The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 17th July 2016

Last week I predicted that the best trades for this week were likely to be short GBP against long Gold. The result of this trade was a large loss of -3.97%, which was a strong move within only one week.

I also predicted that long NZD/USD and short USD/JPY would be good trades. Unfortunately they were unfavorable by 4.21% and 2.49% respectively.

The focus of the market has moved to better than expected U.S. economic data which has led to global equity markets recovering. In fact the S&P500 Index closed last week at an all-time weekly high. If this high is broken and maintained we are likely to see a continuing rally in equities.

As the USD looks strong and the GBP has the greatest long-term weakness of all the major currencies, I forecast that the best trade for this week will be short GBP/USD.

Fundamental Analysis & Market Sentiment

Fundamental analysis may be of some use this week, as it points towards a strong U.S. Dollar, which has been strengthening.

Gold and Silver continue to look strong but they have become increasingly volatile over the past few days so there could be some choppy action ahead.

The British Pound is down sharply over the past few weeks and months, and on Friday resumed its fall. The more likely a Brexit is to be implemented, the greater the chance that the GBP will fall further, and it is looking as if the new Government will indeed press ahead with a British exit.

The Japanese Yen has been acting as a safe haven, so if the global equity market’s recovery rally runs out of steam, we can expect to see the currency strengthen further.

Technical Analysis

USDX

The U.S. Dollar rose last week, printing a bullish inside candle. The price has closed above its level of 13 weeks ago, suggesting that the downwards trend is over. However the action is again suggestive of a resistant cap at 12000.

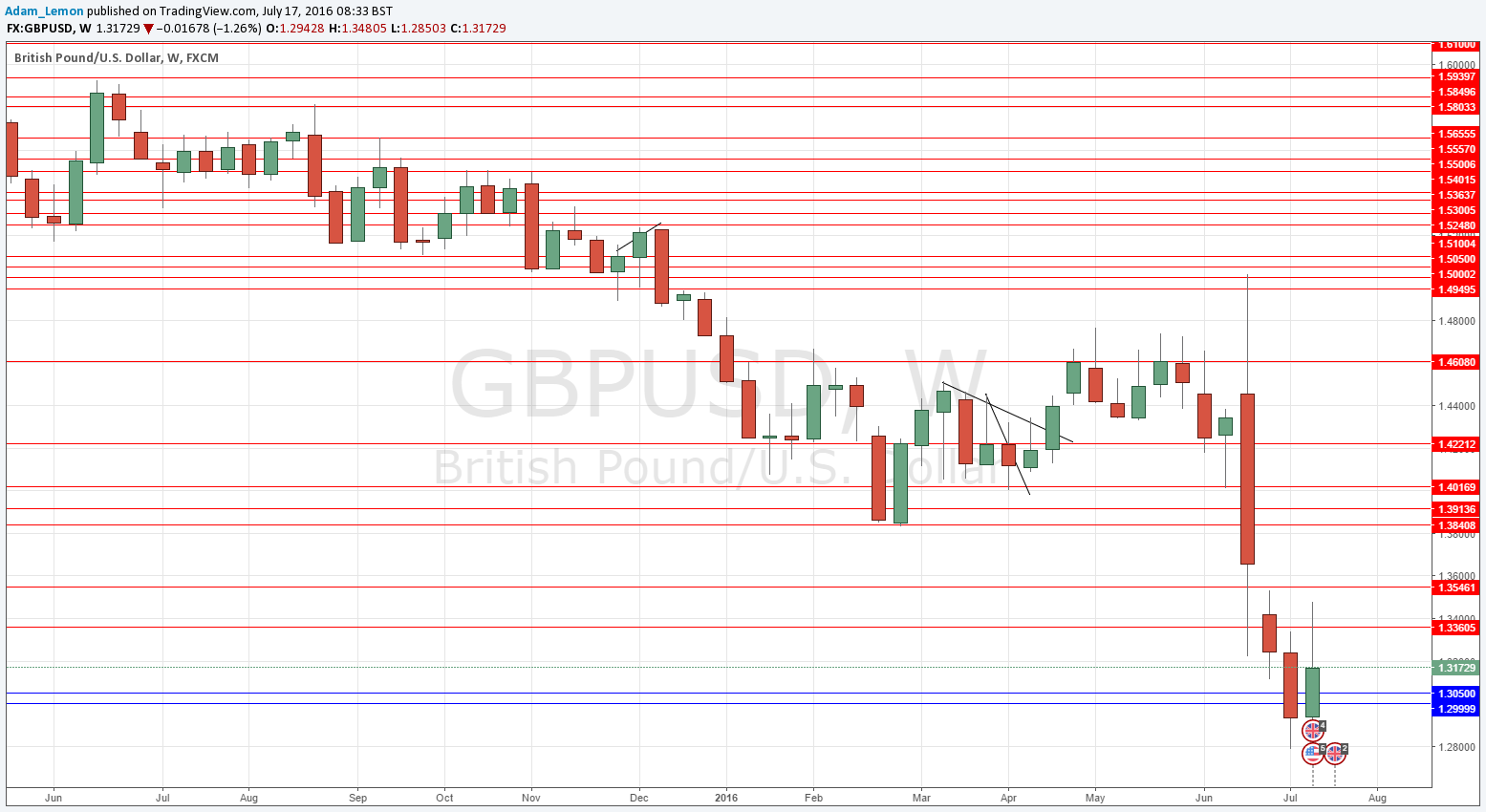

GBP/USD

Although we had a strong recovery last week as the U.K. got a new government in place with a fairly clear policy of implementing a Brexit which is likely to be as soft as possible, the price fell strongly as it got close to recent highs close to 1.3500.

