The EUR/USD pair initially rose during the day on Thursday, but pulled back yet again to form a bit of a shooting star. I still believe that we are essentially consolidating between the 1.12 level on the top, and the 1.10 handle on the bottom. With this being the case, I am more apt to sell rallies such as the one we had on Thursday, but recognize that a lot of volatility will probably be the mainstay in this market for the time being.

Ultimately, I do believe that the Euro falls overall as there will be a lot of concerns when it comes to the European Union and the stability of it as we recently seen so much uncertainty in the form of the UK’s building itself out, Italian banks, and now concerns over the GDP of countries such as Spain. With this, I preferred the downside but recognize it will be more of a grind lower than anything else.

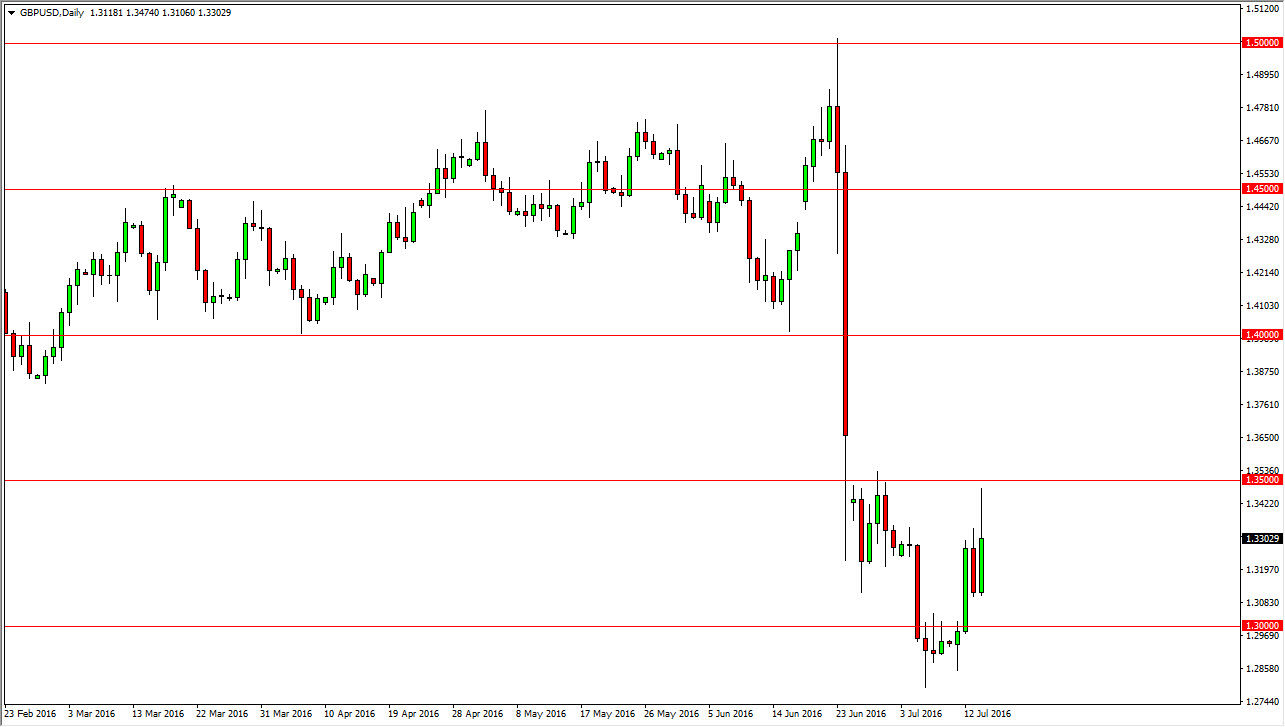

GBP/USD

The British pound initially tried to rally during the course of the day on Thursday, but turned right back around to form a rather negative move late in the day. This is a market that although rallied during the day, could not hang onto the gains. I see the 1.35 level above as massively resistive, and the gap above there as even more so. It is because of this that I am not willing to buy this market until we break above the 1.3650 level, and in the meantime and simply looking for exhaustive candles in order to sell.

The British pound will continue to be punished by traders around the world, as they have voted themselves out of the European Union. Quite frankly though, sooner or later there will be a “buy-and-hold” mentality, but in the meantime I do think that we go lower overall so I have no interest in going long until we break above the obvious gap above.