Gold prices settled at $1364.61 an ounce on Friday, a rise of 1.66% over the course of the week's trading, as upbeat U.S. economic data failed to alter investors’ outlook on Federal Reserve interest rate increases. After six consecutive weeks of gains, the XAU/USD pair rose to the highest level since mid-March 2014. Reports of mixed manufacturing and service sector activity in Europe and Asia have led many in the market to believe that global monetary easing worldwide is going to continue.

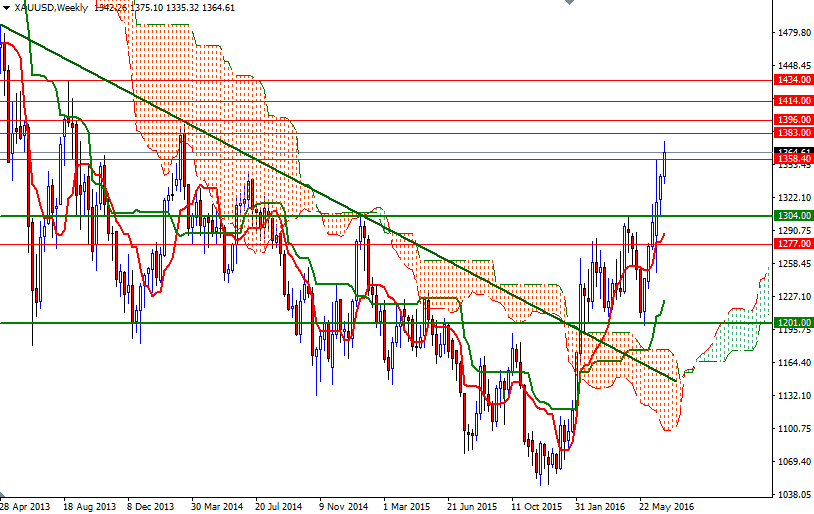

The precious metal has climbed nearly 13% from last month’s low as the extreme bullishness continued. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 315964 contracts, from 301920 a week earlier. It appears that the XAU/USD pair will make a trip to the 1383 level. If the bulls push prices beyond 1383, I think prices will be heading towards the next major resistance zone that stretches from 1392 to 1396. This will be the key level for the bulls to pass in order to challenge the bears on the next battle field at 1414. However, the market is in overbought condition and the risk of the U.K. exiting the European Union is somewhat priced in. Therefore, I expect to see gold peaking in that area (or at least a hiatus in the rally).

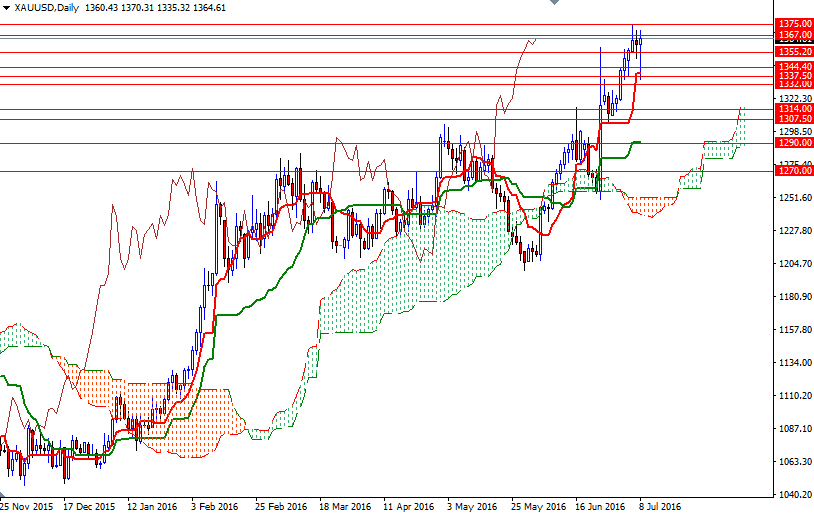

To the downside, the initial support is in the 1355.20-1352 area where the Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on the 4-hour chart reside. A break below 1352 could lead to a fall down to 1344/2. If prices drop through 1342, then 1337.50 and 1332/0 could be the next possible targets. Closing below 1330 on a daily basis would imply that, the bears will be aiming for 1325 afterwards. They have to shatter this support so that they can march towards 1314.