The recent momentum suggests there is still immediate potential to the down side.

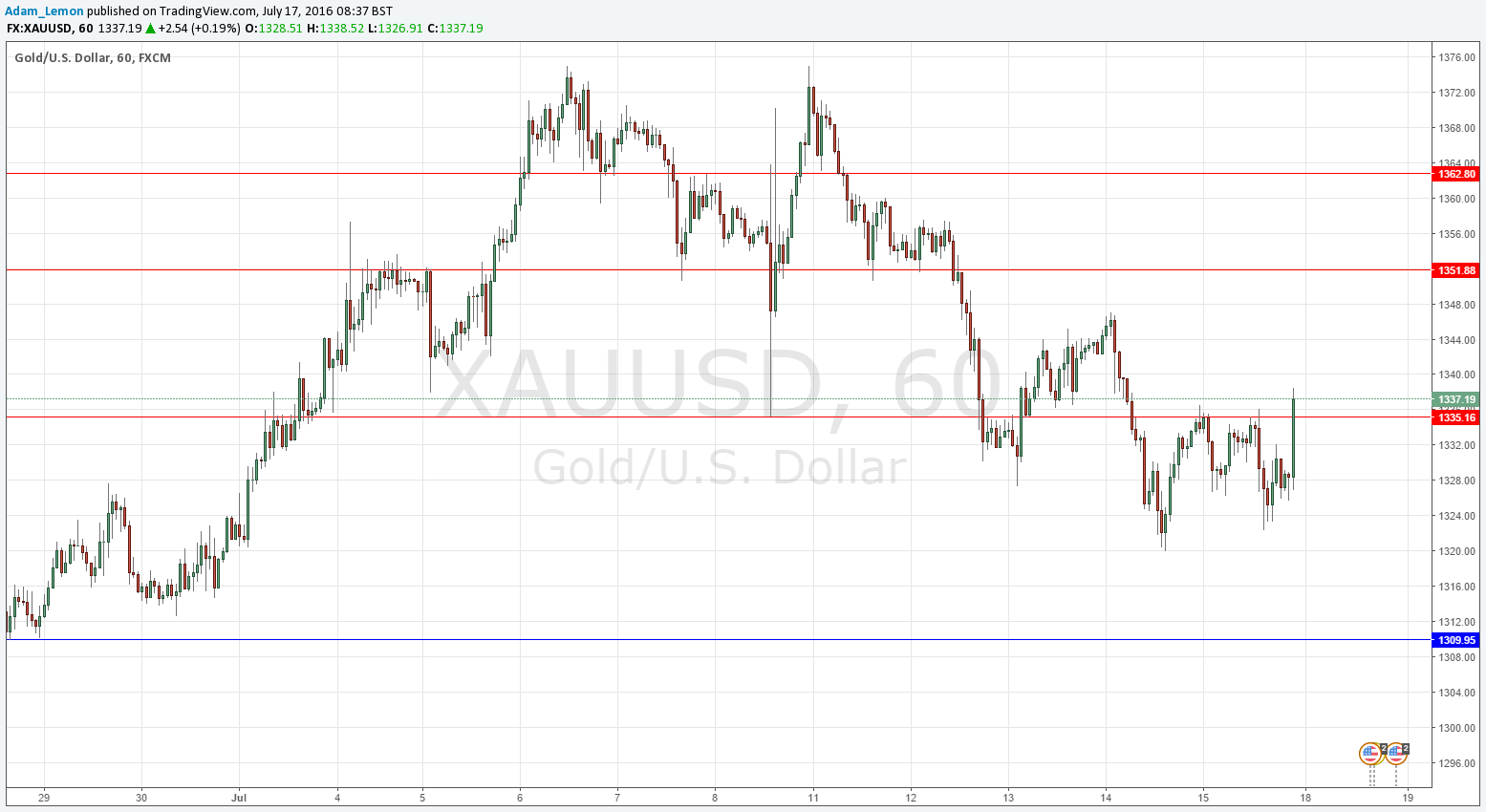

GOLD

Gold fell fairly strongly but right at the end of the week started to look bullish again, as it broke up above the level at $1335.16 which has twice held as resistance. If the price opens above this level and stays there, it should be a sign that the price is heading for $1350 again at least.

Conclusion

Bullish on the USD, bearish on the GBP.