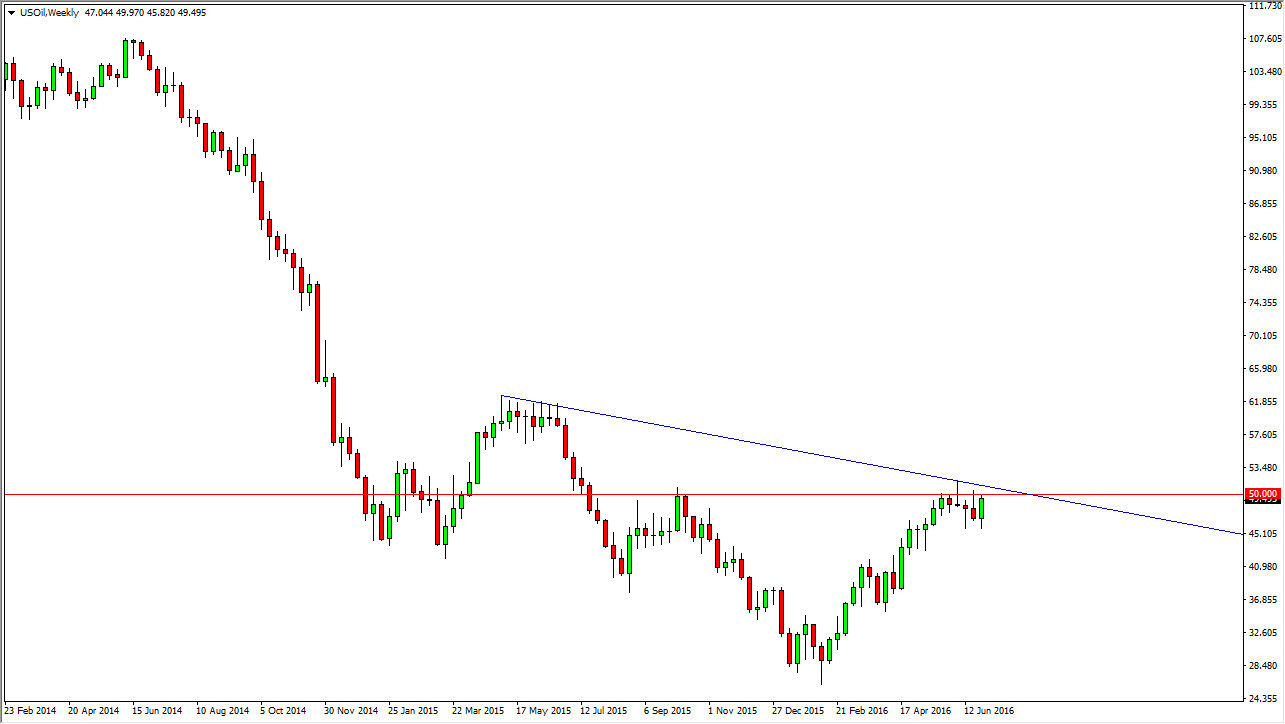

The WTI Oil market has been relatively volatile over the last month, as we have traded in a fairly tight range. When you look at this chart, it’s hard not to notice that the $50 level has offered quite a bit of resistance, and as a result I think that we have a real fight on our hands. The question now will be whether or not we have enough momentum to break out to the upside. If we do, this market could very well find itself going to the $60 level.

Having said that, I see that there is a downtrend line, and that and the shooting star from earlier in the month of June could be a target for buyers to try to break above and free themselves of the resistance. Ultimately, I believe that this market will be highly influenced by the risk appetite around the world. After all, demand will be a bit of a question, and of course there are still ripples of effects in the markets from the United Kingdom vote to leave the European Union.

Building up pressure?

I believe at this point in time the market is trying to build up enough pressure to continue to go higher, but will have to see whether or not that actually happens. If we pullback from here, I believe that there is a significant amount of support, but if we can break down below the $45 level I believe that this will send this market into a bit of a downtrend.

The market could very well find itself going sideways as we try to figure out what’s going on in general, but I think we are at an inflection point that we will decide where going next over the longer term. Again, if we break out above the top of the shooting star from 3 weeks ago, the market should continue to go higher, and a break down below the $45 level would be a selling opportunity for the longer-term.