EUR/USD

The EUR/USD pair had a fairly volatile day on Friday, but did end up forming a positive candle. At the moment, we are testing the bottom of an uptrend line that had previously been very important. Because of this, we could get a little bit of resistance but at this point in time I think the one thing you can count on more than anything else in this pair: volatility. I do not like buying the Euro at this point, I think there are far too many reasons to think that there could be trouble down the road, so I’m waiting to see whether or not we get an exhaustive candle. We do, I will not hesitate to sell this pair. It makes quite a bit of sense that the US dollar will strengthen over the longer term, because quite frankly the only real concern with the US dollar is that there will be any interest-rate hikes soon.

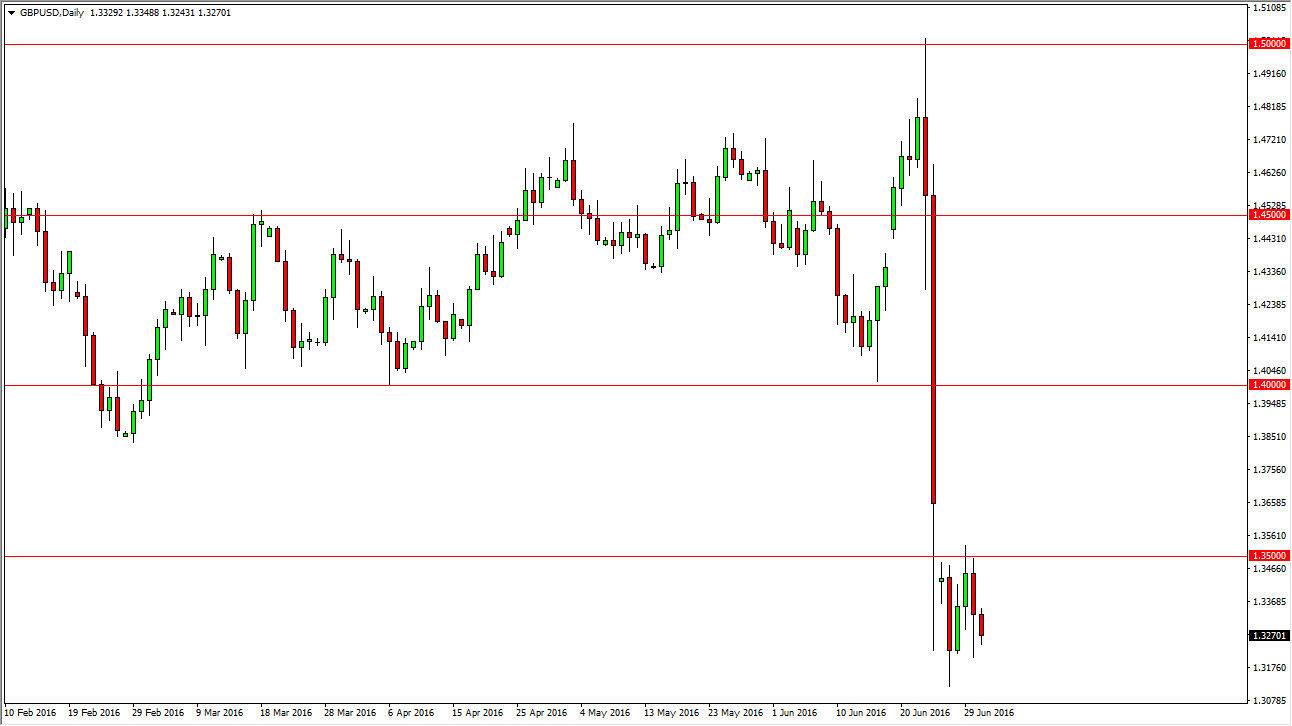

GBP/USD

The British pound fell again during the day on Friday, but quite frankly it was a very quiet day. This is exactly what this currency needs, and it appears that we are trying to figure out what happens next. There is a gap above, which starts at the 1.35 level and ends of the 1.3650 handle roughly. That has not been filled, so would not surprise me at all to see this market tried to do that, and as a result I would expect some type of rally fairly soon. However, I do not believe that the British pound is going to strengthen significantly. I believe that any rally at this point in time will more than likely offer a selling opportunity given enough patience, and I will look for exhaustive candles above in order to start shorting the British pound again. I believe that the relative safety of the US dollar should continue to be attractive as well.