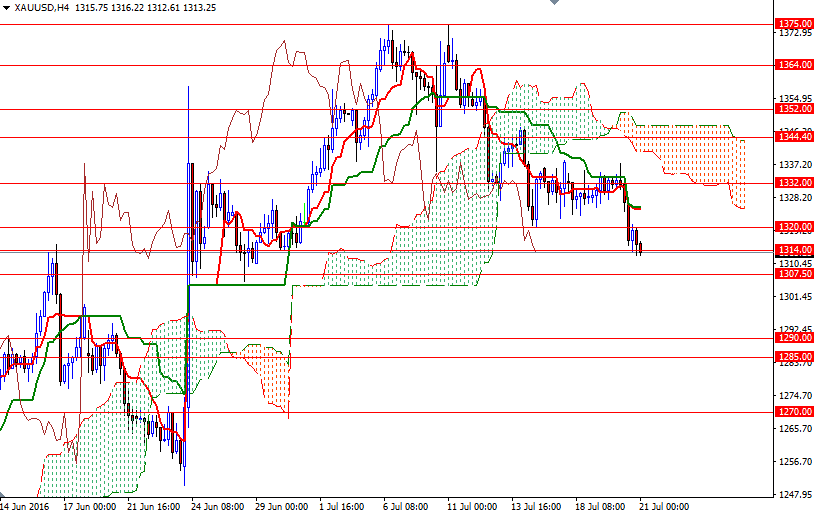

Gold prices ended Wednesday's session down 1.2%, or $16.08, to settle at $1315.65 an ounce as strength in global equities diverted interest from the precious metal. The XAU/USD pair edged higher early yesterday but the area at around $1338.50 did provide resistance and sent prices lower. The market extended losses after breaking below the $1320 support level and consequently tested $1314 as anticipated.

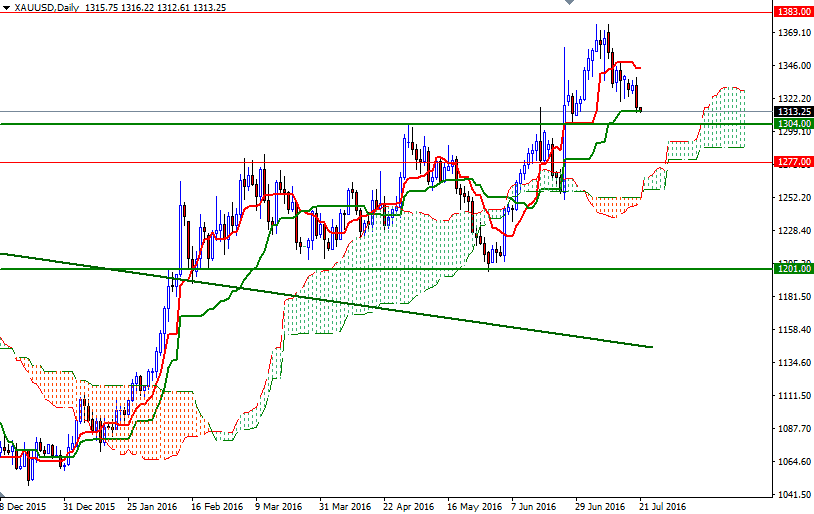

Lately, I have been repeating that gold prices were vulnerable to the downside and we could retreat towards the daily Ichimoku cloud -or at least to support around 1304- before we see another leg up. Trading below the 4-hourly Ichimoku cloud suggests that XAU/USD is going to feel pressure, however, keep in mind that we are still above the weekly and daily clouds. Therefore, expect ranging conditions to persist.

If the bulls start to step in as prices approach the 1307.50-1304 area, XAU/USD could bounce back to test the 1320 or even 1326. Buyers will need to push prices beyond 1326 so that they can find an opportunity to tackle the 1334/2 resistance. Only a close above 1338.50 could provide the bulls the extra fuel they need to reach 1347.60-1344 area, where the bottom of the 4-hourly Ichimoku cloud resides. The 1307.50-1304 support is the key for the bears to conquer if they intend to increase the downward pressure. In that case, I think the market will be targeting 1299/7 next. A successful break below 1297 could see a fall to 1290/85.