EUR/USD

The EUR/USD pair initially fell during the day on Wednesday, but then shot higher. However, we are very much in the way of consolidation, so therefore I think that it’s only a matter of time before we start selling. An exhaustive candle above on a short-term chart might be enough for me to start selling. I believe that the market will continue to be negative as the previous uptrend line should now be resistive. On top of that, I believe that the market will continue to punish the European Union for all of the uncertainty in that region of the world. With this, I believe that the markets will continue to favor the US dollar is more or less a “safety bid.”

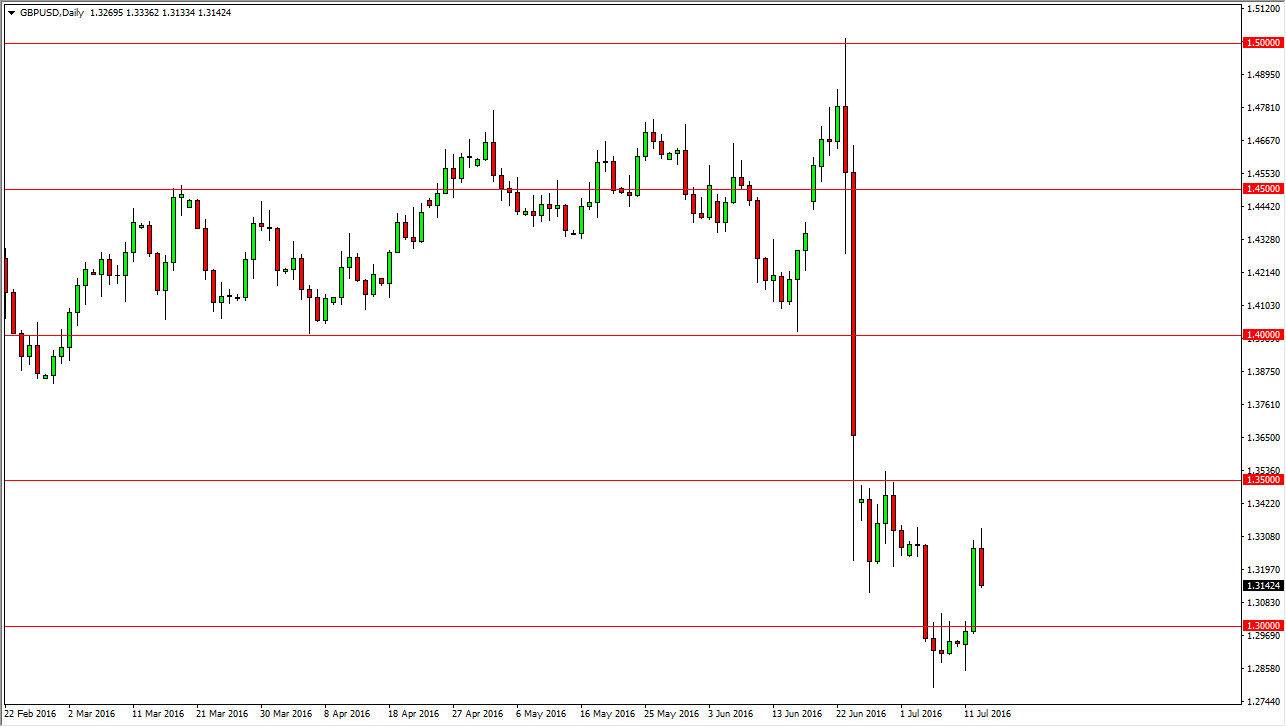

GBP/USD

The GBP/USD pair initially tried to rally during the course of the day on Wednesday, but turned right back around as we approached a fairly significant cluster of noise. This noise runs all the way to the 1.35 handle, and of course above there. With this being the case, I feel as if the market should continue to find selling pressure time and time again, as we should reach down to the 1.3 level. I believe that we break down below there as well, but it may take some time. I believe ultimately that the British pound continues to get beat up upon as people are punishing it for the British people deciding on leave the European Union. I believe that the British pound will continue to drop over the longer term, so having said that any rally at this point in time should offer a selling opportunity at the first signs of exhaustion as of course we have fallen quite drastically, but we will get the occasional rally as we grind our way much lower. With this, it wouldn’t be until we got above the gap above that I would even consider buying.