NZD/USD Signal Update

Last Thursday’s signals were not triggered as there was no bullish price action at 0.7158.

Today’s NZD/USD Signals

Risk 0.75%

Trades must be entered from 8am New York time to 5pm Tokyo time over the next 24 hours only.

Long Trade 1

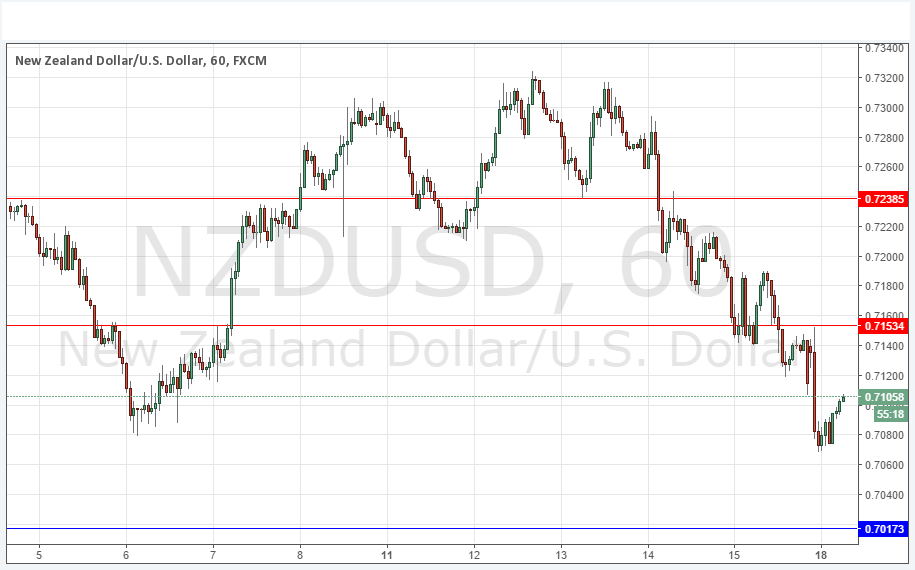

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7017.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trades

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7153 or 0.7239.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

NZD/USD Analysis

The significant divergence in behaviour from its sister pair AUD/USD continues, although that has also turned a little bearish. Here however the price has continued to fall steadily, cutting through and invalidating support levels quite easily leaving only 0.7017 below. As this is close to a very psychologically key round number at 0.7000, we should watch any action down there with close interest.

Meanwhile the area at 0.7153 has again seen some selling: this half-number area is a place to watch for any bullish move to falter, giving a potential short trade entry opportunity.

This pair had been looking very bullish, but recent action is an example of how sustained directional moves in this pair have become quite rare over the long-term.

There is nothing due today concerning either the NZD or the USD.