Gold ended the week down nearly 0.8% on rising equity prices and the stronger dollar. The American dollar got support from fresh economic data suggesting that the U.S. economy remains on a solid footing. The global stock markets were mostly higher. Although they started the week on the back foot, with investors taking profit after recent gains, they reversed earlier losses. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 285911 contracts, from 297463 a week earlier.

This week, meetings of the Federal Open Market Committee and the Bank of Japan will set the mood in the markets. Recent upbeat U.S. economic data stoked speculation that another rate hike is back on the table, though policymakers appear to be in no hurry to tighten policy. In my opinion, the next rate hike is more likely to happen in December. Bank of Japan Governor Haruhiko Kuroda dismissed the idea of radical monetary policy easing. If the BoJ stands pat this Friday, that could prompt a fall in stock prices and a rise in the yen - which in return could lend some support to gold.

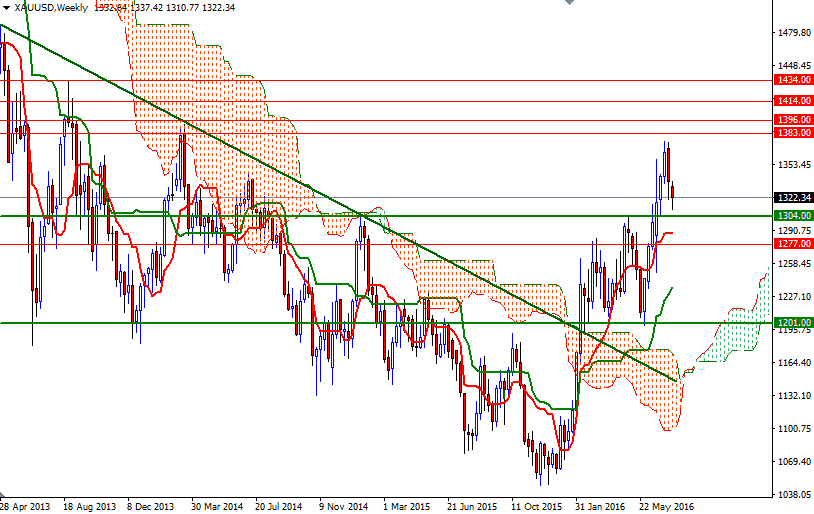

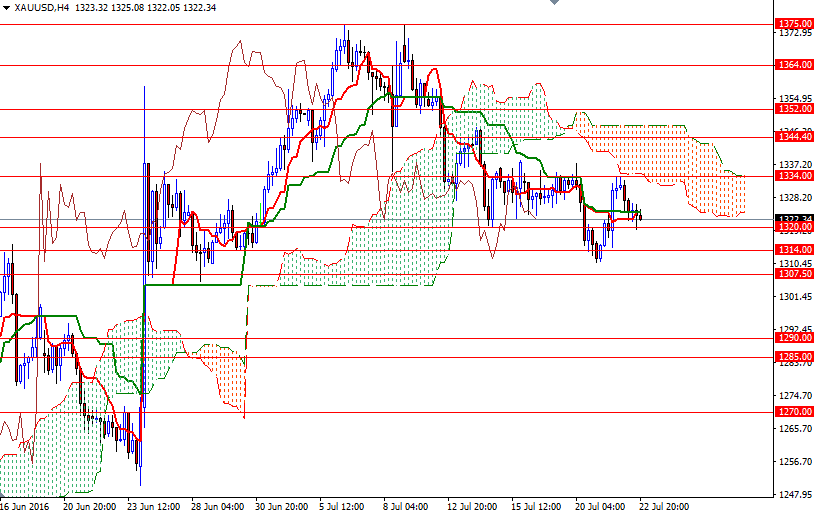

From a technical perspective, there are two things that I pay attention at the moment. First of all, the market is trading above the Ichimoku clouds on the weekly and daily time frames, plus the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) lines are positively aligned on both time frames. Secondly, despite the medium-term positive outlook, the 4-hourly chart is still bearish. With that in mind, it wouldn't be surprising to see XAU/USD heading towards the 1307.50-1304 area. If this support fails to hold, then the market may test the 1299/7 area. Closing below 1297 could increase the possibility of an attempt to visit the 1290/85 support, where the weekly Tenkan-sen reside. To the upside, keep an eye on the 1334 level. Clearing this resistance would give the bulls a chance to challenge the bears waiting in the 1347.60-1344 region. Closing beyond 1347.60 on a daily basis would shift my attention back to the long-side of the trade as it paves the way towards 1364.