Gold prices ended Wednesday’s session up $8.63, recouping some of the recent losses, as a softer dollar lured bargain hunters back to the market. The XAU/USD pair initially tried to break below the 1332/0 area but found enough support in the vicinity to reverse and test the 1344.40 resistance ahead. Expectations that the Federal Reserve will go easy on raising interest rates, coupled with growing perception that accommodative monetary policies in advanced economies are likely to stay, pushed prices to their highest level since mid-March 2014.

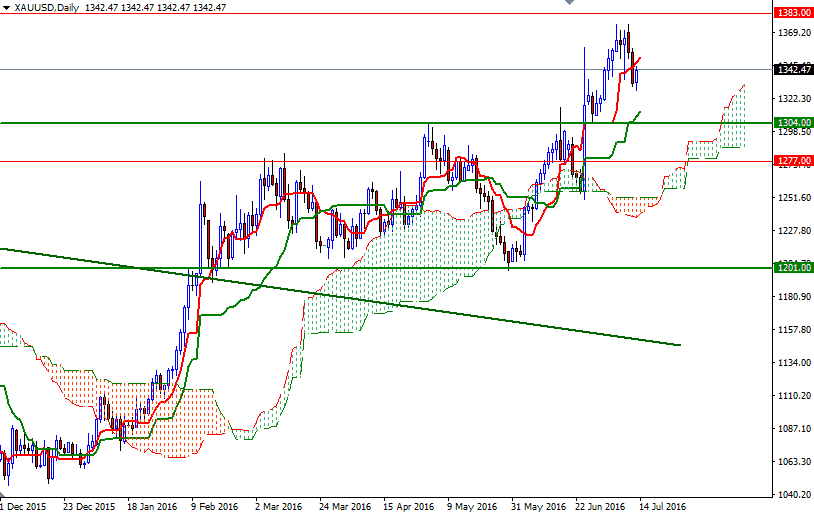

Although the medium-term trend is rather bullish, I expect prices to stay range-bound at these higher levels for some time. The 4-hourly Ichimoku cloud stays right on top of us and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are negatively aligned. In other words, I can't rule out the possibility of a retreat towards the daily cloud - unless the market anchors somewhere above the 4-hourly cloud.

To the downside, the initial support sits at 1337.50, followed by 1332/0. If XAU/USD falls through this area and break below yesterday’s low, I think the bears will be aiming for 1325 and 1320. This is the key level for bears to capture today if they intend to push prices lower and reach the 1314 level. Closing below 1314 would make me think that the XAU/USD pair will revisit the 1307.50-1304 area. If the market passes through the cloud and break above the 1355.20-1352 zone, then it is likely that the 1362 level will be the next stop. Clearing this barrier suggests that XAU/USD is getting ready to march towards 1375. On its way up, resistance can be found at 1367.