The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 31st July 2016

Last week I predicted that the best trades for this week were likely to be short GBP against long USD and also long JPY. The results of these trades was an average win of 1.05% thanks to the strong performance by the Japanese Yen.

The focus of the market has shifted to bearish on the U.S. Dollar following a poorer than expected Advance GDP data release last Friday.

British Preliminary GDP data was a little better than expected, which has helped to hold the Pound up, but there is still considerable anxiety that the Brexit vote is going to trigger a recession in the near term.

As the USD looks strong and the GBP has the greatest long-term weakness of all the major currencies, I forecast that the best trade for this week will again be short GBP/USD and also probably short GBP/JPY.

Fundamental Analysis & Market Sentiment

Fundamental analysis may be of some use this week, as it points towards a weaker U.S. Dollar, and we have seen that currency weaken already.

Gold and Silver continue to look relatively strong and both have benefitted from the weak U.S. Dollar after finding support at key levels last week.

The British Pound has held steady.

The Japanese Yen has risen sharply following the Bank of Japan’s Monetary Policy Statement which has resulted in the stimulus measures not going as far as the market had been expecting.

Technical Analysis

USDX

The U.S. Dollar fell sharply last week, printing a strongly bearish outside candle which has engulfed the real bodies of the previous 3 weekly candles. The price however is still above its level of 13 weeks ago, suggesting that the downwards trend is over, but I would still see some bearish momentum here. Below there seems to be support from 1170 to 1160.

GBP/USD

We had a small move upwards last week, with the pair finding support above 1.3050. However the key highs at around 1.3300 remain unbroken, although a strong break through this area could see a push all the way up to 1.3500.

The recent momentum suggests there is still immediate potential to the down side.

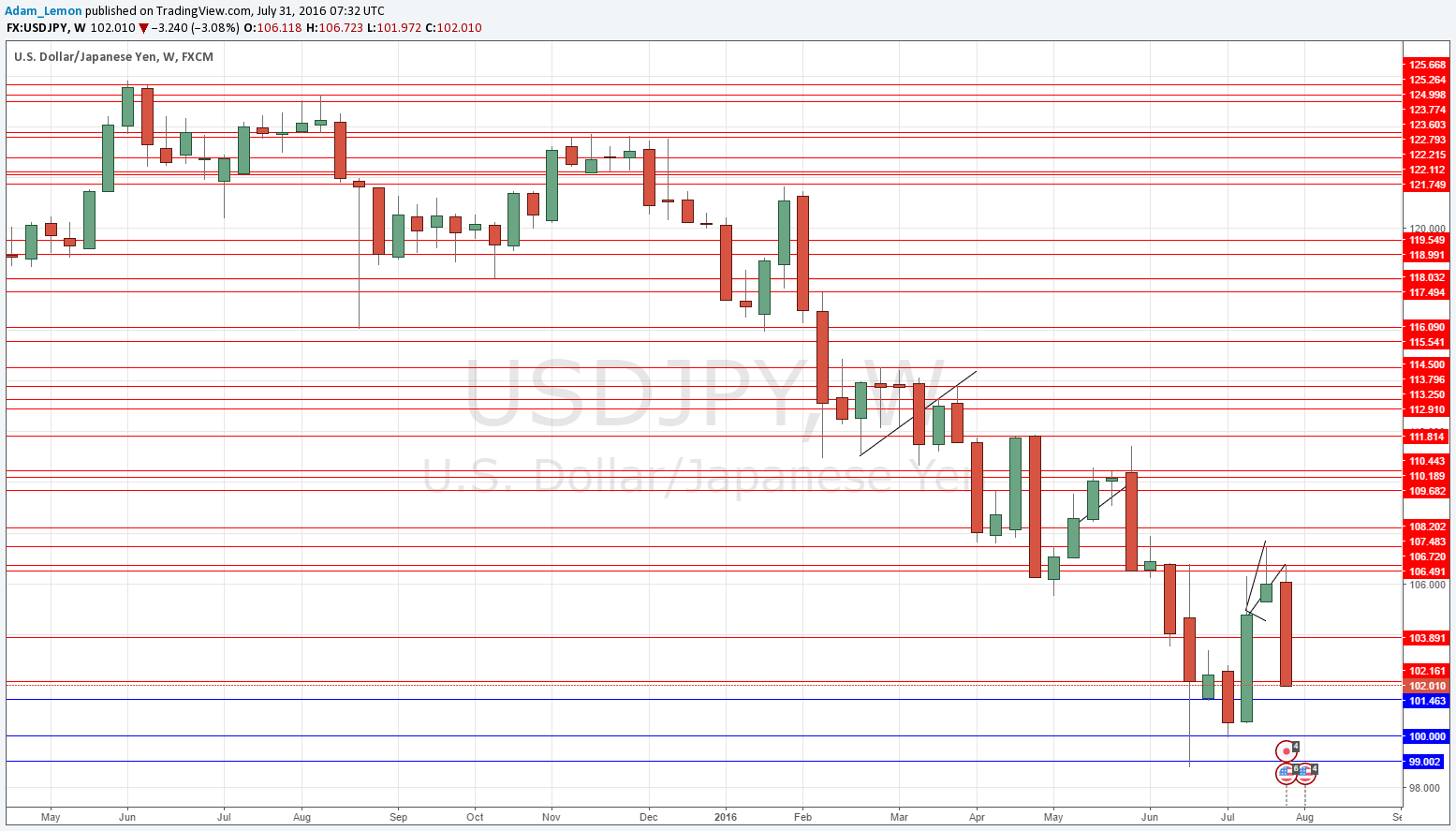

USD/JPY

Although I mentioned GBP/JPY, as we already looked at GBP/USD I prefer to examine the chart of USD/JPY as it is more important as a major pair than a cross such as GBP/JPY.

The chart below shows a strong bearish reversal from a key resistance zone above 106.49. A continuing fall over the next week looks quite probable after this final strong bearish weekly candle closing very hard on its low price. Beware of support at 101.50 and especially at 100.00 below.

GOLD

Precious metals are strong as obvious barometers of USD strength, and although Silver has taken the lion’s share of long pips recently, it was Gold that really benefited from last week’s move.

Any pullbacks to key support levels which continue to hold are going to look attractive in this macro environment and with continuing bullish momentum in Gold prices.

Conclusion

Bullish on the JPY (and Gold to a lesser extent), bearish on the GBP.