EUR/USD

The EUR/USD pair fell significantly during the course of the day on Tuesday, testing the bottom of the recent consolidation area. The bottom of course is the 1.10 level, and the top of course is the 1.12 level. With this, it looks as if we are trying to break down below the bottom of this consolidation area, and perhaps continue to reach down to the 1.09 level. Regardless, this is a market that is very soft in my estimation, and it’s only a matter time before the sellers take over. Even if we rally from here, I’m looking for an exhaustive candle to start selling. The uptrend line that previously had been supportive for this market should now be rather resistive as well.

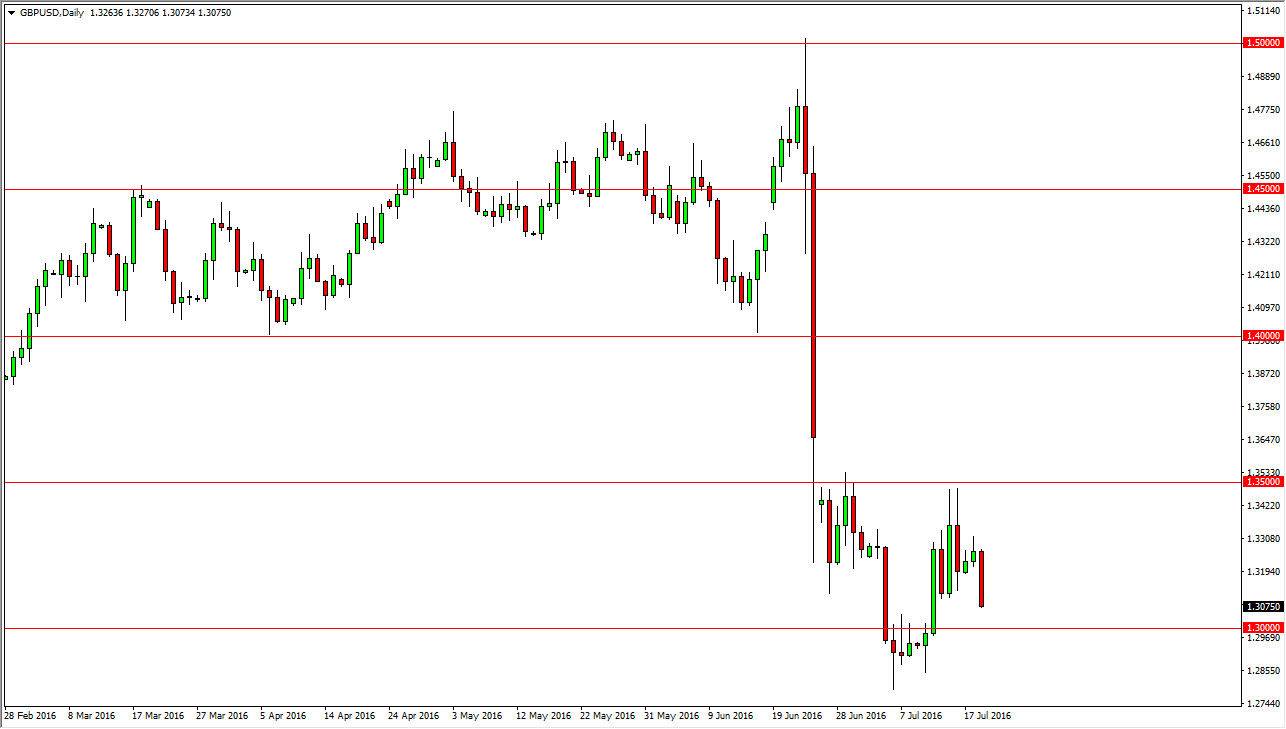

GBP/USD

The GBP/USD pair fell significantly during the course of the session on Tuesday, breaking down and reaching towards the 1.30 level below. That’s an area that has simply shown quite a bit of support and resistance, so with this I feel that we will probably struggle to break down below that level and it’s not until we get below the 1.29 level that I feel comfortable shorting yet. However, I have absolutely no interest whatsoever in buying the British pound, because of the so-called “Brexit” that is an effect. With this, I feel that we will see continued bearish pressure, but we may have to have a small bounce off of the 1.30 level in order to take advantage of it.

Ultimately, the US dollar is a bit of a safety currency, and with all of the issues that we have coming out of the United Kingdom due to the vote, and of course the potential problems that we have in the European Union including the Italian banking system, it makes sense that the US dollar should continue to strengthen overall as this market is negative in general.