EUR/USD

The EUR/USD pair had a slightly positive day during the session on Monday, but quite frankly this is a market that looks like it is struggling for some type of direction now. After all, we have been banging around between the 1.10 level on the bottom, and the 1.12 level on the top. With this, the market looks as if it is simply just trying to figure out where to go next. The previous uptrend line was broken below recently, and as a result I feel that the market may drop from here given enough time. However, we don’t have the opportunity to start selling quite yet, unless of course we get some type of exhaustive candle after a short-term rally. A break down below the 1.10 level on a daily close could also be a nice selling opportunity as well.

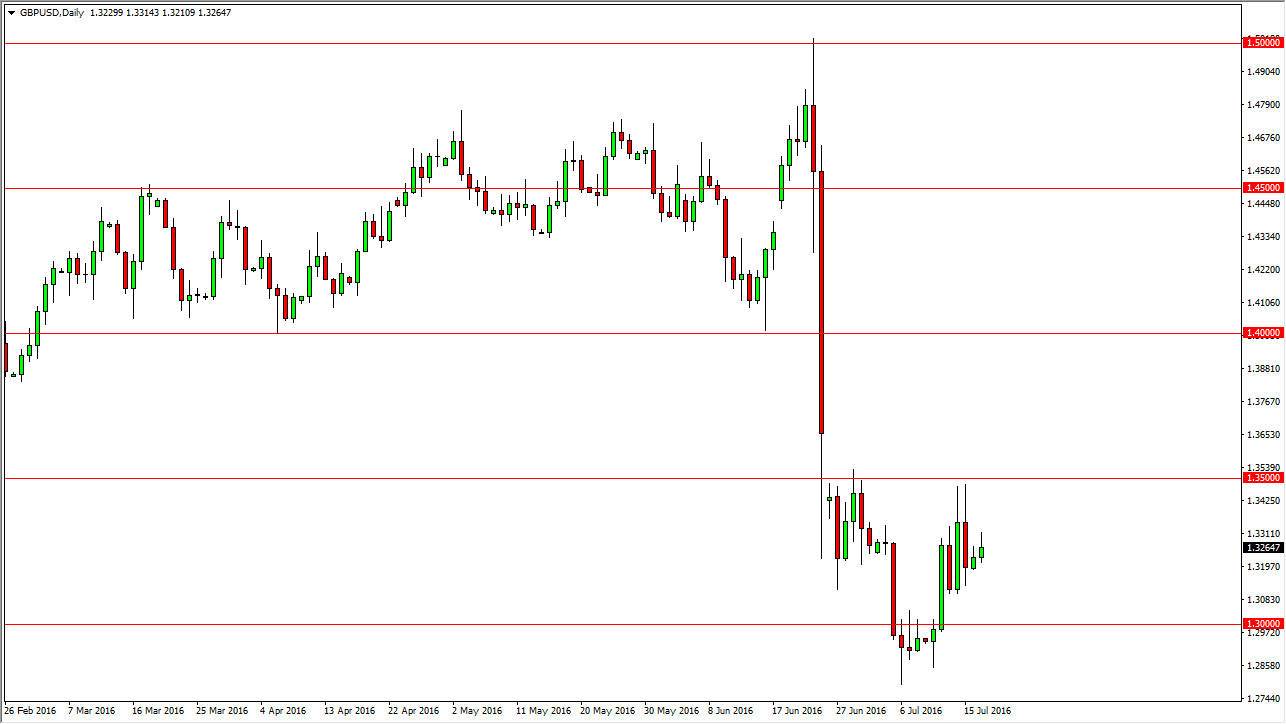

GBP/USD

The British pound had a slightly positive session on Monday, but at the end of the day we ended up giving back some of the gains. Also, I think that the 1.35 level continues to be massively resistible below, and an area above there should then continue to keep this market somewhat, as the gap extends all the way to the 1.3650 level. At this point, I feel that every time we rally, it’s only a matter of time before we see some type of exhaustive candle that I can search selling. I think that the market then reaches down to the 1.30 level below, and perhaps even try to break down below the 1.28 level, which was where the market bounce from. Ultimately, the British pound should continue to struggle as the currency will continue to be punished after the United Kingdom order to leave the European Union.

On top of that, the US dollar of course is a bit of a “safety currency”, so having said that it’s probably only a matter of time before the market leans in that direction anyway.