EUR/USD

The EUR/USD pair fell initially during the day on Wednesday, but then shot higher after the FOMC statement. It appears that the market sold the US dollar off after the announcement, but quite frankly the Federal Reserve suggested that a rising chance of an interest-rate hike by the end of the year. That’s the case, that should continue to favor the US dollar, unless of course the war buying this on a “risk on” type of move. Ultimately, I do think that the sellers return, and therefore this rally should offer a nice selling opportunity on signs of exhaustion. There is a lot of confusion and uncertainty when it comes to the European Union, and with that being the case I think that we will prefer to own the US dollar longer term. With this, I’m waiting to sell.

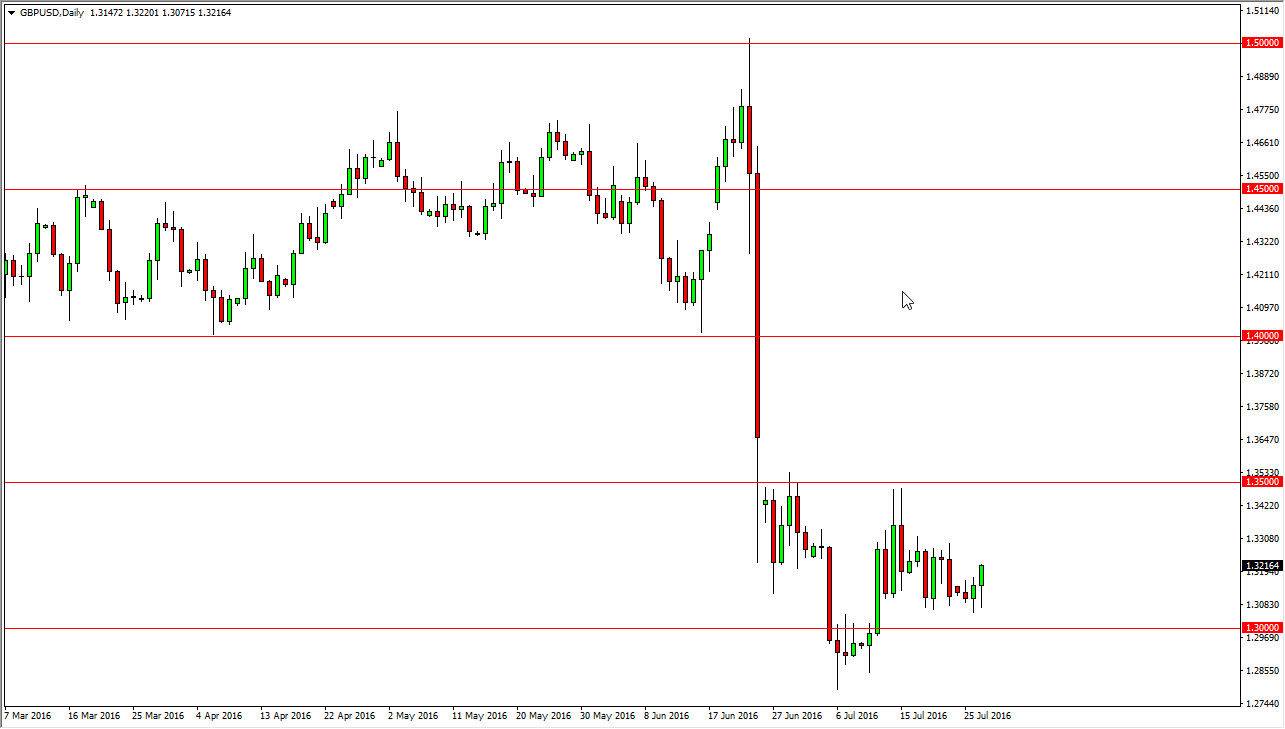

GBP/USD

The GBP/USD pair initially fell during the course of the session on Wednesday, but turned around to form a nice-looking hammer. I think this market will probably rally from here for the short-term, but I give it only a matter time before the market finds exhaustion, so having said that I feel that simply waiting for a sell signal is probably the way to go. I don’t necessarily think that a break down right away, and I believe that we will continue to bounce around and consolidate between the 1.30 level on the bottom, and the 1.35 level on the top. Given enough time, we should break down but at this moment in time I think we need to bounce in order to find even more sellers. After all, the United Kingdom leaving the European Union causes quite a bit of concern, and the initial economic numbers coming out of the British Isles look very tired, so the British pound is more than likely going to continue to fall over the longer term.