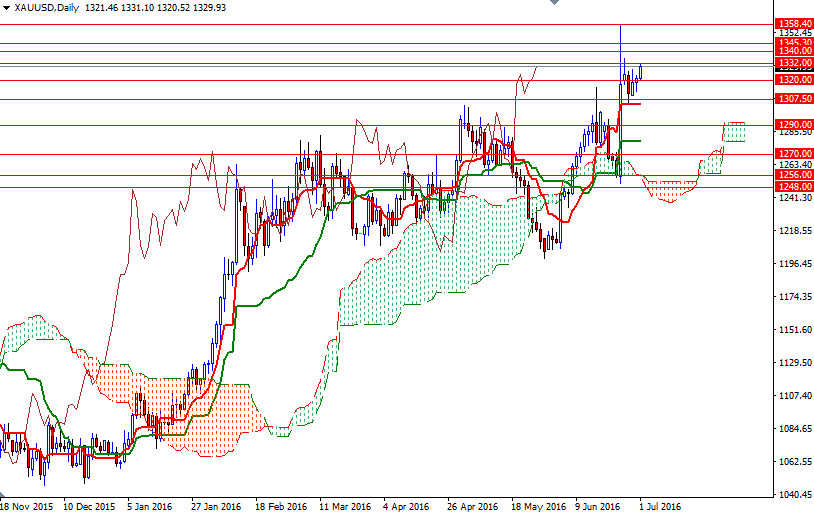

Gold prices advanced for a second straight session on Thursday and settled at $1321.81 an ounce. The XAU/USD pair initially pulled back towards the $1312 level but found enough support there climbed back above the $1320 resistance level. The market rose further during today's Asian session and reached the key resistance at $1320 as technical buying lent support.

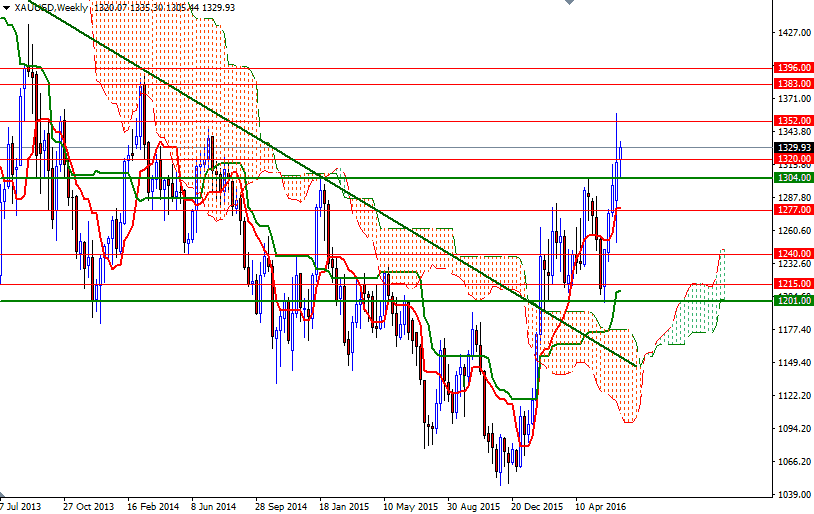

Technically, the odds favor further upside, with the market trading above the Ichimoku clouds on almost all time frames. However, it is likely that the upside potential will be limited unless the 1332 resistance is convincingly broken. If the bulls penetrate this barrier, the 1336.70 and 1340 levels could be the next possible targets. A break up above 1340 might lure additional buyers into the market and increase the prospect of XAU/USD visiting the 1352 level.

On the other hand, if the bulls fail to push the market above 1320 and prices start to fall, expect to see some support at 1325 and 1320. Sellers will need to drag prices back below 1320 so that they make an assault on 1312. Once below 1312, XAU/USD will head towards the bottom of the recent consolidation area at 1304. The bottom of the 4-hourly cloud sits around the same level, so we need to get down below there in order to continue to the downside.