closed at the very top of the range for the day, and with this I believe that the market can only go higher from here. Buying pullbacks and breakouts above the top of the range for the day is how I’m going forward in this market.

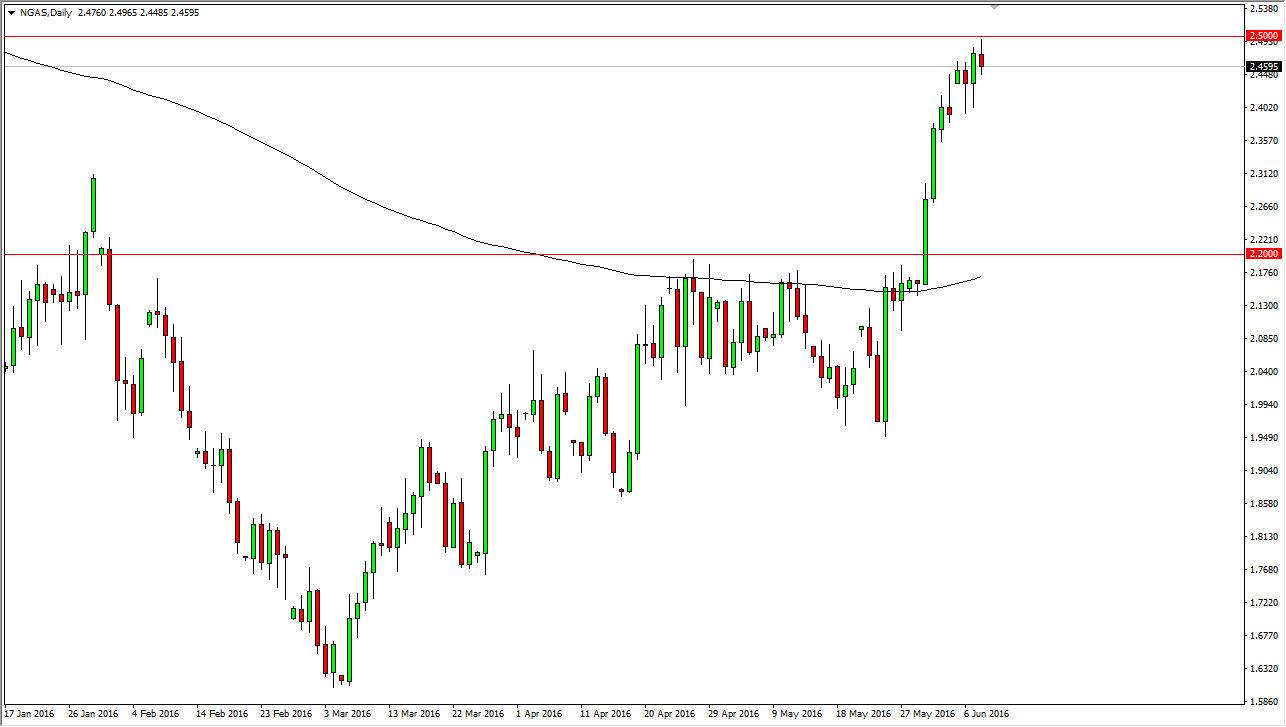

Natural Gas

The natural gas markets test of the $2.50 level during the day on Wednesday but failed. We ended up turning around in forming a bit of a shooting star which of course is a slightly negative signal, but at the end of the day we have so much in the way of support just below that it’s not until we break down below the $2.40 level on a daily close that I would consider selling this contract right now. After all, we have seen quite a bit of bullish pressure and at this point in time I believe that there still will be quite a bit of buying interest when it comes and natural gas.

Obviously, breaking above the $2.50 level is a much more attractive offer of bullish pressure, but I think that pullbacks and signs of support could also be used as well. Ultimately, I believe that part of this could be due to the US dollar losing strength, and of course the possibility of a tightening of supply due to the fact that so many drillers have stepped away.