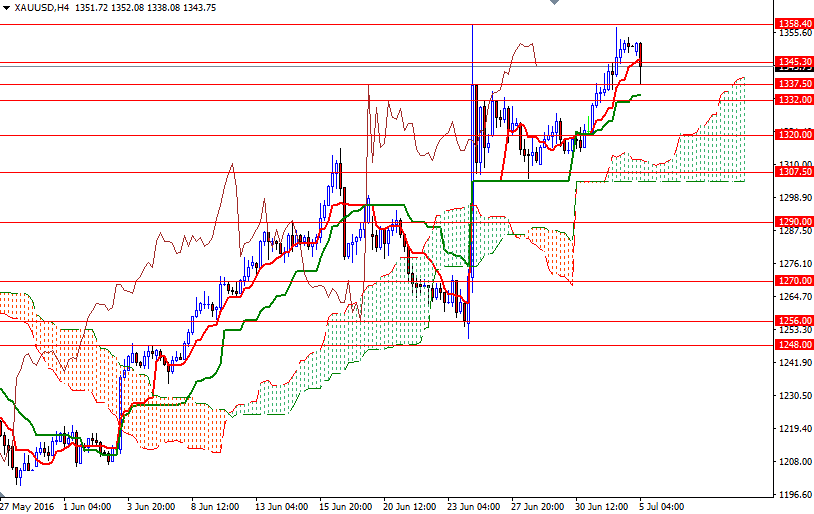

Gold prices edged higher on Monday but the trading range was relatively tight as the U.S. markets were closed for a public holiday. The XAU/USD pair tested the 1358.40 resistance as expected after the 1345.30 level but investors used this used this opportunity to take profit ahead of the release of minutes of the Federal Reserve's latest policy meeting. As a result, the market returned the support at around 1337.50. Although this area gave a bounce up, it might be in danger again unless prices climb back above 1348.50-1345.30 area.

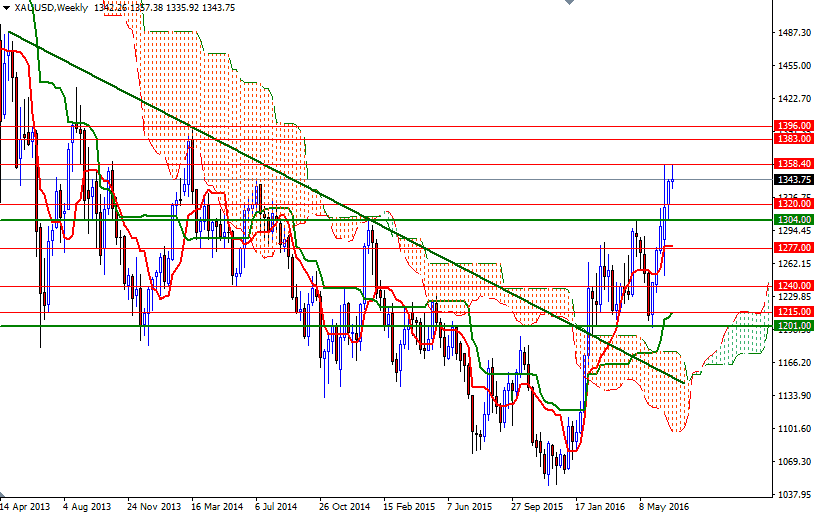

There is a lot of uncertainty in the market and gold is often seen as a safe, tangible commodity in times of turmoil. However, neither the UK nor EU will collapse anytime soon. Therefore, the precious may stay range-bound at these higher levels. Technically, trading above the weekly and daily Ichimoku clouds suggest that gold is likely to maintain bullish trend over the medium term, though the upside potential will be limited unless the resistance at 1358.40 is surpassed.

From an intraday perspective, the key areas to watch will be 1348.50-1345.30 and 1340-1337.50. It is quite possible that the pair will gain some traction if it can push through 1348.50, where the top of the Ichimoku cloud on the 30-minute chart currently sits. In that case, I think the bulls may have another chance to challenge the bears at 1358.40. Once the bulls clears this barrier on a daily basis, the market might proceed to 1375. On its way up, resistance can be found at 1362 and 1367. On the other hand, if the bulls fail to push prices back above 1348.50, keep an eye on the 1340-1337.50 zone. A break down below 1337.50 could see a fall to 1332/1. The bears have to shatter this support so that they can march towards 1325.