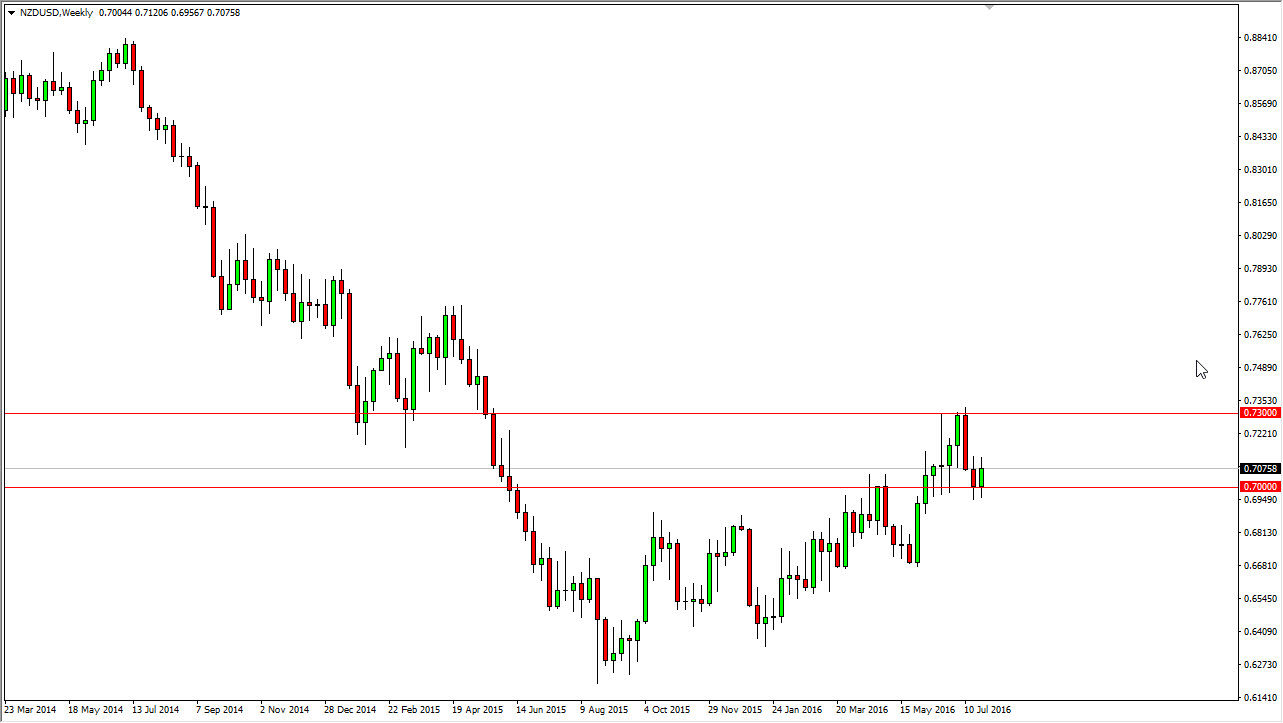

The New Zealand dollar has had quite a bit of volatility in it over the last several weeks, and as we approached the 0.73 level, it turned the market back around. In fact, we slammed into the 0.70 level below, which was previously resistive. With this previous resistance we can now expect some type of support, and I believe that we will more or less try to rally yet again, reaching towards the 0.73 level above. With this, I believe that the market should continue to be volatile but with a slightly positive tone to it as long as we can stay above the 0.70 level.

Massive support

I believe that there is massive support just below here, so having said that I think pullbacks continue to offer value that you can take advantage of it. However, I don’t necessarily think that were going to be able to break above the 0.73 level anytime soon as it has been so massively resistive, just as it was so massively supportive early in the year 2015. This is a market that continues to grind its way higher, but it is difficult to hang on to trade for any real length of time so what I feel will be the best way forward is simply buying short-term pullbacks as it gives us opportunity to pick up “value.”

Keep in mind that the New Zealand dollar is highly sensitive to the commodity markets, and with that being the case it’s likely that we will have to see the commodity markets behave a little bit more positive for the New Zealand dollar to continue going higher. This would certainly be the case for the longer term situation. However, at this point I believe that the market simply will try to break out to the upside but it will probably take quite a few different attempts to finally break above there.