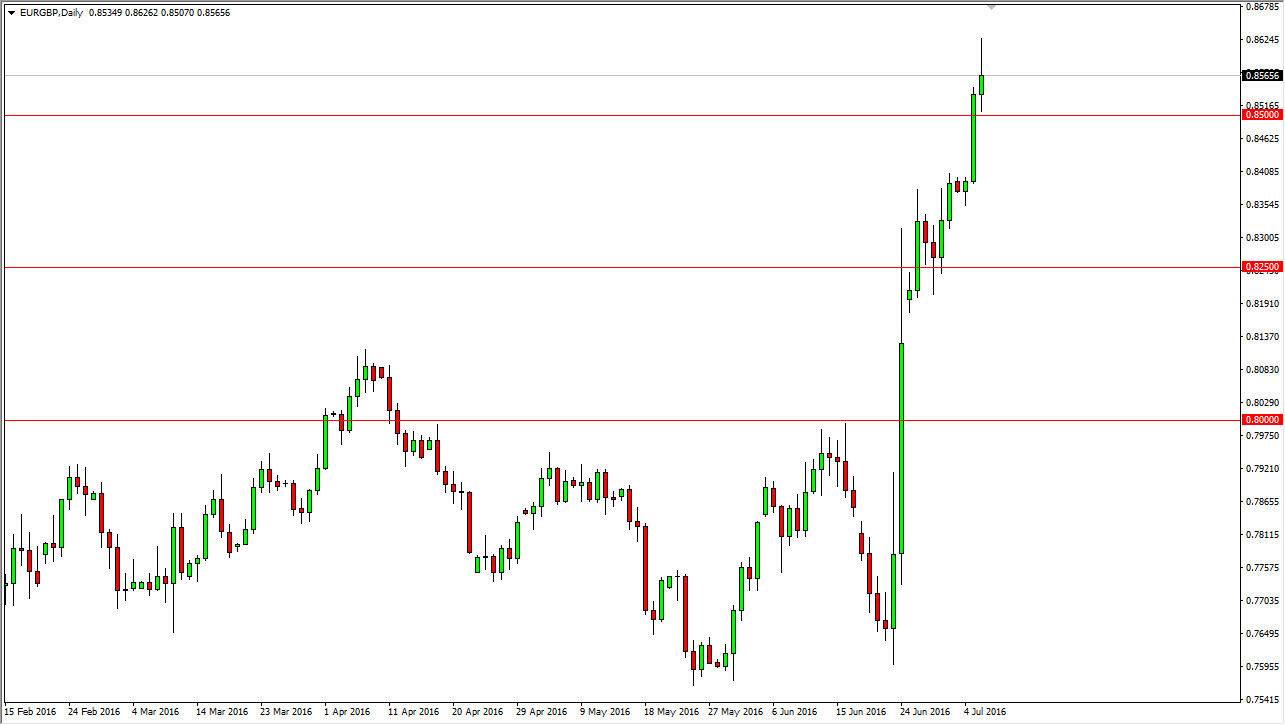

The EUR/GBP pair initially tried to rally during the course of the day on Wednesday, but turned right back around to form a massive shooting star. The shooting star of course is a very negative candle, and I do think that it’s likely we pullback. Having said that, I think it’s very important to suggest that we are going to pull back, and not break apart. I think that the Euro continues to strengthen against the British pound over the longer term, but we are a bit overbought at this point in time, and a bit of a reprieve is probably needed. I think that we will more than likely reach down towards the 0.84 level, if not the 0.8250 handle.

Parabolic

The markets are a bit parabolic at this point in time, so therefore it is easy to think that we are overbought. With that, I think that we need to fall in order to build up enough momentum to go long. There is the possibility that we break above the top of the shooting star, and if we do it’s likely that buyers will flood back into this marketplace again but I feel that we are starting to run out of momentum.

I think this point in time simply waiting on the sidelines for some type of supportive candle is going to be the best trade. Ultimately, this is a market that will favor the Euro over the United Kingdom and its Pound, as there is a lot of uncertainty when it comes to the United Kingdom. However, this is a pair that typically doesn’t move that rapidly, so this parabolic move should be looked at as extraordinary when it comes to this market. With that, it makes a lot of sense that we need to build up enough momentum to finally go higher. If we do break out to the upside, I would be a bit concerned as we are far too overextended to hang onto that trade with any type of comfort.