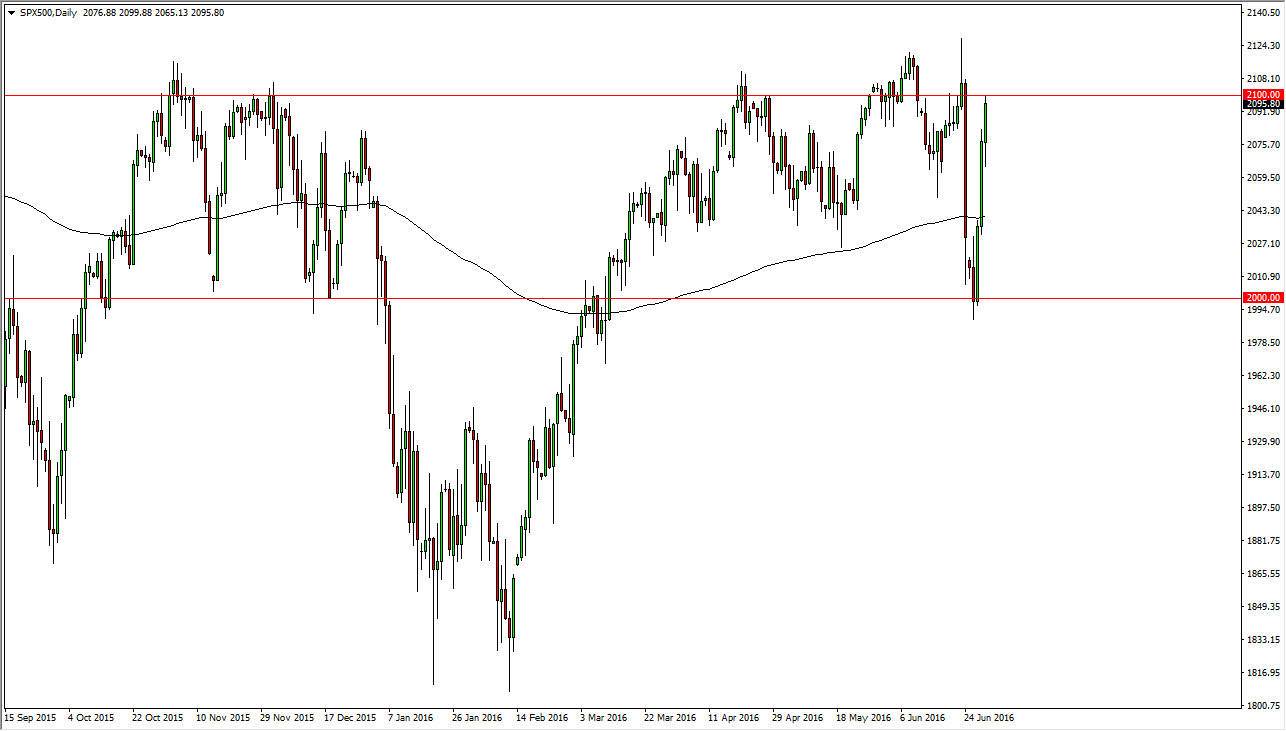

S&P 500

Initially, the S&P 500 fell during the day on Thursday, but we found enough support to continue going higher. In fact, we crashed into the 2100 level, an area that I had marked on the chart previously. With this, I think we are starting to get a little bit overbought, so I think that pullbacks are likely. Nonetheless, I have no interest in selling this market because I believe that it’s only a matter of time before the buyers come back into the market. We could break above the 2100 level and continue to go higher, but at this point in time I am eyeballing a shooting star from last Thursday that seems to solidify the resistance. Markets can’t go in one direction forever, so it makes quite a bit of sense that we pullback from here.

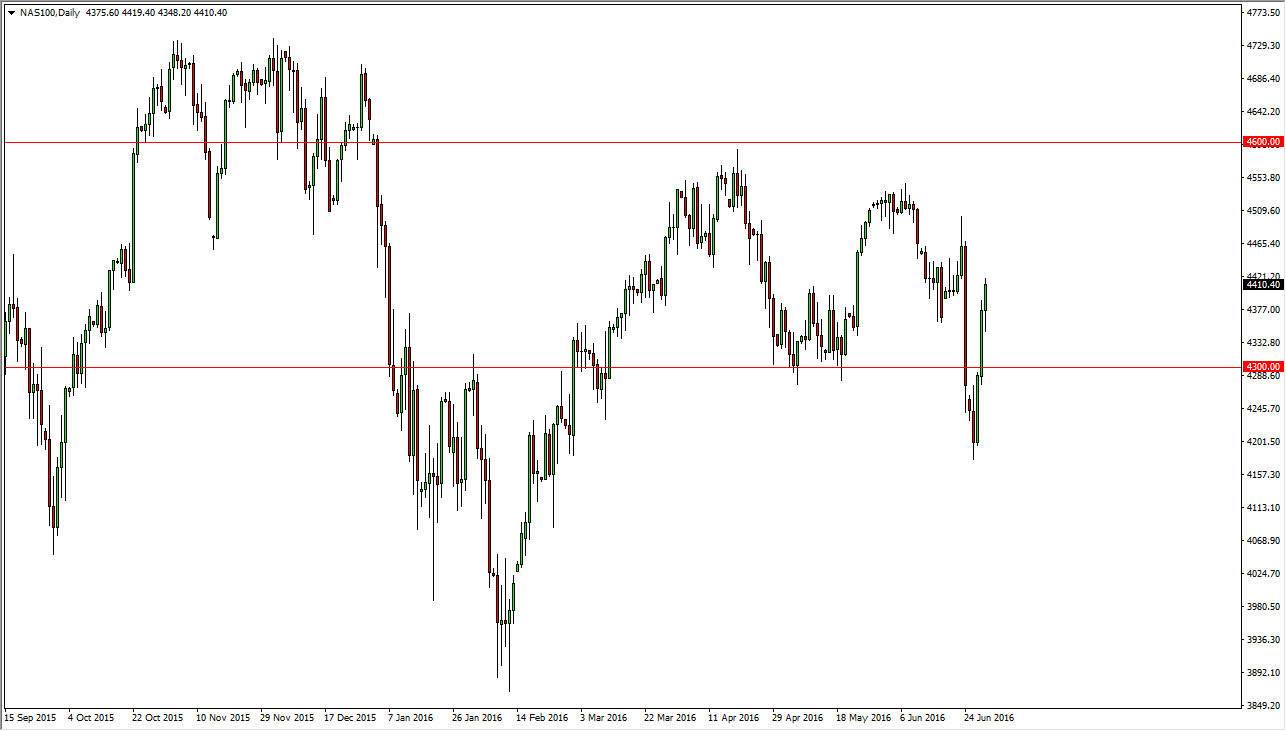

NASDAQ 100

The NASDAQ 100 initially fell during the course of the session on Thursday but turned right back around to form a fairly positive looking hammer. We broke through the 4400 level, and that of course is a bullish sign. Ultimately, I do think that we go higher but we might be a little bit overextended at this point in time so I’m actually looking for a short-term pullback to show signs of support that I can take advantage of as perceived “value.” A break of the top of the candle would also be bullish, but I think there’s a lot of noise just above so it’s very likely that a move directly higher from here would face quite a bit of choppiness.

I believe that the 4300 level below will end up being the “floor” in this market, and as a result it’s not until we break down below there that I would even remotely consider selling this market, even though I have quite a bit of noise underneath there that will make we have to think about that very seriously.