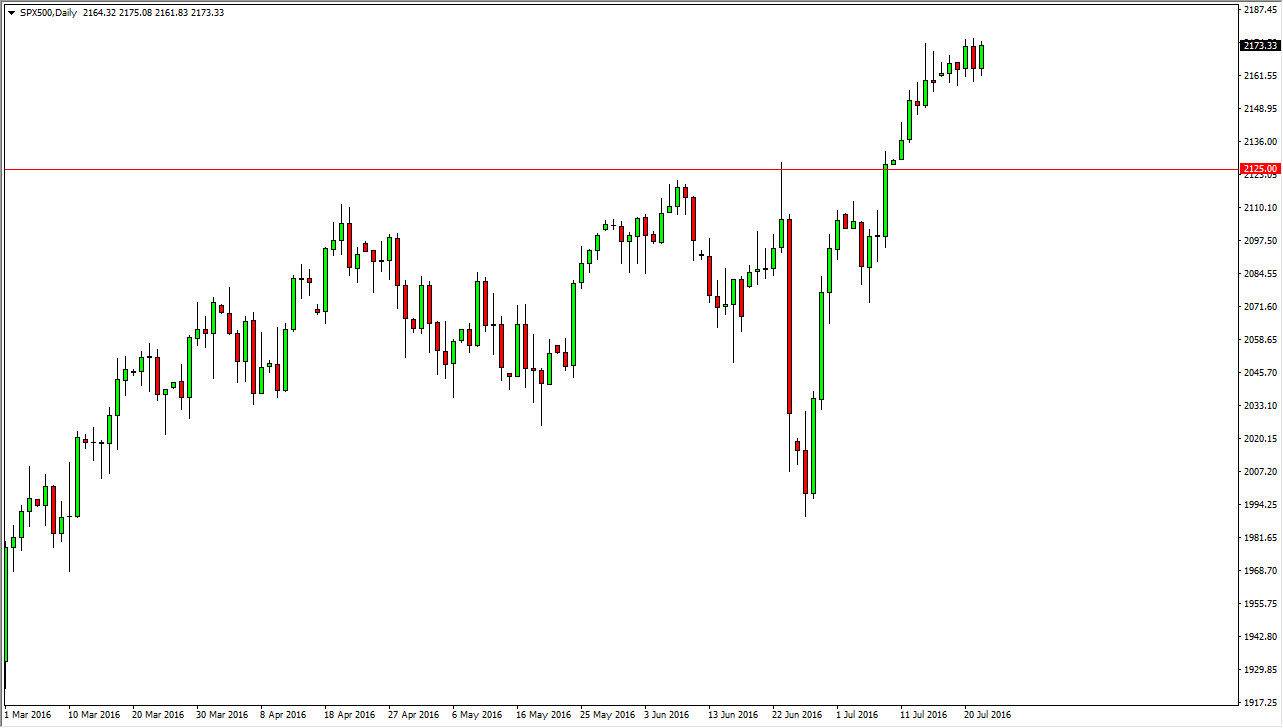

S&P 500

The S&P 500 had a slightly positive session during the day on Friday, as we continue to grind away in this general vicinity. Nonetheless, I am very bullish of this market and have absolutely no interest in selling whatsoever. I believe that the market will continue to find buyers every time we pullback, even all the way down to the 2125 handle at the very least. In other words, I’m very long-term bullish of this market but recognize that we need to either grind away sideways in order to build up momentum, or a pullback to find some type of value in this market. I have a longer-term target of 2250 going forward, and have very little doubt that part of this comes down to the Federal Reserve not been able to raise interest rates anytime soon.

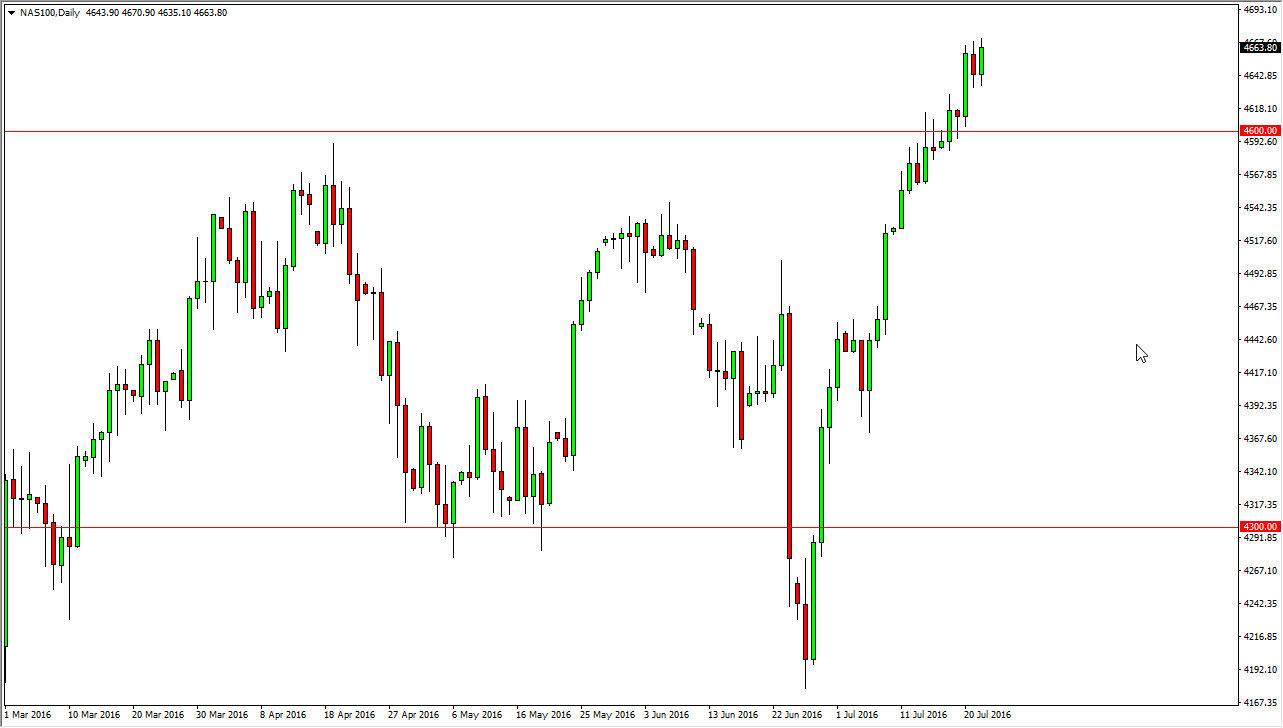

NASDAQ 100

The NASDAQ 100 rose during the course of the session here on Friday, but you can see still remains within the trading range that we have been in over the last couple of sessions. Nonetheless, this is a market should also go higher due to low interest rates and of course the recent breakout. On top of that, the NASDAQ 100 has been a bit of a laggard when it comes to the bullish pressure that we’ve seen coming out of the United States stock markets, and therefore I feel that although it’s been parabolic, we should continue to see buying opportunities. After all, it took this market much longer to break out above the top of resistance in order to start going even higher.

I think there is essentially a “floor” in this market near the 4500 level, so it’s not until we break down below there that I would even remotely consider selling this market, which seems to be very unlikely at this point in time. Low interest rates keep this market moving, despite a strengthening US dollar.