NZD/USD Signal Update

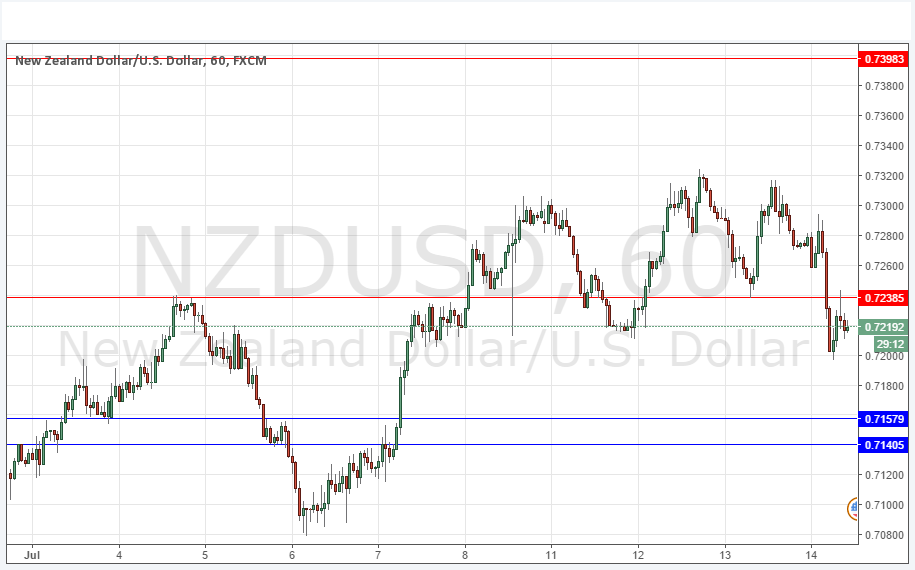

Yesterday’s signals may have produced a long trade following the bullish bounce earlier at 0.7211 but in any case it just gave the minimum profit required to break even before retracing and eventually stopping out at break even.

Today’s NZD/USD Signals

Risk 0.75%

Trades may only be taken between 8am New York time and 5pm Tokyo time over the next 24 hours.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7158.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7239.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

NZD/USD Analysis

Interestingly, this pair is finally starting to diverge in behaviour from its sister pair AUD/USD, which remains very bullish while this turns bearish. Note that we have printed a new lower resistance level which the price has already bounced off at 0.7239. We also seem to have found that the anticipated support just above 0.7200 is weak and soft. Therefore I would be comfortable going short at a retest of 0.7239 if it happens later today.

There is nothing due today concerning the NZD. Regarding the USD, there will be a release of PPI and Unemployment Claims data at 1:30pm London time.