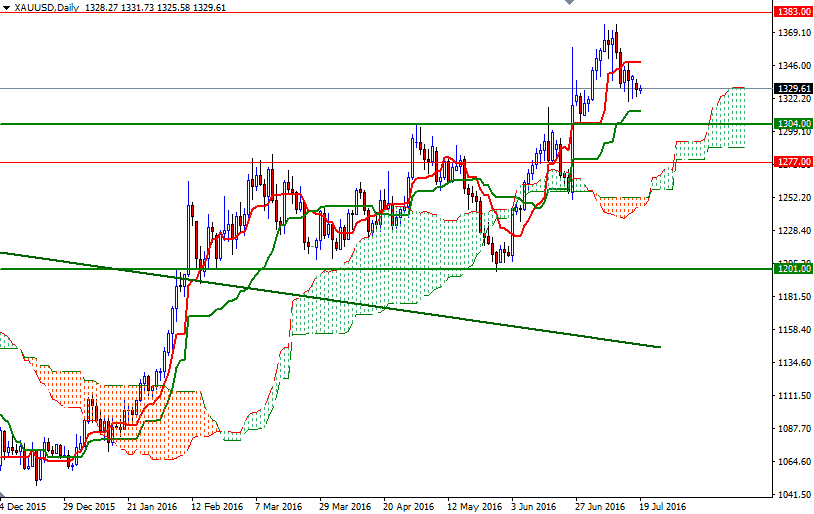

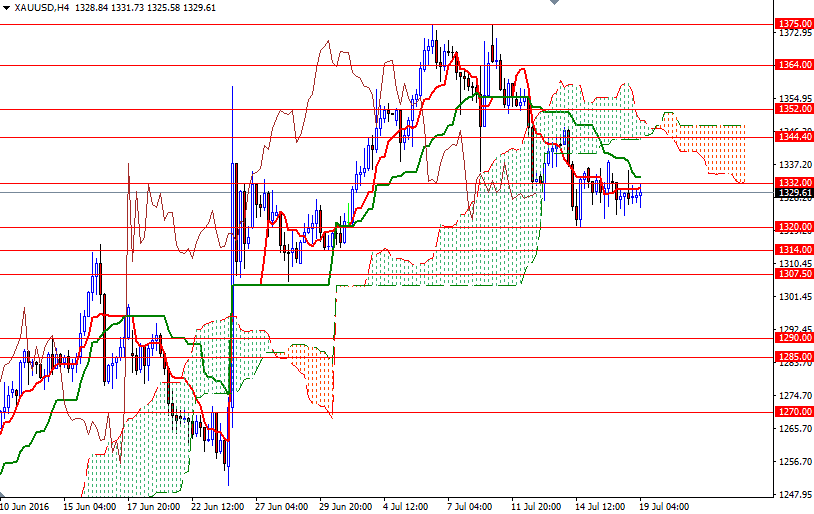

Gold prices fell $4.19 an ounce yesterday as investors shook off geopolitical concerns generated by a failed military coup in Turkey. The XAU/USD is currently trading at 1329.61, slightly higher than the opening price of 1328.27. The short-term technical picture remains poor, with the market trading below the Ichimoku clouds on the 4-hour time frame - we also have a negative Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) cross.

The XAU/USD pair remains within the trading range of the previous 3 sessions and yesterday was also an inside day which is usually an indication that the market is going to break out one way or the other. The key resistance overhead in the 1347.40-1344 area remains untested and intact. Meanwhile, the market finds support each time it retreats towards 1320.

The market will either break above the 1338.50 level and head towards the 4-hourly Ichimoku cloud or drop below the 1320 level and test 1314 afterwards. Closing above 1347.40 implies that bulls are getting ready to challenge the 1356/2 resistance. A break down below 1314 suggests that 1307.50-1304 zone will be the next port of call.