Gold prices settled at $1337.73 an ounce on Friday, falling nearly 2.3% over the course of the week, as strength in the dollar and calmer financial markets dulled the precious metal's attractiveness. The greenback got a boost from strong economic data, increases the probability of a rate hike in 2016. Federal Reserve officials appear to be in no hurry to tighten monetary policy but I think they are still planning to lift rates at least one time before the end of the year.

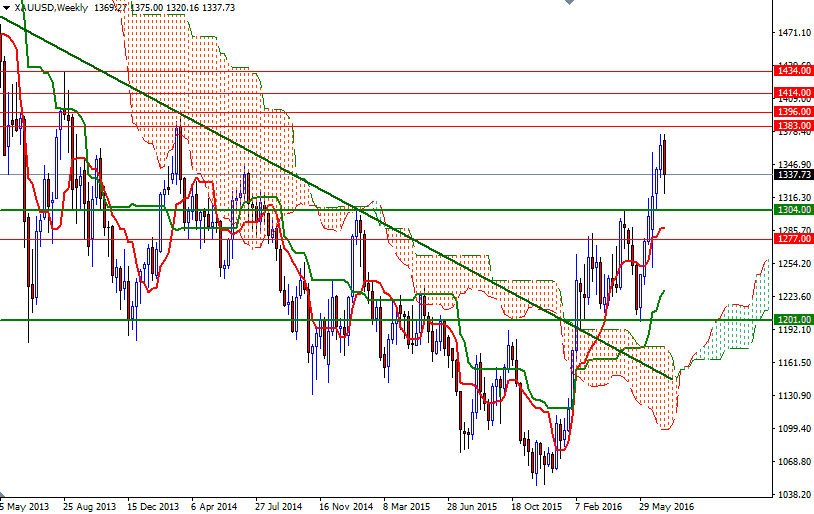

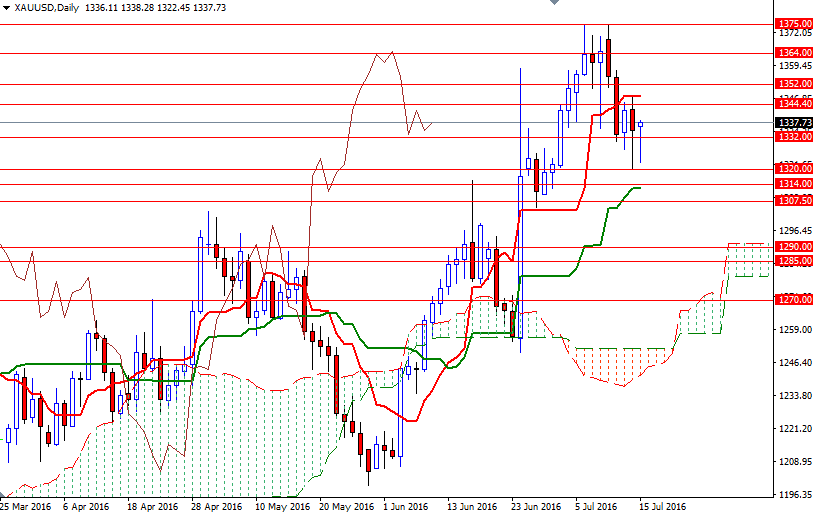

Profit taking and persistent rally in stocks also weighed on gold. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 297463 contracts, from 315963 a week earlier. Trading above the weekly and daily clouds suggests the market will have a tendency to rise further. However, the short-term outlook indicates that gold prices are vulnerable to the downside and may need to retreat before another leg up - unless XAU/USD confidently anchors somewhere beyond the 1356/2 area.

To the upside, the initial resistance stands in the 1347.40-1344 area, where the bottom of the 4-hourly Ichimoku cloud sits. If the bulls can penetrate this barrier, then they may proceed to the anticipated resistance zone that stretches from 1352 to 1356. Closing above 1356 would make me think that 1364 will be the next stop. If the bears increase downward pressure and prices drop below 1332/29, support may be seen at 1325 and 1320. A break down below 1320 would open up the risk of a move towards 1307.50-1304. Once below 1304, the market will be aiming for 1299/7.